Crypto Firms Push Trump to Direct Agencies on Stalled Regulatory Guidance

Industry groups have urged Trump to use executive authority to speed crypto rules, saying agencies can offer clarity without Congress.

Crypto Industry Appeals to Trump for Accelerated Regulatory Clarity Through Executive Action

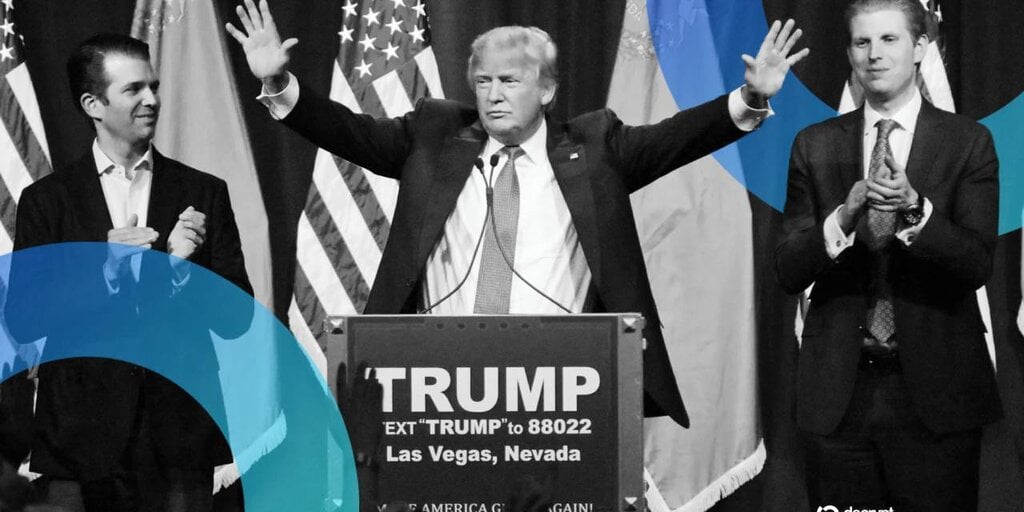

In a concerted effort to break the regulatory deadlock impeding the cryptocurrency sector, over 65 leading crypto organizations have petitioned former President Donald Trump to leverage executive powers to direct federal agencies in providing comprehensive guidance on digital asset regulations. This coalition underscores the urgency for regulatory frameworks that enable innovation, protect investors, and clarify tax obligations without awaiting lengthy congressional processes.

The letter emphasizes the significant challenges posed by the existing regulatory ambiguity, which has contributed to market uncertainty and hampered growth. By advocating for agency-led rulemaking and interpretative guidance, the industry seeks to create actionable roadmaps, particularly around contentious areas such as staking rewards, decentralized finance (DeFi) protocols, and safe harbor provisions.

Key Regulatory Issues and Industry Priorities

Among the core requests are clearer tax treatments of staking income, federal safe harbor policies to shield compliant projects from unforeseen penalties, and tailored regulatory approaches that recognize the distinctiveness of blockchain technologies. The collective also highlights the need for harmonized rules across agencies, including the SEC, CFTC, and Treasury, to reduce jurisdictional conflicts that have historically stalled decisive regulatory action.

Industry representatives assert that such clarity is critical for attracting institutional investment, fostering innovation, and ensuring the United States remains competitive in the global crypto arena. With decentralized technologies advancing at a rapid pace, there is increasing concern that regulatory delays could drive innovation and capital offshore.

Potential Impact and Future Outlook

If successful, this initiative could catalyze a new phase of regulatory engagement, setting the stage for a formalized crypto framework rooted in executive guidance rather than Congressional legislation. It would represent a pragmatic approach to governance, reducing ambiguity while enabling regulatory bodies to adapt swiftly to technological developments.

However, the approach also raises questions about the scope of executive authority in shaping complex financial regulations and the balance between innovation and investor protection. Stakeholders will be closely watching ongoing discussions and any resulting policy shifts, which will significantly influence the trajectory of crypto adoption and regulatory integration in the U.S.

Original Source

Read the original article from Decrypt

Recommended Articles

gapless-crypto-clickhouse 6.0.6

ClickHouse-based cryptocurrency data collection with zero-gap guarantee. 22x faster via Binance public repository with persistent database storage, USDT-margined futures support, and production-ready ReplacingMergeTree schema.

Spot XRP ETFs advance as 21Shares prepares to list ‘TOXR’ on Cboe BZX

Why are institutions buying while retail sentiment fades?

Taiwan mulls Bitcoin reserves in bold move to fortify financial sovereignty

Taiwan is formally exploring the integration of Bitcoin into its national treasury reserves, led by legislator Dr. Ju-chun Ko, with the goals of studying it as a strategic asset and launching a pilot program using seized Bitcoin. The primary motivation is to …