ERC3643 is an Ethereum-based token standard designed for the tokenization of real-world assets (RWA). It provides a comprehensive framework for issuing, managing, and transferring permissioned tokens.

Key features of ERC3643

- Permissioned Tokens: ERC3643 supports the creation of permissioned tokens, which means that only authorized users can hold or transact these tokens. This is particularly important for assets that require regulatory compliance or identity verification.

- Built-In Decentralized Identity (ONCHAINID): This standard incorporates ONCHAINID, a decentralized identity framework that allows for the verification of user identities directly on the blockchain. This ensures that only users who meet specific predefined conditions (such as identity verification or regulatory compliance) can become token holders.

- Compatibility and Interoperability: ERC3643 is compatible with the ERC-20 standard, which is the most common framework for creating fungible tokens on the Ethereum blockchain. This compatibility ensures that ERC3643 tokens can interact smoothly with the majority of decentralized finance (DeFi) applications.

- Audit by Kaspersky: The protocol has been audited by the cybersecurity firm Kaspersky, which adds a layer of trust and security assurance for users and developers.

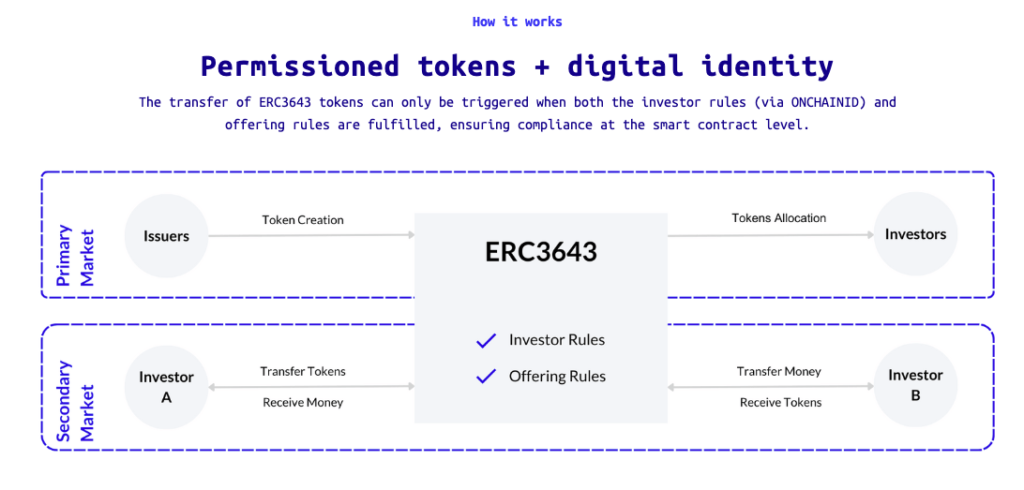

Mechanism of Action

The ERC3643 standard implements a set of rules that govern the transfer of tokens:

- Investor Rules and Offering Rules: The transfer of tokens under this standard can only occur if specific conditions are met, both from the investor’s side (via ONCHAINID) and from the offering’s side. This setup ensures that all transfers comply with relevant regulations at the smart contract level, without requiring external verification for each transaction.

ERC-3643 vs ERC-1400

While ERC3643 focuses on managing compliance through an automatic validator system built into the blockchain, ERC-1400 operates differently. ERC-1400 standard requires each trade to be validated by a specific key that is generated offchain. This approach can offer flexibility but might introduce complexities in ensuring compliance as it relies on external validation.

The founding members of the ERC-3643 are credible and experienced players in TradeFi and the digital asset space.

Overall, the future looks bright for ERC3643 which offers a robust framework for the secure and compliant issuance and management of tokenized assets on the Ethereum blockchain, making it suitable for scenarios that require strict adherence to identity and regulatory standards. Learn more about real world asset tokenization.

Learn more about real world asset tokenization.