Equalizer – Decentralized Exchange on Fantom Blockchain

Fantom Decentralized Exchange Equalizer Review 2023.

Equalizer emerged from Andre Cronje’s idea of a perpetual decentralized exchange called Solidly. The Equalizer platform’s inception aims to adapt this concept to a more intuitive, user-friendly DEX. As the primary trading mechanism for the Fantom network, Equalizer incorporates the Solidly perpetual model, along with a few adjustments to fee structures and emissions.

Why Equalizer Exchange?

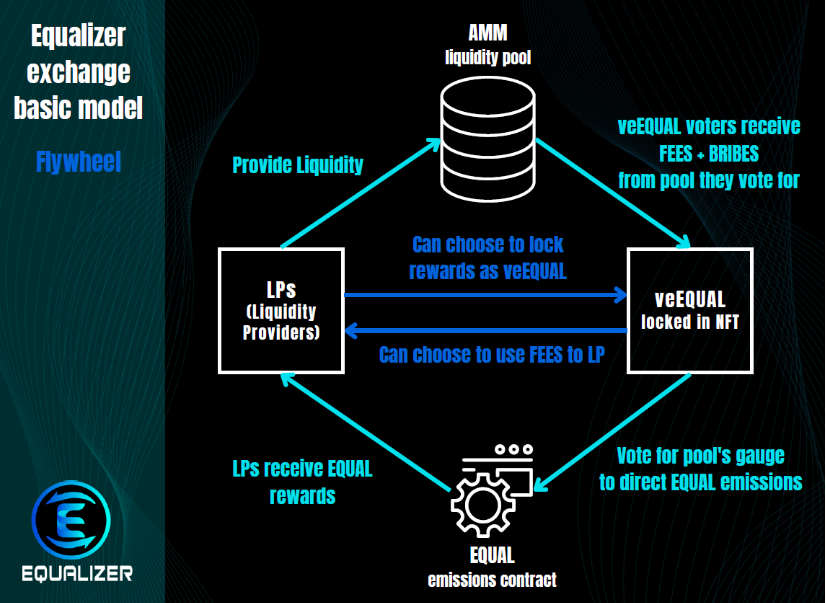

The groundbreaking perpetual model is the first of its kind capable of maintaining a steady emission token price. Equalizer addresses the challenge of balancing rewards for token holders and incentives for liquidity providers (LPs). Their model achieves this by rewarding liquidity with a valuable token, generating income akin to the Curve model. The fee structure guarantees that the utility and reward for holding and locking tokens are sufficiently high to provide the necessary liquidity for low-slippage trades.

What Makes Equalizer Exchange Unique?

A minimal fee (e.g., 0.01%) may appear flawed unless the trading volume justifies the incentives needed to maintain enough total value locked (TVL), particularly for volatile pairs. Consequently, this can trigger a downward spiral in the native token price, crippling the platform’s ability to preserve liquidity.

Consider this: a 0.01% fee is insignificant if the slippage in the trade reaches 2% or 3%. This insight reveals the importance of maintaining a fee that supports low-slippage trades, ultimately delivering a superior trading experience and outcome for users.

Tokenomics

$EQUAL

The fundamental liquid form of the token is $EQUAL. This versatile and transferable token serves as the primary medium for emissions and can be locked into a veNFT.

veEQUAL

By locking $EQUAL into veEQUAL, users can obtain an NFT that utilizes the vote escrow model for securing fees and directing emissions. A range of lock periods is available, and the asset remains transferable.

No Rebase

Those acquainted with the rebase model that rewards early adopters on the SOLIDLY platform may be surprised to learn that they have chosen to eliminate this model. The rationale behind this decision is that new entrants often struggle to attain a fair share of fees and voting power as the exchange evolves.

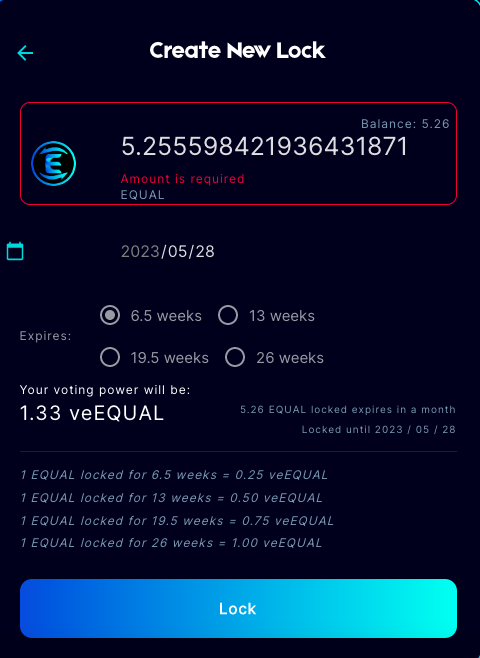

veLOCK Period

The maximum lock period for the platform is 26 weeks. During this time, the percentage of your lock duration will be allocated to your $veEQUAL. This modifier determines your voting power and the proportion of fees you receive from the pool you choose.

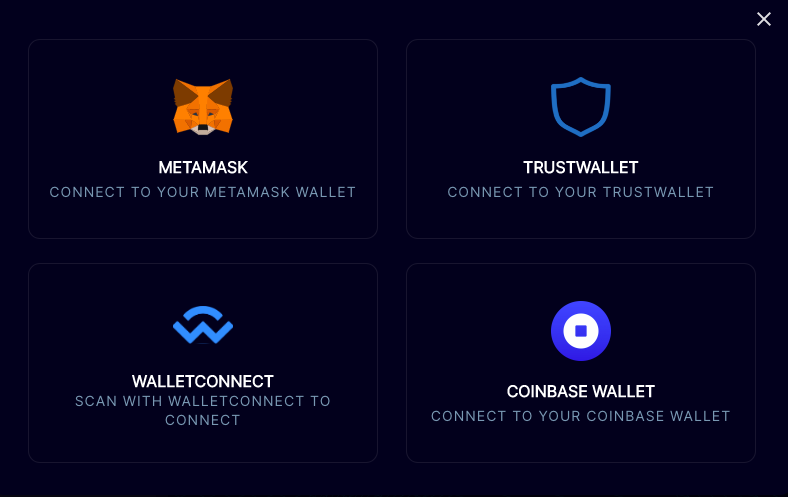

To get started on Equalizer Exchange, connect your web3 wallet e.g. MetaMask.

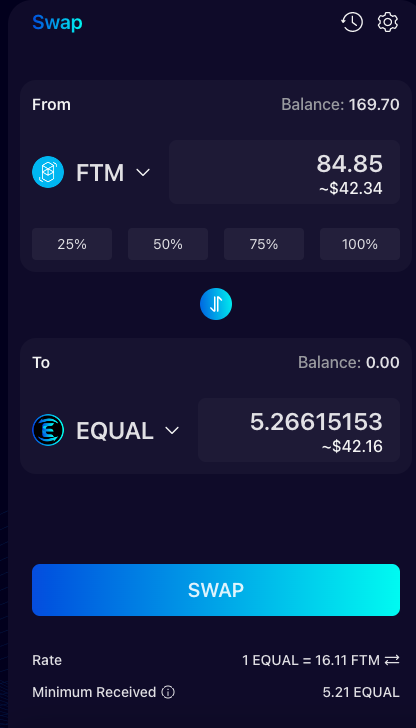

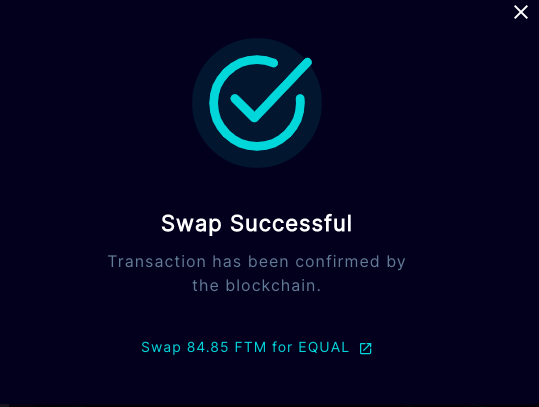

Equalizer Exchange is available on the Fantom blockchain. One of the easiest ways to acquire some $EQUAL tokens is to swap from $FTM to $EQUAL via MetaMask.

You can purchase FTM tokens from different centralized crypto exchanges including KuCoin and Binance. Following that you can send the $FTM to your MetaMask then swap the tokens to $EQUAL.

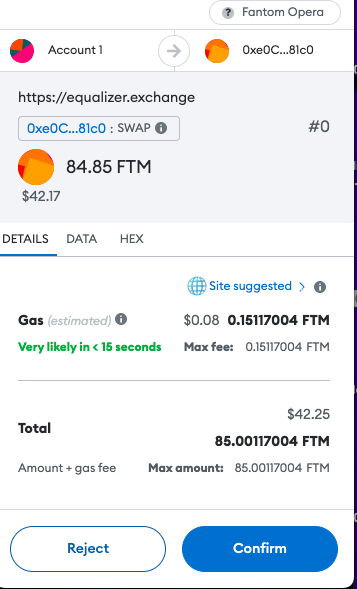

Pay the gas fee.

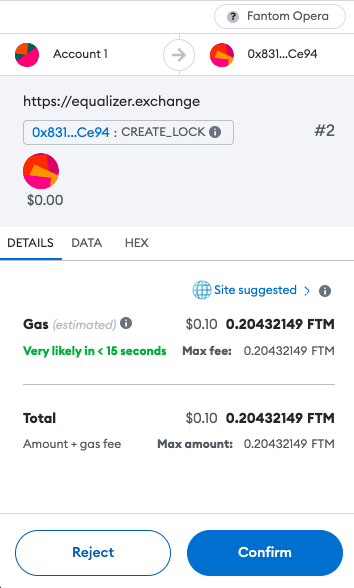

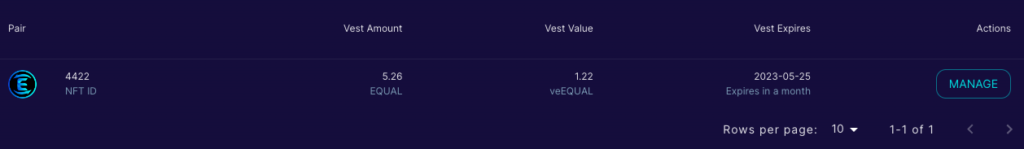

In order to stake your $EQUAL tokens, go to https://equalizer.exchange/vest and create a lock. Choose how many tokens you want to lock-up as well as decide on the lock-up period.

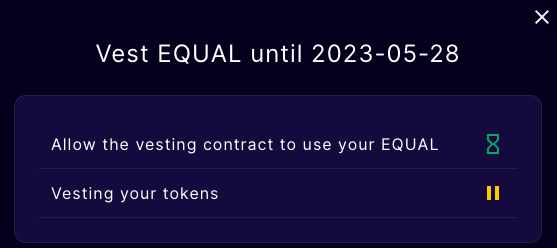

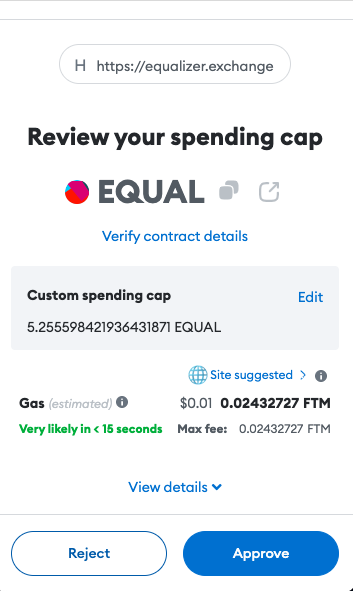

Allow the vesting smart contract to use your $EQUAL tokens.

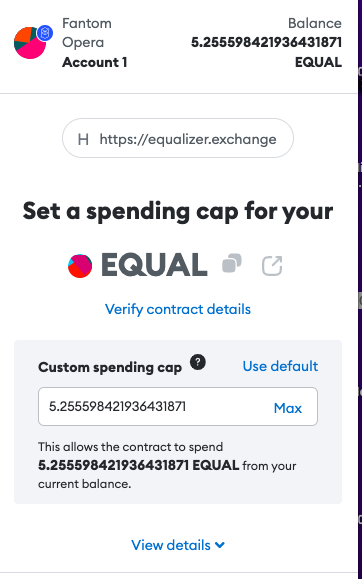

Make sure you set your spending cap.

Approve the contract and pay the gas fees.

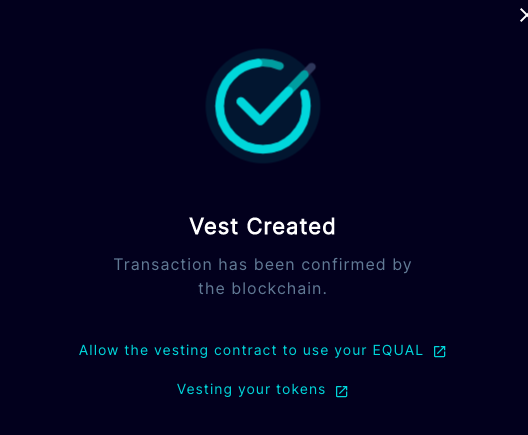

You will get confirmation of successful vesting.

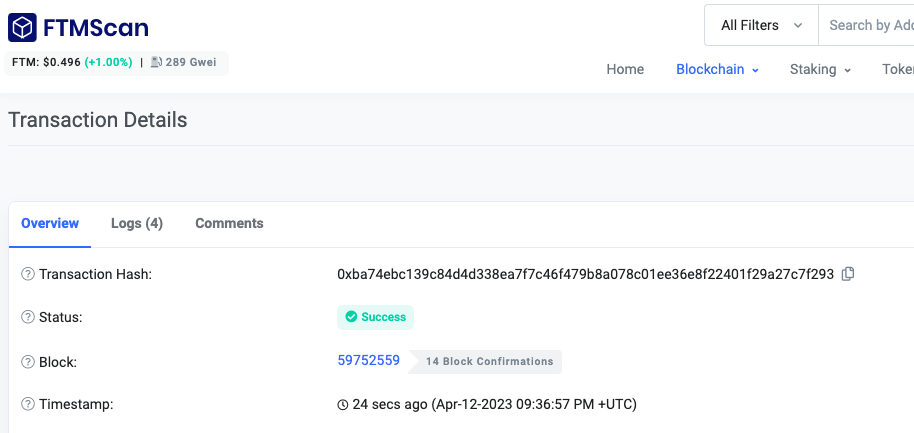

You can also verify the transaction on the Fantom block explorer.

Alternatively, check your dashboard on the Equalizer Exchange.

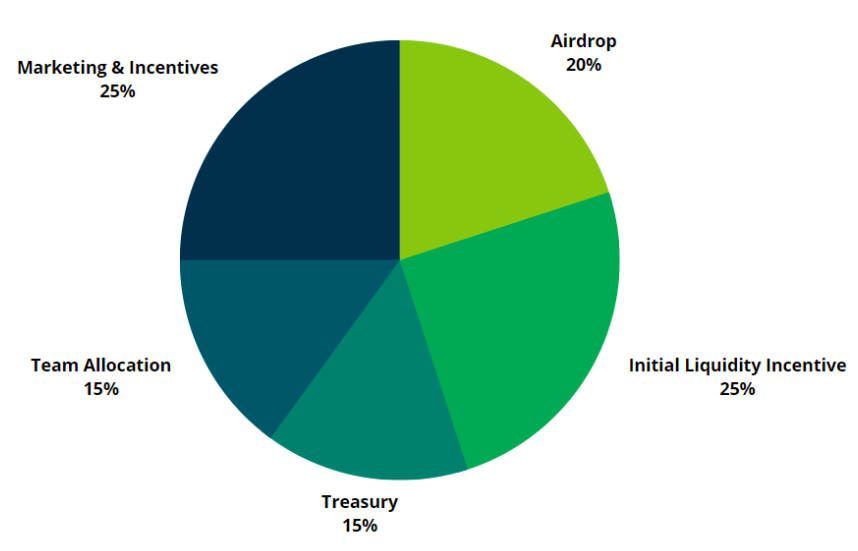

Token Distribution

Gauge Voting & Bribes

Voting

Holders of $veEQUAL tokens participate in weekly voting to decide which LP pairings should receive emissions. The pool corresponding to the percentage of your vote will earn 100% of the fees it generates. Trading fees accumulate in the epoch following the vote snapshot. Once cast, your vote rolls over each week until you decide to change it. To earn bribes from any pool during an epoch, you must recast your vote each epoch.

Bribes

In addition to fees, bribes are claimable 24-48 hours after the snapshot, which occurs at 23:59 UTC on Wednesdays, marking the end of each epoch. Unclaimed rewards carry over to future epochs.

Rewards Explained

The Equalizer protocol offers three types of rewards:

Emissions

Reserved for LP providers, emissions are distributed over each epoch based on $veEQUAL votes before the start of the new epoch. Rewards stream throughout the epoch and can be claimed as they accrue.

Fees

Generated with each completed trade on the exchange, fees are then streamed back to gauge voters proportionate to their share of the vote. You can claim these rewards as they accrue for your chosen pair/s.

Bribes

An extra opportunity for $veEQUAL holders, bribes may be allocated to a gauge to incentivize voters to support a specific pair. Bribes accrue and can only be claimed after the Wednesday 23:59 UTC snapshot, proportionate to your voting power cast for the relevant gauge.

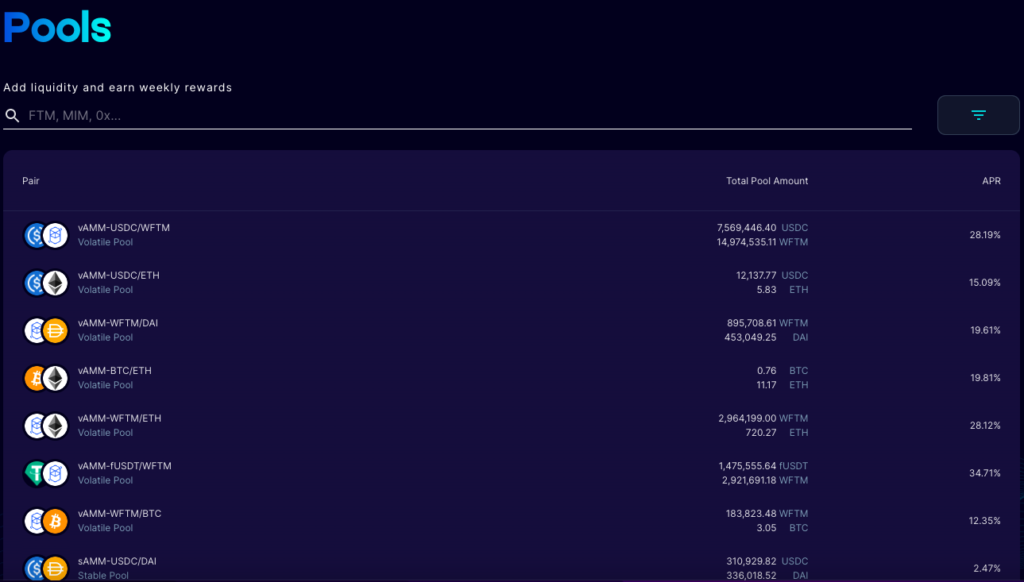

Liquidity Pools

Equalizer, an innovative Automated Market Maker (AMM), employs the traditional liquidity pool system to establish tradable pairs. In their view, this system surpasses the Uniswap model, which relies on fees to incentivize pools. Instead, Equalizer utilizes a continuous loop system that leverages tokens tied to fees to stimulate its operations. This approach fosters an equalized environment that supports token utility and growth.

They chose this model to encourage the use of their token and create a system where users lock tokens to enjoy the benefits they offer. The incentive system ensures a continuous loop of rewards, enabling low-slippage trades at reasonable fees.

Fees

Equalizer charges a 0.2% fee per trade for volatile pairs and 0.02% for stable pairs. With community approval, these fees may increase to 0.3%. This fee structure promotes and preserves liquidity, crucial for sustaining low-slippage trades.

Most AMMs on the market apply similar fees to reward Liquidity Providers. Their extensive research reveals that such fees are vital for attracting liquidity and maintaining a healthy ecosystem. The focus should not only be on the fee amount but also on the trade efficiency offered by the AMM. With this in mind, Equalizer is the first-of-its-kind DEX that supports the necessary equilibrium for maintaining an effective balance for LP providers and token holders in both stable and volatile assets.

Stable Pools

Designed for assets with minimal volatility, stable pools use a pricing formula that allows for low slippage, even on large traded volumes:

x³y + y³x = k

Variable Pools

Catering to assets with high price volatility, variable pools employ a generic AMM formula:

x × y = k

Hop you enjoyed our review of Equalizer Exchange. Check out other top DEX reviews including gTrade, SynFutures, Kromatika, ApeX, GMX, etc.