DeFi is commonly associated with the Ethereum blockchain but the one major advantage that Bitcoin Cash has is that fees are low, while they can be incredibly high on Ethereum. Detoken is an online, decentralized and autonomous environment that displays price information and autonomous smart contract mechanisms of digital assets and provides the user-interface that guides users’ access to Detoken’s services.

Detoken explained simply

A non-custodial provider of software services, Detoken does not custody, control or manage user funds. Detoken only stores an encrypted version of the user’s master private key which is protected with the wallet password. The services are deployed in a decentralized environment wherein the services can be autonomously and directly accessed by the users without any involvement or actions taken by any third-party.

According to reports, Detoken plans to allow SLP token support and allow zero-confirmation trades, which means users don’t have to wait for block confirmations before their transactions are created. SLP tokens can easily be created, traded, and managed on the Bitcoin Cash blockchain within seconds; costing the user only fractions of a penny for each transaction. Atomic swaps are also enabled with Detoken so that trustless and non-custodial trades can be achieved with users having full control of their private keys.

Detoken Wallet

The Detoken wallet runs within the browser, in much the same way as MetaMask. The wallet is easy to back up and users can restore their wallets using seed words at anytime and from anywhere. The private key belongs to there user. Detoken never sees a user’s unencrypted private key. Detoken’s server stores encrypted keys for convenience, however, decryption happens in the user’s browser.

Users can import any BCH wallet into Detoken. The wallet is automatically saved by Detoken in an encrypted form and users can access it anytime on Detoken using their email and password to sign in.

When a user signs in, their encrypted private key is retrieved from Detoken’s server and decrypted in their browser using a wallet password. When users create their Detoken wallets, they will be shown their wallet seed words. These are 12 words implemented using the BIP 39 standard, which allow the user to import their Detoken wallet into any BIP-39 compatible wallet. Detoken’s wallet is the same as any other Bitcoin Cash wallet. You can see Detoken’s client source code on GitLab.

How contracts work on the AnyHedge protocol

Detoken uses the Anyhedge smart contract protocol to create blockchain-based synthetic derivatives, also known as futures contracts. AnyHedge is built on the Bitcoin Cash (BCH) blockchain. The AnyHedge smart contract, open source protocol and libraries were originally created by General Protocols You can also view the source code on Gitlab. AnyHedge is built on a UTXO-based blockchain, meaning that each contract is fully independent from top to bottom. The Bitcoin Cash blockchain’s UTXO model and other unique properties made it the best fit for AnyHedge. UTXO-based blockchains have advantages in reducing systemic risk and giving users the option to participate in anonymous markets or to choose their counterparties.

Since AnyHedge is open source that can be used by anyone, it is up to each user, exchange and OTC desk to be in compliance with relevant laws and regulations within their jurisdiction. Prohibited countries include Cuba, Iran, Iraq, Libya, North Korea, Pakistan, Sri Lanka, Sudan, Syria, Ukraine-Russia (Crimea), USA, and many more. Check terms and conditions for the full list.

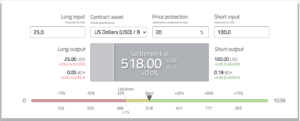

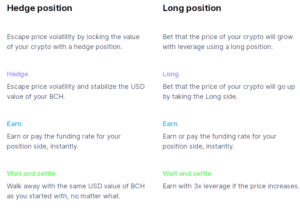

Hedge and long positions are smart contracts enabled on the Bitcoin Cash blockchain, where both parties pay into a Pay-to-Script-Hash (P2SH) address using a custom funding transaction. This funding transaction is made in the Detoken wallet. There is no order book. Detoken currently uses a private liquidity pool. The start price for a contract is always the current market price for the respective product. Premiums (the cost of funding) are calculated based on the current ratio of hedges and longs. In the future, the liquidity pool may be made public. Contracts get pricing data using a secure Oracle operated by General Protocols. Price data is sourced from BitPay’s price API.

Fees

There are no withdrawal fees, no deposit fess, no maintenance fees. The contract fees are fixed to 0.3% of the size of a user’s position. Contract fees are paid during contract creation. Currently, users can’t cancel an AnyHedge contract. The contract settles either after expiry or price-based liquidation. In connection with use of the services, users agree to bear all costs necessary to conduct a transaction, such as network fees. Bitcoin Cash powers all transactions and acts as a cheap and reliable monetary ledger. Users can simulate a contract using AnyHedge’s contract simulator.