What is Deri Protocol?

Deri Protocol epitomizes DeFi’s approach to derivative trading, enabling users to hedge, speculate, and arbitrage entirely on the blockchain. Trades within Deri Protocol are conducted using the AMM model, and positions are uniquely tokenized as NFTs, enhancing their integration with other DeFi projects. Offering a precise, capital-efficient means to exchange risk exposures on-chain, Deri Protocol has emerged as a crucial component of DeFi infrastructure.

From its inception, Deri Protocol has evolved through two significant updates and now supports three primary types of derivatives: Perpetual Futures, Everlasting Options, and Power Perpetuals. To date, it has been implemented across multiple blockchain networks, catering to traders’ hedging and speculative needs, with a cumulative trading volume exceeding 20 billion USD. These figures establish Deri Protocol as a leading DeFi derivative protocol in terms of trading volume.

Deri Protocol V3 represents an advancement of the decentralized derivative protocol from its previous version, Deri Protocol V2. Maintaining all functionalities of V2, Deri V3 broadens its derivative offerings to include all types of perpetual derivatives based on funding fees, ensuring uniform handling. A notable feature of Deri V3 is the “external custody” concept, where user funds are stored in an external money market protocol rather than in the protocol’s own liquidity pools. This development brings about a range of supported base tokens, enhancing scalability and the efficiency of capital use significantly.

Initially, Deri Protocol V1 emerged as a decentralized solution for trading risk exposures both accurately and with high capital efficiency. Since its inception, the protocol has epitomized the DeFi method for trading derivatives – whether for hedging, speculation, or arbitrage – completely on-chain. This functionality is driven by what is known as the Automatic Market Making (AMM) method.

What sets Deri Protocol apart?

As a decentralized solution for derivative exchange, Deri Protocol incorporates core aspects of both DeFi and financial derivatives:

- True DeFi: Deri Protocol operates as a suite of smart contracts on the blockchain, facilitating fully on-chain risk exposure exchange. (Deployed on BNBChain, Arbitrum, and zkSync Era mainnet)

- Genuine Derivatives: Users’ PnL is calculated using an oracle-updated mark price for accuracy, and positions are backed by margin, providing inherent leverage.

- Composability: Positions, tokenized as NFTs, can be owned, transferred, or integrated into other DeFi projects for various financial purposes.

- Universality: Deri V3’s trading pools can support multiple funding-fee-based perpetual derivatives simultaneously, allowing for more flexible liquidity organization beyond just derivative types.

- External Custody: User capital is stored in a time-tested, large-scale money market protocol. Both Liquidity Providers and Traders benefit from additional yield – interest and protocol liquidity mining rewards. (v3 pools)

- Dynamic Mixed Margin: Deri Protocol’s novel margin system accepts various base tokens simultaneously, allowing traders to post margins from a supported range.

- Dynamic Liquidity Provision: Liquidity Providers can select from a range of base tokens for liquidity provision, with the value of provided liquidity being dynamic as well.

- Multiple Symbols in One Pool: Enhancing capital efficiency, different trading symbols share the same liquidity hub within a single pool.

- Simplicity: Deri Protocol maintains a straightforward trading process.

- Openness: Anyone can initiate a pool with any base token, typically a stablecoin like USDT or DAI, without mandatory specific tokens.

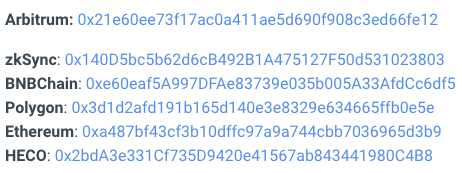

- Intercompatibility: The Deri Token facilitates cross-chain functionality between Ethereum, Binance Smart Chain, Huobi Eco Chain, and is also available on Polygon, an Ethereum scaling solution.

With “external custody,” Deri Protocol V3 significantly enhances scalability and capital efficiency, supporting a wide range of base tokens. Furthermore, Deri V3’s DPMM readily supports funding-fee-based perpetual derivatives, allowing for more adaptable liquidity arrangements in derivative trading. This makes derivative innovation more accessible within the V3 framework.

As a hallmark of DeFi 2.0, Deri Protocol V3 elevates DeFi projects’ “lego gameplay” to new heights. Notably, Deri’s Everlasting Options are a first in DeFi, the crypto realm, and the broader financial world!

Key Roles in the Ecosystem

The ecosystem thrives with various vital contributors:

- Liquidity Providers: They inject liquidity into pools, earning transaction fees, funding fees, and DERI rewards, thereby acting as traders’ counterparts.

- Traders: These are the primary users of Deri Protocol, engaging in derivative trading.

- Arbitragers: A unique trader category, they are driven by funding fee arbitrage to equilibrate long and short positions.

- Position Liquidators: In case a position nears liquidation, liquidators can execute the liquidation, receiving a portion of the remaining margin as a reward

How Deri Protocol Works

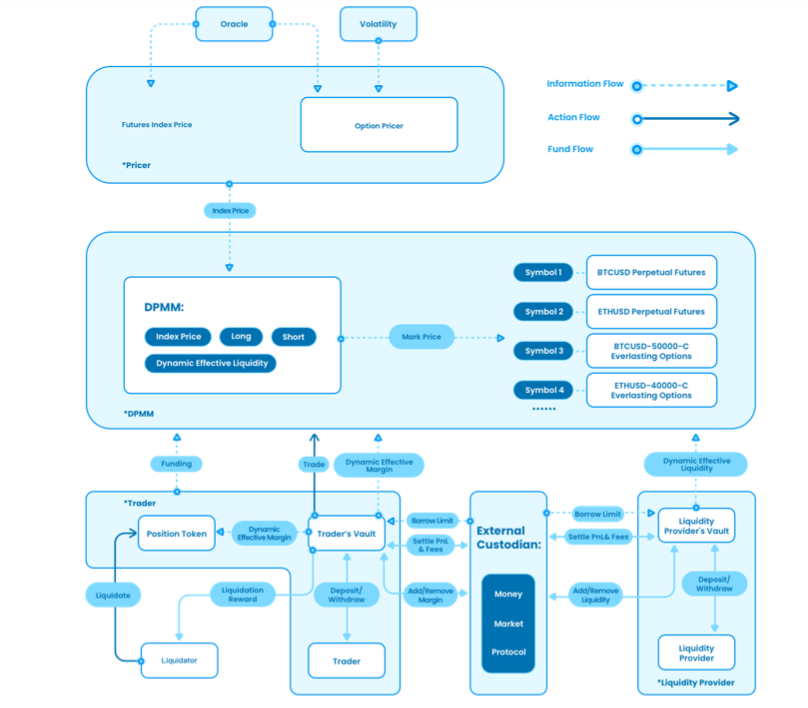

In the Deri AMM process, specifically referred to as Deri PMM or DPMM, the mechanism operates as follows:

- Liquidity providers (LPs) supply liquidity to the pool, collectively acting as counterparties to traders; meanwhile;

- Traders contribute margins to initiate either long or short positions on futures/options.

The gains or losses (PnL) are computed based on the market prices of the underlying assets and are settled between the LPs collectively and the traders individually. Although LPs and traders fulfill different roles within the DPMM.

Deri V2 introduced several enhancements to optimize capital efficiency for user capital:

- Allows trader-contributed margins in one or multiple supported base tokens;

- Permits liquidity from LPs in one or multiple supported base tokens;

- Enables trading of various symbols within a single pool.

The protocol is able to accept user capital in various base tokens. This key attribute of Deri V2 allow users to achieve a capital efficiency surpassing most other derivative trading exchanges, including centralized ones. Such efficiency primarily results from the interactivity and composability inherent in DeFi applications, where one application can seamlessly interact with another within the same blockchain network.

For Deri V1 and V2, user capital was kept in Deri’s own liquidity pools. In the DPMM system, the liquidity from LPs and margins from traders are essentially used as collateral in trading activities. Hence, user capital is only used or altered in instances of PnL or fee settlements.

Since V1’s launch, the Deri Protocol has smoothly facilitated derivative trading, handling over 10 billion USD in trading volume. This track record demonstrates the mechanism’s effectiveness and efficiency. However, the protocol still hadn’t reached peak capital efficiency in the DeFi sector, a status subject to continual evolution and improvement. A key challenge with Deri V2 was its limited scalability in accommodating multiple base tokens for user capital.

As a result, Deri Protocol is upgraded once more, moving from V2 to V3. This upgrade again capitalizes on the composability feature of DeFi applications. The introduction of the novel “External Custody” method aims to address the scalability issue when supporting multiple base tokens.

How to Trade on Deri v3

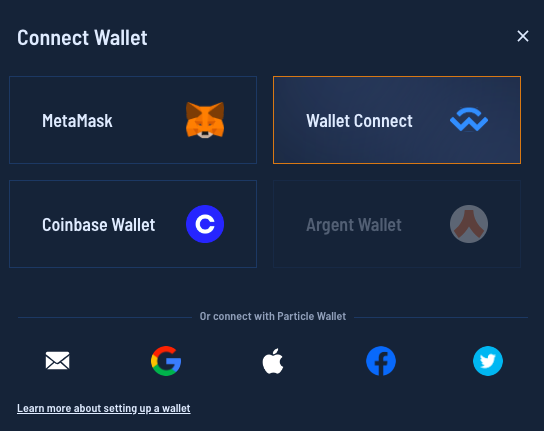

You can connect to Deri using a web3 wallet e.g. MetaMask.

Connect to a supported network e.g. Arbitrum or BNB Chain.

The trading interface on Deri is quite intuitive. To test it out, let’s try a small futures trade.

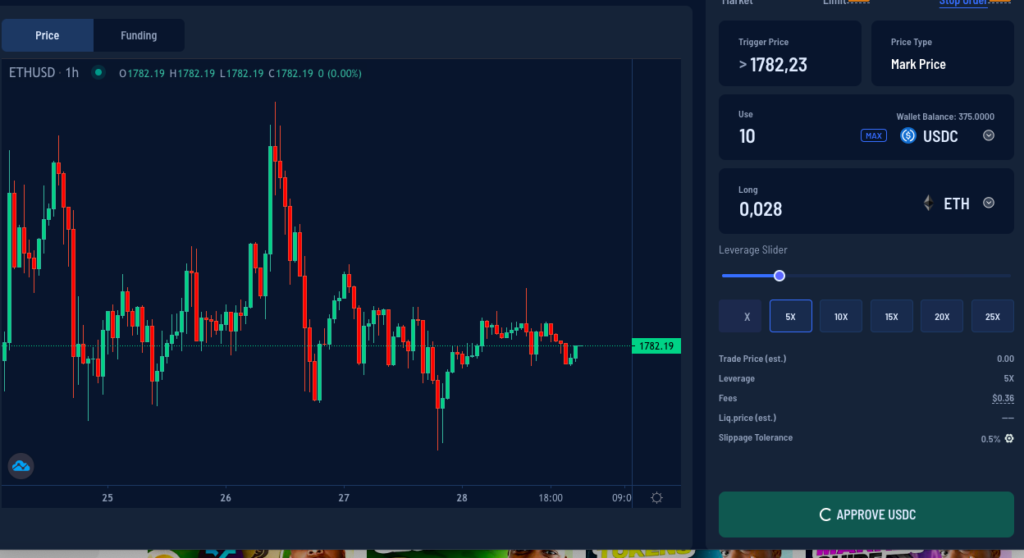

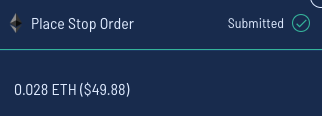

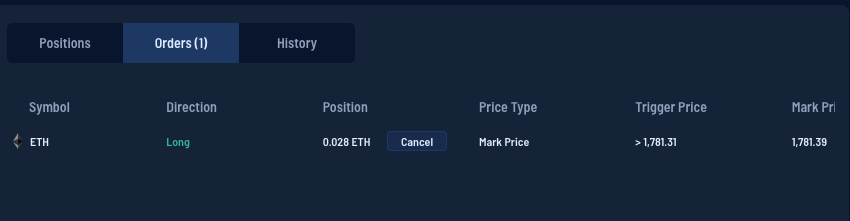

Users can choose to trade using Deri Lite or Deri Pro. We will open a LONG ETH position with a small sum of $10 USDC and set our leverage a 5X as a Stop Order. You also have the option to place a Market or Limit order.

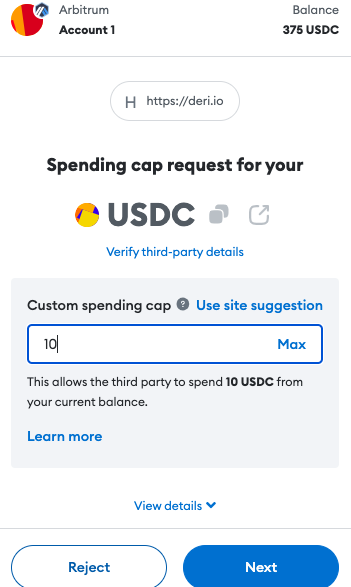

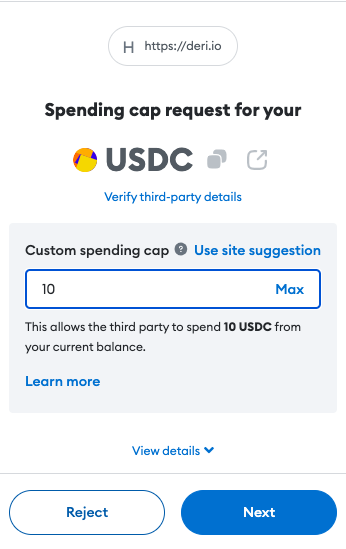

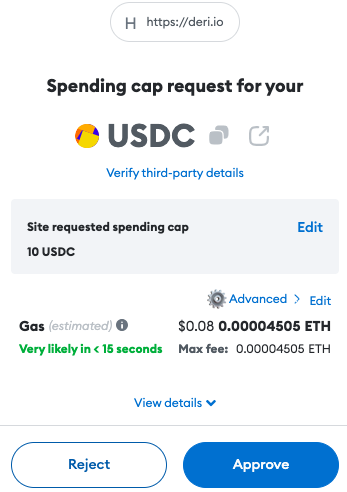

If using MetaMask you can also set your spending cap to make sure you don’t spend more than you wish to on a specific trade.

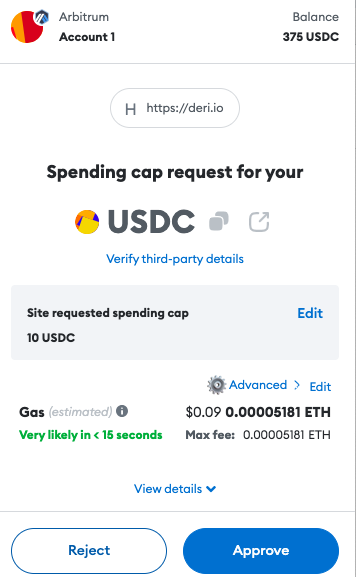

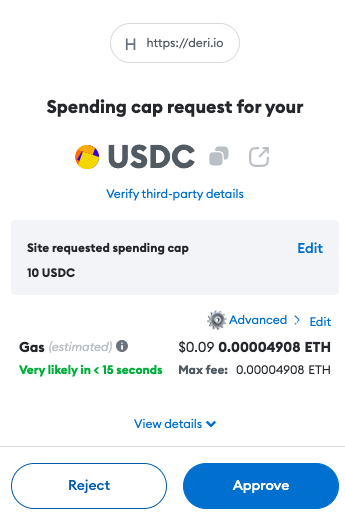

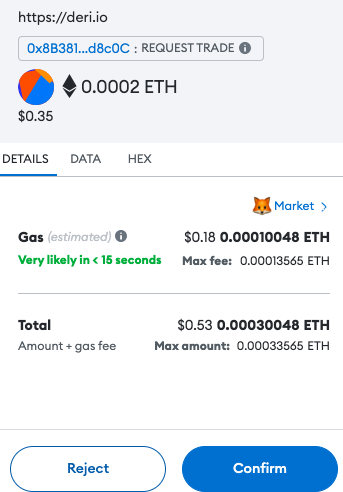

Then you need to pay the gas fee to process your order after you’ve given the smart contracts permission to execute your trade command.

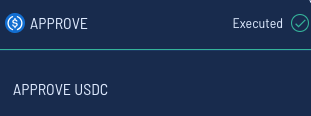

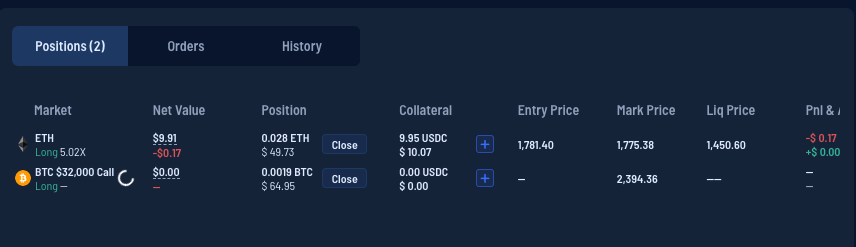

You can view your order on the dashboard quite easily.

How Options Trading Works on Deri Protocol

An option is a financial derivative that gives the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a specified price (known as the strike price) within a certain time frame. There are two types of options:

- Call Options: Give the holder the right to buy a cryptocurrency at a fixed price within a specific period.

- Put Options: Allow the holder to sell a cryptocurrency at a predetermined price within a set time frame.

The predetermined price at which the underlying crypto can be bought or sold is the Strike Price and the last date by which the holder must exercise their option is the Expiration Date. A Premium is the price paid by the buyer to the seller to acquire the option.

On Deri, options trading is simplified. To demonstrate, we buy a call option.

Set the spending cap.

Pay the gas fee.

Once the smart contract approves the asset for the trade, you can place your order.

Pay the transaction fee in for order execution.

Once the option trade is approved, you can view your position on the dashboard.

Staking in Pools on Deri Protocol

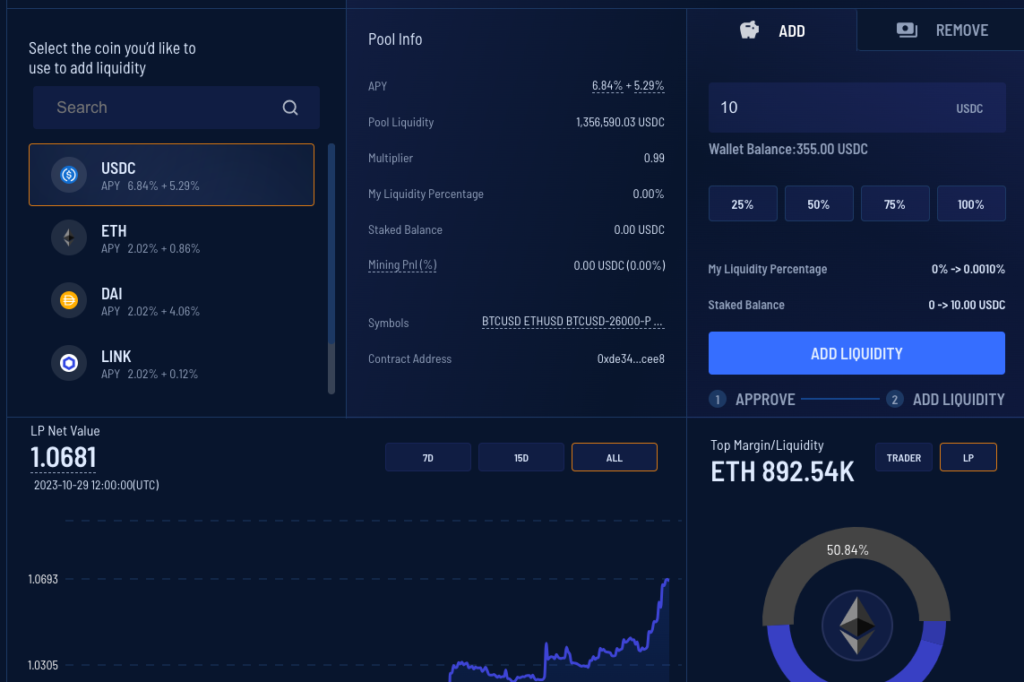

To get started, choose which pools you’d like to participate in.

Choose the digital asset you’d like to use to add liquidity and how much liquidity you wish to add to the pool.

Once again, you can set your wallet’s spending cap.

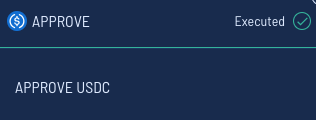

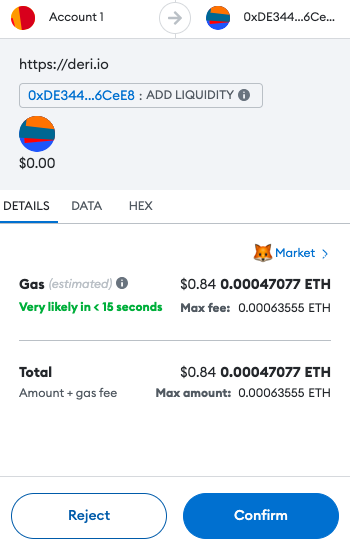

Pay the gas to approve the contract.

Once approved, you can pay the transaction gas fee.

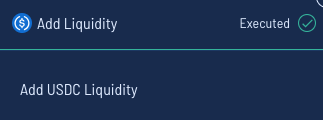

Proceed to add liquidity.

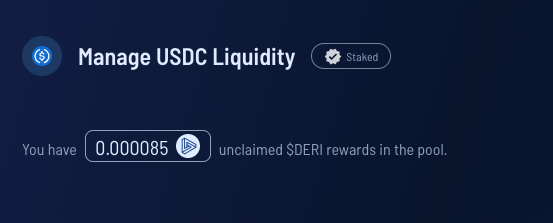

Once your liquidity is added, you can manage your LP position easily on the dashboard.

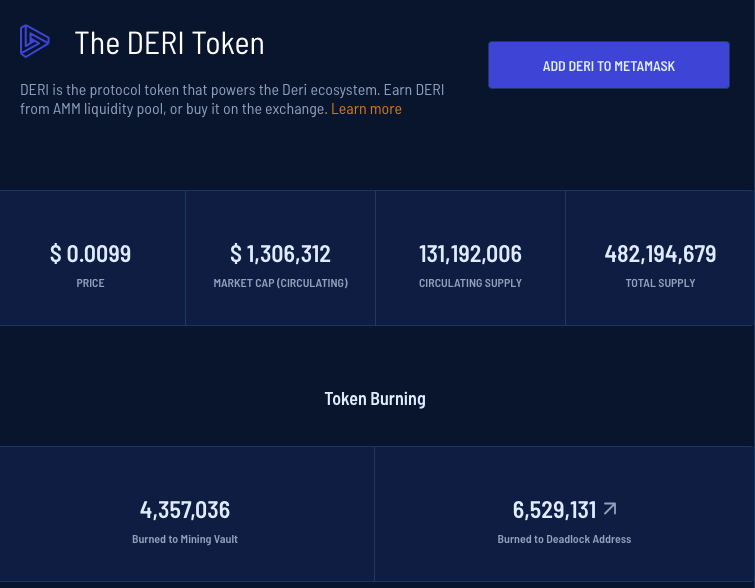

Deri Token

The Ultimate Total Supply (Fully Diluted Total Supply) is set at 1,000,000,000, divided into two main segments: a non-mining (preallocation) portion comprising 400,000,000 DERI tokens and a mining portion consisting of 600,000,000 DERI tokens.

Utilities & Use Cases

Governance

Similar to other DeFi initiatives, the DERI token anchors the community ownership and governance framework in the Deri Protocol. This setup empowers DERI holders to engage in pivotal protocol and tokenomics decisions through a voting system.

Privilege

Introducing a novel category in the DeFi token space, they’ve established the Privilege Token, distinct from more familiar token types like governance, fee, or security tokens. DERI, as a Privilege Token, means that participants in the Deri ecosystem must stake DERI to gain certain advantages in Deri trading activities.

It’s crucial to differentiate between a privilege token and a governance token. A governance token is indicative of authority over community governance or decision-making within the protocol, such as amending rules. In contrast, a privilege token provides specific operational advantages during business dealings. By analogy, holding a governance token is akin to having a say in hotel operations, whereas a privilege token is comparable to owning a VIP card that offers access to premium services at the hotel.

DERI specifically endows holders with privileges like:

- Liquidator Qualification: The Deri Protocol democratizes position liquidation, allowing those who are qualified to participate. While liquidation is a risk-free profitable venture and open to all, for certain trading pools, we mandate that participants stake DERI in the liquidator qualification pool, maintaining at least an average staking amount.

- VIP Transaction Fee Rate: We plan to implement a tiered transaction fee structure based on the amount of DERI staked by traders in a designated pool.

As Deri’s business facets expand, we aim to introduce an array of privileges tailored to various situations, fostering a thriving ecosystem.

The DERI token also features multi-chain support, being accessible across several networks, each with its own smart contract address.

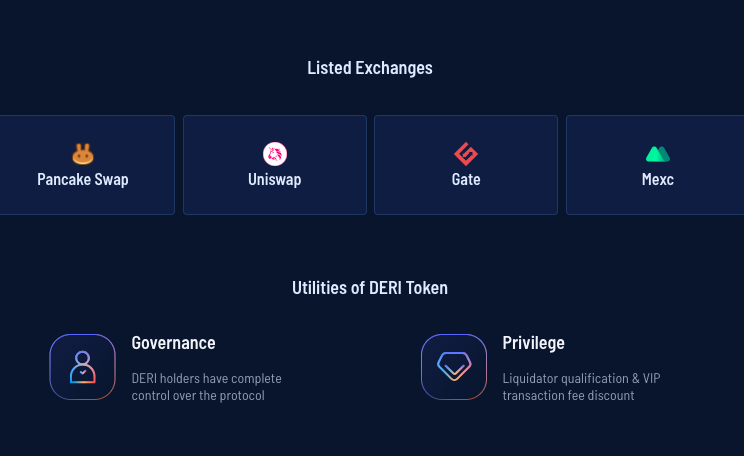

You can acquire DERI tokens from both decentralised exchanges such as Uniswap or PancakeSwap or centralised platforms such as Gate or MEXC.

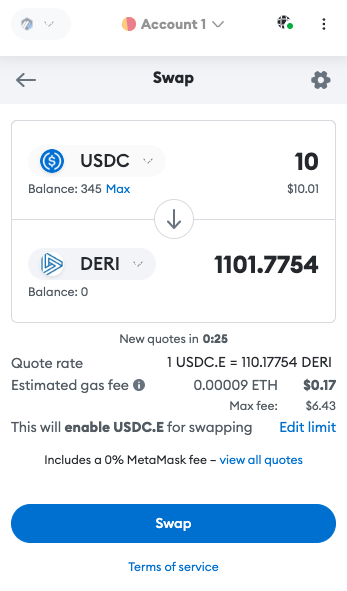

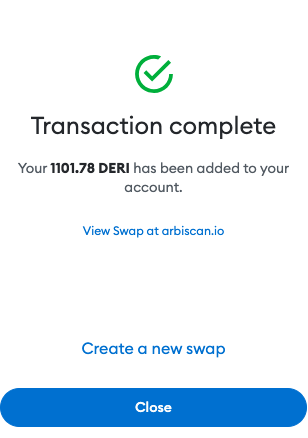

Another convenient way to acquire DERI is by swapping for another asset in your web3 wallet.

For more about Deri Protocol check out: