Demex Decentralized Mercantile Exchange Review

Demex cross-chain platform for spot, perpetuals, and futures markets.

What is Demex?

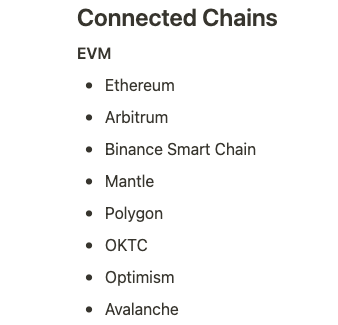

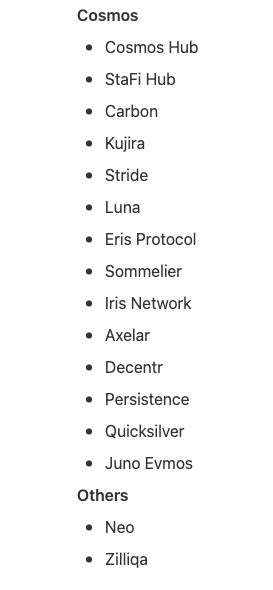

Demex, short for Decentralized Mercantile Exchange, is a comprehensive cross-chain platform, aiming to be your go-to DEX. It accommodates a variety of features including spot, perpetuals, and futures markets, in addition to a cross-chain money market. Plans to expand its support to options, bonds, synthetic assets, and more are in the pipeline.

Operating on the Carbon blockchain, Demex assures a trading engine that is completely decentralized, resistant to Miner Extractable Value (MEV), and promotes fairness.

Operating on the Carbon blockchain, Demex assures a trading engine that is completely decentralized, resistant to Miner Extractable Value (MEV), and promotes fairness.

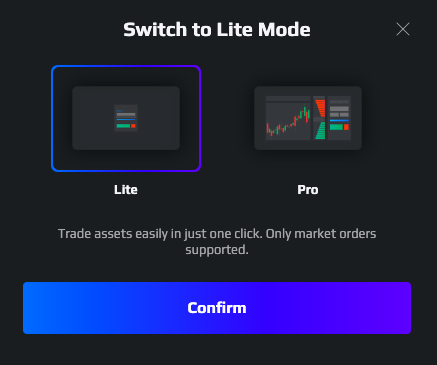

Demex Lite vs. Pro Mode

Customized to Fit Your Trading Preferences

Demex recognizes the diversity among traders, with varying preferences and levels of experience. To serve everyone, it provides two user-centric modes: Lite Mode and Pro Mode, each designed to deliver a trading experience that resonates with your style.

Lite Mode: Effortless and Efficient Trading

For those who value simplicity and user-friendliness in their trading platform, Demex Lite Mode is ideal. This mode strips away excess, offering a streamlined, intuitive interface, perfect for both novices and experienced traders. Key information like market prices is readily accessible, facilitating quick trading actions.

Lite Mode

Simplifies the process yet includes essential elements such as live charts, leverage choices, estimated price impact, and potential liquidation prices. It’s compatible with all of Demex‘s spot and perpetual markets, and optimally designed for mobile use, enabling trading anywhere, anytime.

Streamline Your Trading Process

Demex Lite is about offering an uncomplicated trading experience while maintaining necessary features. The advantages include:

User-Friendly Interface

The interface of Demex Lite is straightforward and easy to navigate, ideal for beginners. It avoids complex terminology and busy designs, focusing on what’s needed for effective trading.

Trading on the Move

Recognizing the need for mobility in today’s trading environment, Demex Lite is fully optimized for mobile use. This means you can trade from anywhere, directly from your mobile device.

Quick, Simple Trading Demex

Lite allows for rapid trading by concentrating on market prices and quick trade execution. It cuts down on distractions, enabling swift decision-making and simpler trading for users.

Essential Trading Tools

Accessible Despite its simplicity, Demex Lite doesn’t sacrifice key trading tools. It still offers live charts, options for leverage, insights into price impacts, and data on potential liquidation prices, equipping you with the information necessary for informed trading decisions.

Pro Mode

Advanced Trading for Professionals

If advanced charting, diverse order types, and customizable trading tactics are what you seek, Demex Pro Mode is your solution. Targeting professional traders, it includes detailed features like Limit orders, Stop Limit orders, and Stop Market orders, allowing for precise trade execution and effective risk management.

Demex distinguishes itself as a DEX that truly caters to every type of trader, whether you favor Lite Mode’s simplicity or the comprehensive features of Pro Mode. Switch seamlessly between modes, and engage in spot or perpetual trading with leverage, using either a streamlined modern interface or a classic setup.

Indulge in the easy, swift, and convenient trading experience offered by Demex Lite Mode. Trade cryptocurrencies with comfort and ease – anytime, anywhere – because Demex Lite insists on making trading straightforward!

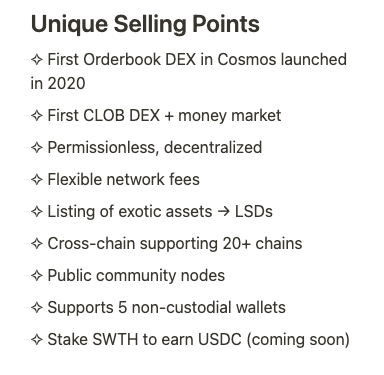

What Sets Demex Apart

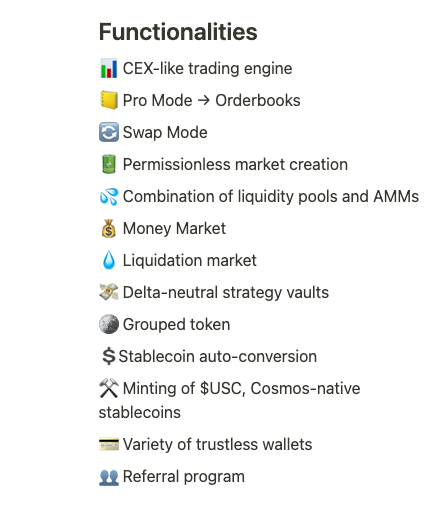

Demex presents a highly customizable, innovative, and seamless trading experience. It provides access to multiple Layer-1 chains and unique features like AMM-backed orderbooks and unequal liquidity pools.

AMM-backed Orderbooks

Conventional AMMs, limited to simple swap interfaces, often don’t provide a clear view of slippage at different price points, leading to uncertainty in exchange rates.

Demex, however, enables users to view AMM liquidity in the form of an order book, mimicking the experience of centralized exchanges (CEX) while staying decentralized. This setup, combined with traditional market makers, offers enhanced capital efficiency and abundant liquidity.

Additionally, Demex integrates a full suite of TradingView tools for comprehensive price analysis, a significant improvement over earlier DEX models.

Customizable Pool Weights

Typical Uniswap pools feature a 50/50 asset distribution. This means liquidity providers are equally exposed to both assets, like ETH and DAI in an ETH-DAI pool, regardless of their desired allocation.

Demex, embracing innovations by Balancer, supports uneven pools, allowing for more sophisticated liquidity pooling strategies. For example, an 80-20 ETH-DAI pool lets token holders have more exposure to ETH than previous models. This feature offers better control over impermanent loss exposure, which is further explained here.

A graphic below illustrates how a 95/5 ETH-DAI pool more closely aligns with holding ETH exclusively, showcasing the benefits of uneven pools.

Permissionless Innovation

Demex empowers users with the ability to create their own markets and liquidity pools:

- Market Creation Without Permissions

- Seamless Token Importing

- Permissionless Pool Establishment

Fully Tailorable Markets

The Carbon chain’s capabilities allow users to set up markets and liquidity pools according to their specific preferences and needs. With a token added to the Carbon protocol, users can autonomously establish related markets and pools. This includes choosing market types (Spot, Futures, Perpetuals), setting fees for makers and takers, outlining margin requirements, and adjusting various other parameters.

Fees Explained

Demex involves three primary fee types:

- Trading Fees: A commission applies to each trade, reducible through staking.

- Network Fees: Most activities on Demex incur a nominal network fee (<$0.01), covering the use of the underlying Carbon network. This fee compensates the decentralized validators overseeing every Demex transaction.

- Deposit & Withdrawal Fees: To move tokens between blockchains, external blockchain network fees are payable for transaction processing.

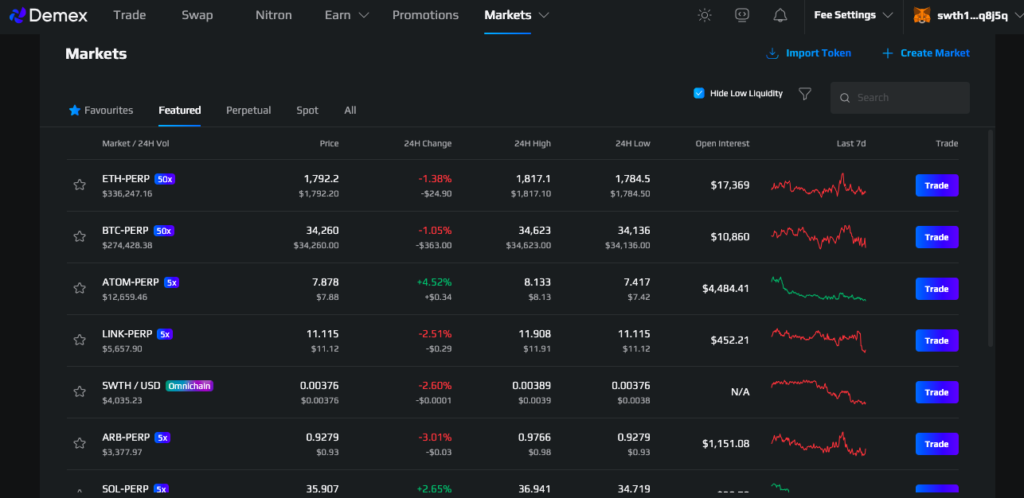

How to Trade Perps on Demex

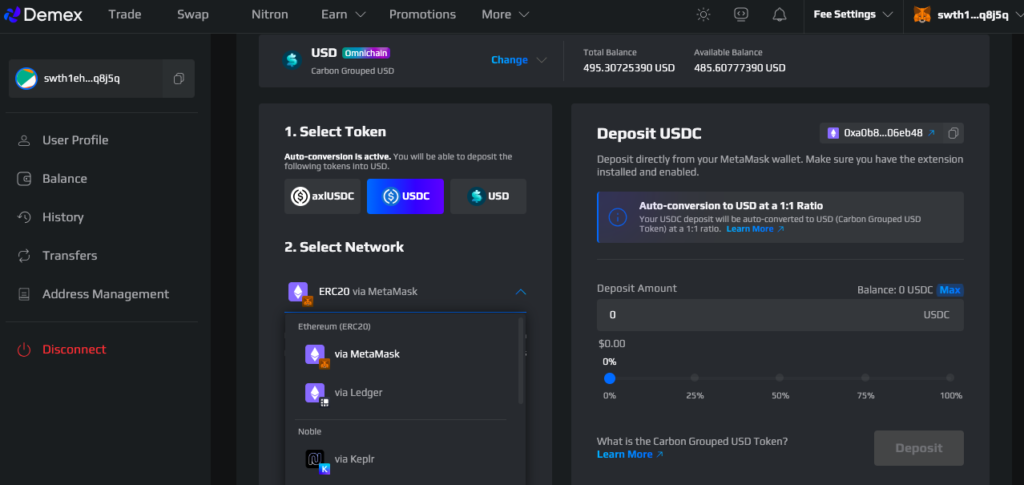

To start trading , first deposit assets from any chain.

You can use MetaMask, Ledger or other web3 wallet.

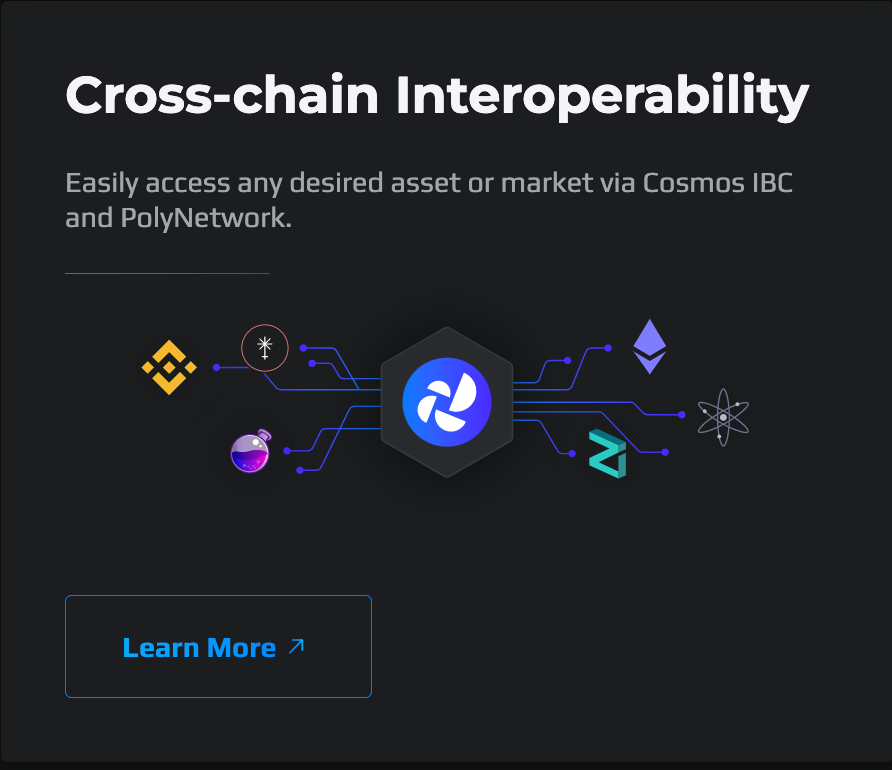

In this review, we’ll be using Carbon – a multi-chain protocol serving as a fundamental component for DeFi projects. It enables the creation of open financial markets on any blockchain, accommodating all asset types through the Carbon protocol. Carbon is the driving force behind Demex which supports trading in a broad array of financial products. It offers interoperability among various blockchains like Ethereum, Cosmos, and BSC.

Furthermore, Carbon is integral to the PolyNetwork bridge, facilitating genuinely cross-chain liquidity pools.

The protocol is versatile in DeFi innovation, offering inherent support for a range of features including crypto derivatives, Balancer-like liquidity pools, automated market makers (AMMs), and on-chain order books. Built on the Cosmos-SDK and secured by numerous validators via Tendermint Proof of Stake (PoS), Carbon guarantees trustless and secure transactions.

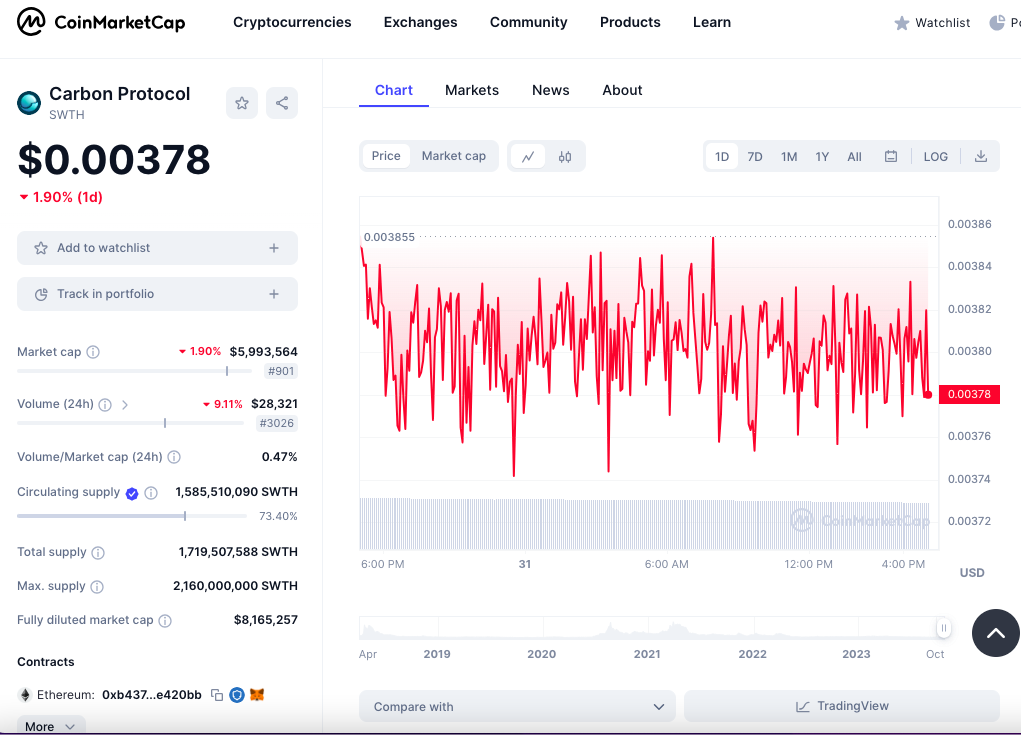

To use Carbon, you need SWTH for transaction fees.

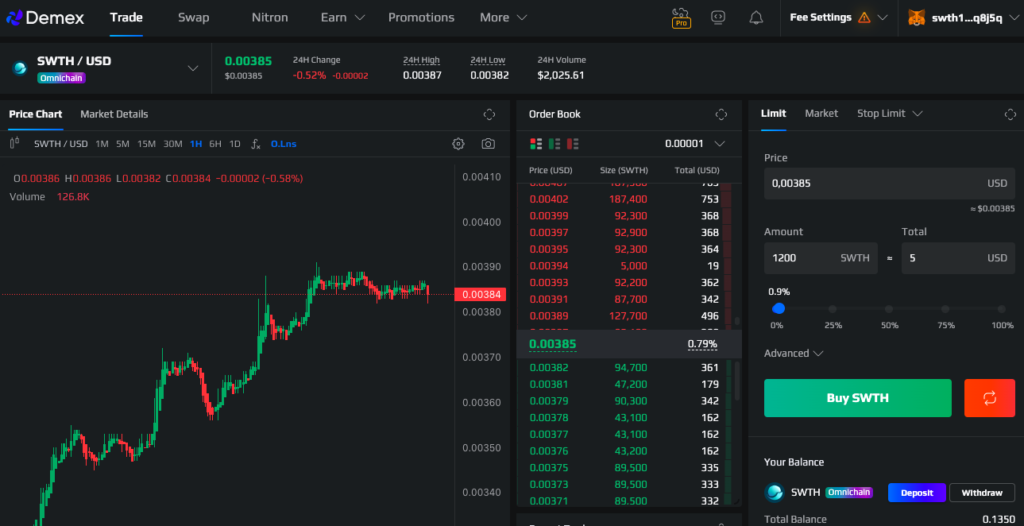

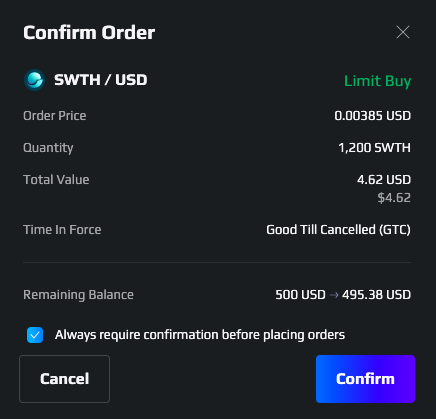

We’re going to buy a small amount of SWTH tokens.

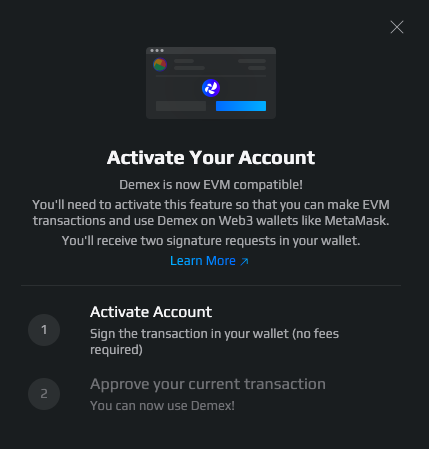

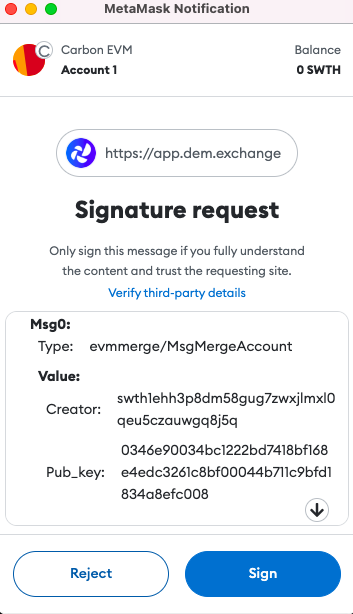

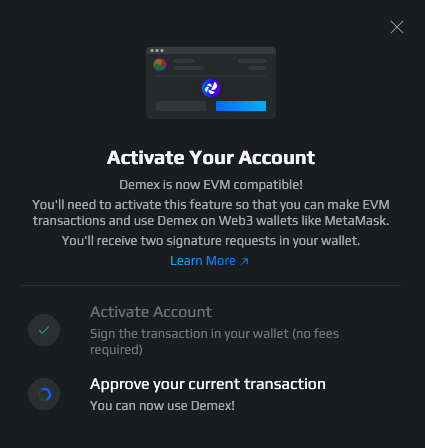

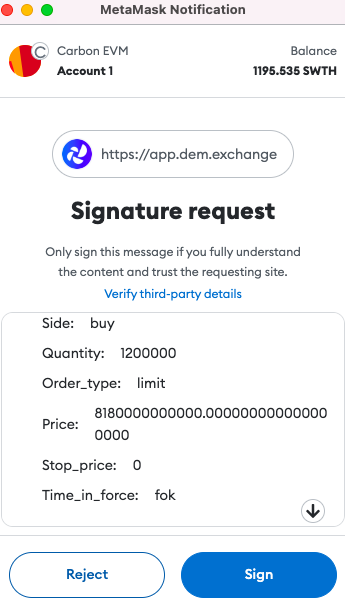

Demex is now compatible with the Ethereum Virtual Machine (EVM) which makes it easy to trade on Demex in a non-custodial way using wallets such as MetaMask by simply enabling the feature by simply signing transaction in your wallet.

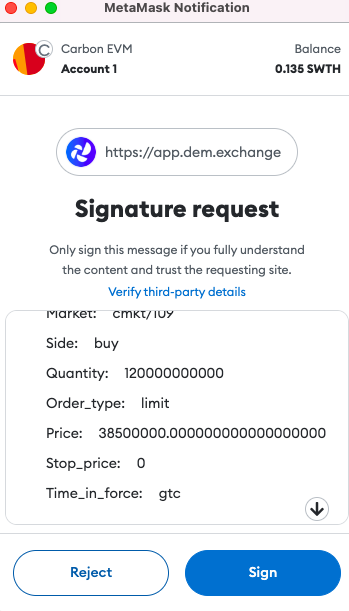

Once you sign to activate, you can then proceed to process your transaction to purchase SWTH if you also wish to use Carbon.

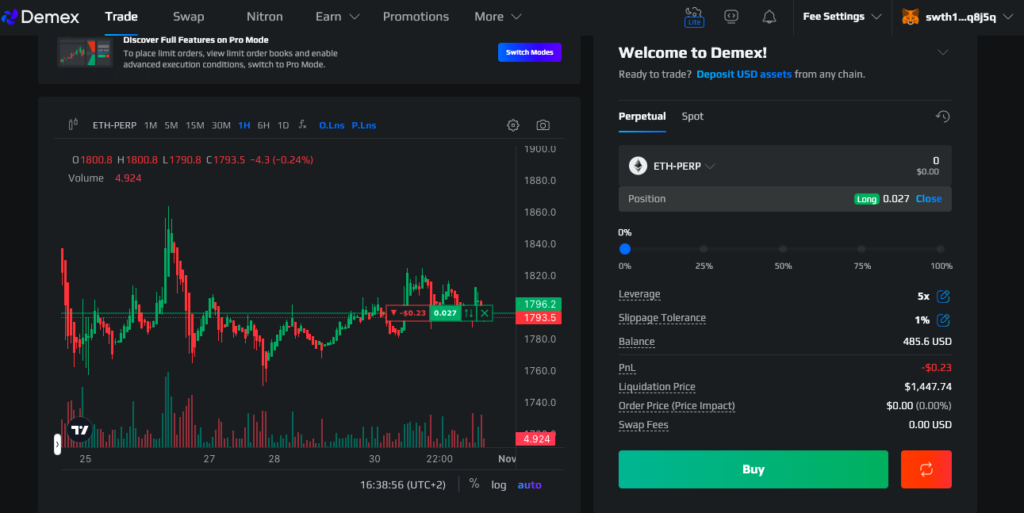

To trade perpetual contracts on Demex, simply go to the easy to use interface and choose the mode you wish to trade in.

You have the option to trade using wither the Lite or Pro version.

Proceed to deposit the base asset e.g. USDC.

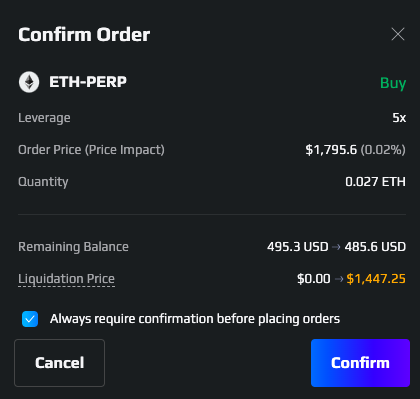

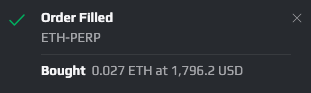

In this example, we’re going to take a long position on an ETH-perp contract at 5X leverage with a small amount of just $10 just to test it out before placing our large order.

You can see here that Demex gives you the liquidation price. You’ll also be notified when the order is filled.

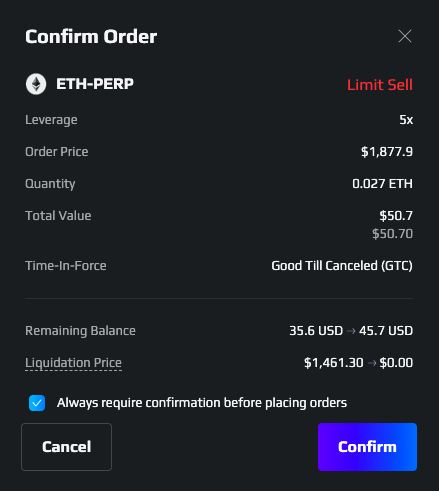

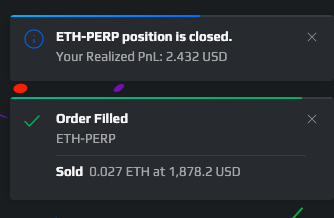

How to Close a Position on Demex & Take Profit

In this instance, we let the test trade placed above play out. Then we decided to sell the limit order and close the position to secure profit.

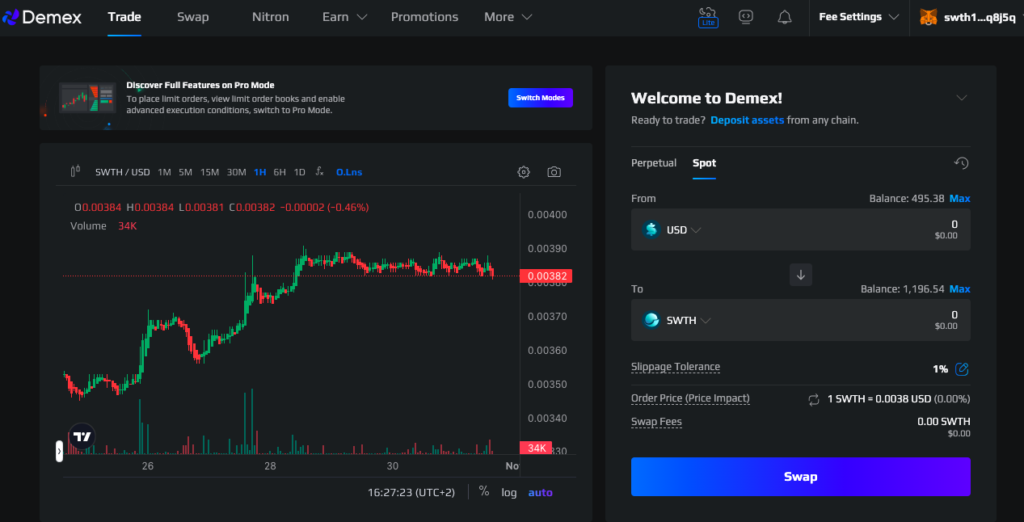

How to Swap Using Demex

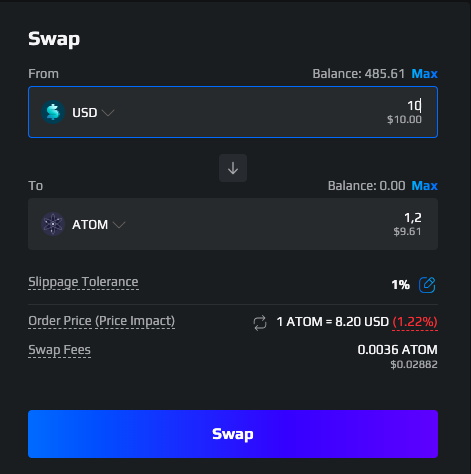

The Demex swap feature is quite intuitive.

Simply choose the assets you wish to swap e.g. here we swap $10 of USDC for ATOM token – the native ecosystem token of the Cosmos blockchain which Demex is also native to.

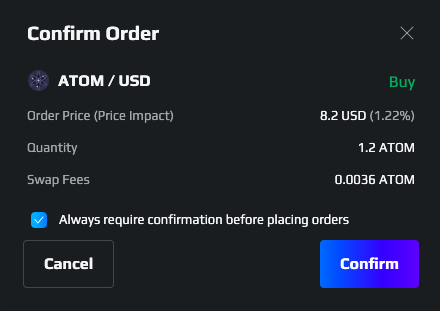

You’ll be able to clearly see the order price, quantity and swap fees before confirming your order.

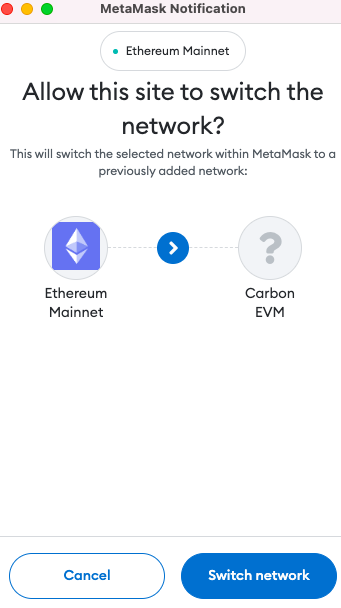

You may be required to switch networks in your wallet.

Proceed to sign the transaction.

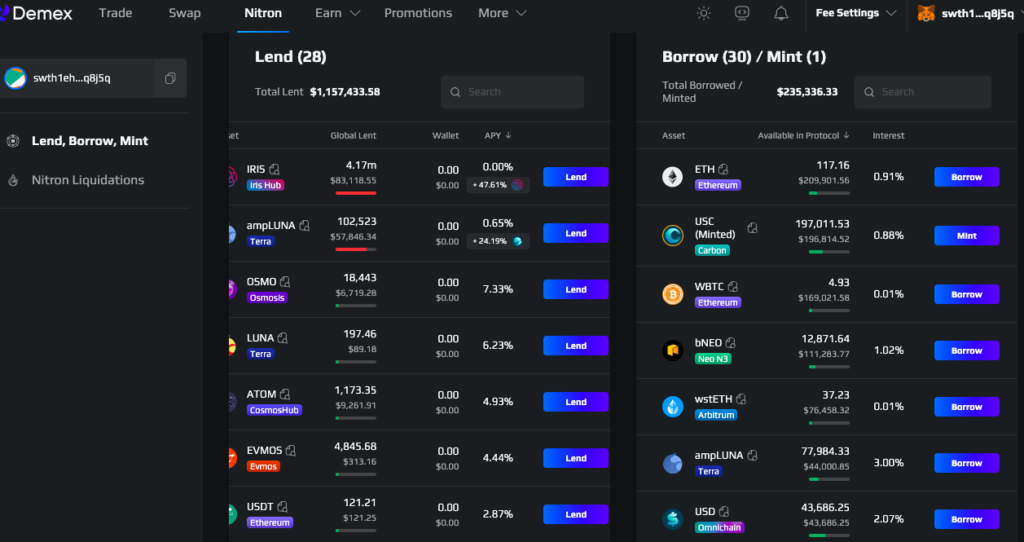

Demex Nitron – Lending & Borrowing

You can also earn passive yield on your assets through lending, or borrowing tokens via secured loans on Nitron, the money market for Cosmos.

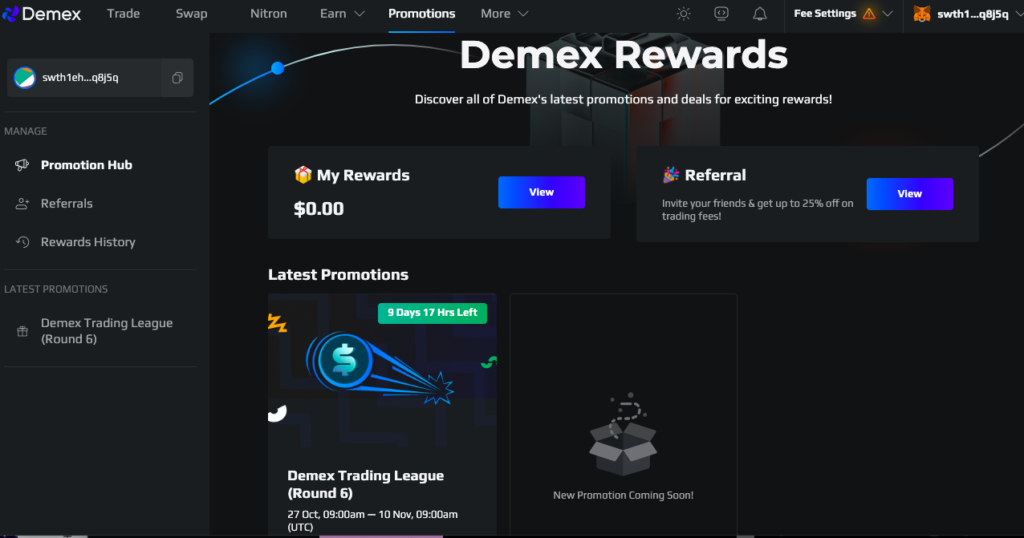

Rewards & Promotions

Demex has exciting promotions and rewards ongoing.

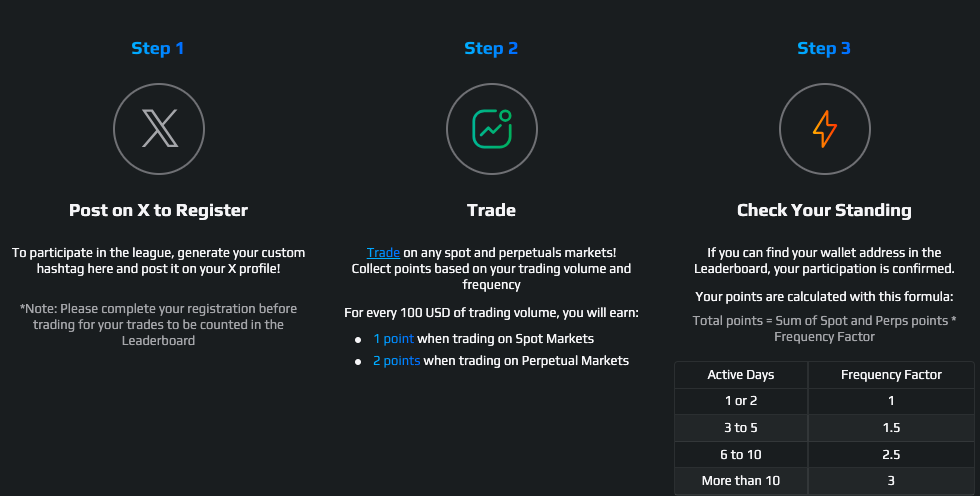

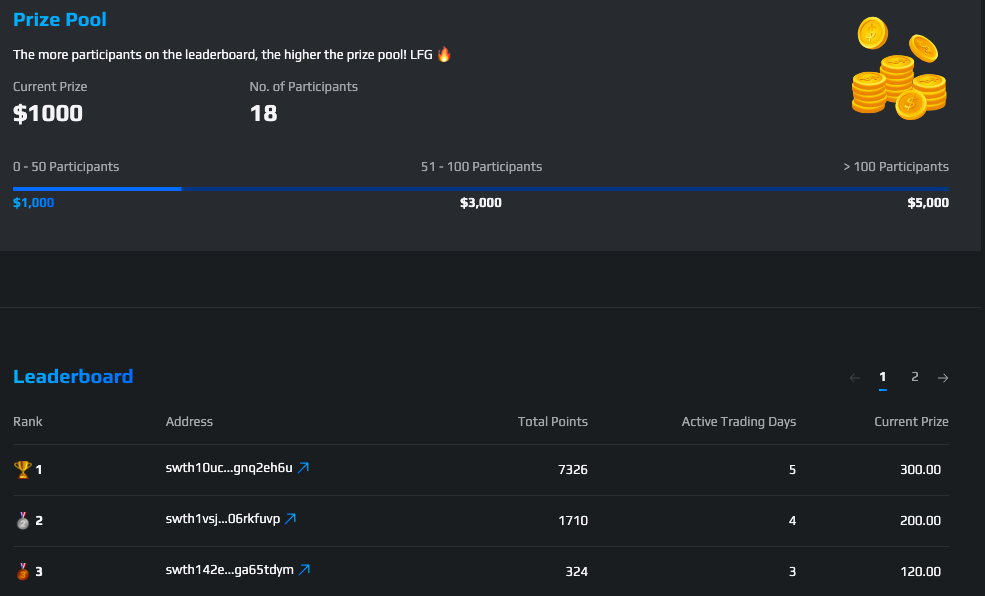

Currently, you can join the Demex Trading League and stand a chance to win from a $5000 price pool.

Simply trade every day on any spot and perpetuals markets, earn points from each trade, and climb up the leaderboard!

For every 100 USD of trading volume, you will earn:

- 1 point when trading on Spot Markets

- 2 points when trading on Perpetual Markets

Demex Referral Program

For those interested in making more passive income, you can join the Demex referral program. If you sign up with my affiliate link, you can get 10% fee rebate. Start trading on Demex now and enjoy decentralized perpetual trading, swap, lending & borrowing markets and so much more!