DeFi or CeFi: Which Is the Better Bet for Crypto Traders in 2025?

CeFi vs DeFi: Platform Breakdowns.

In 2025, crypto traders are spoiled for choice — should you go all-in on DeFi protocols, stick to the security and speed of CeFi, or choose a hybrid model that merges the best of both worlds? With platforms like GRVT, XT.com, Polynomial, and gTrade leading innovation in their domains, it’s more important than ever to understand how custody, performance, and profit potential differ across the spectrum.

CeFi vs DeFi

| Platform | Type | Highlights |

|---|---|---|

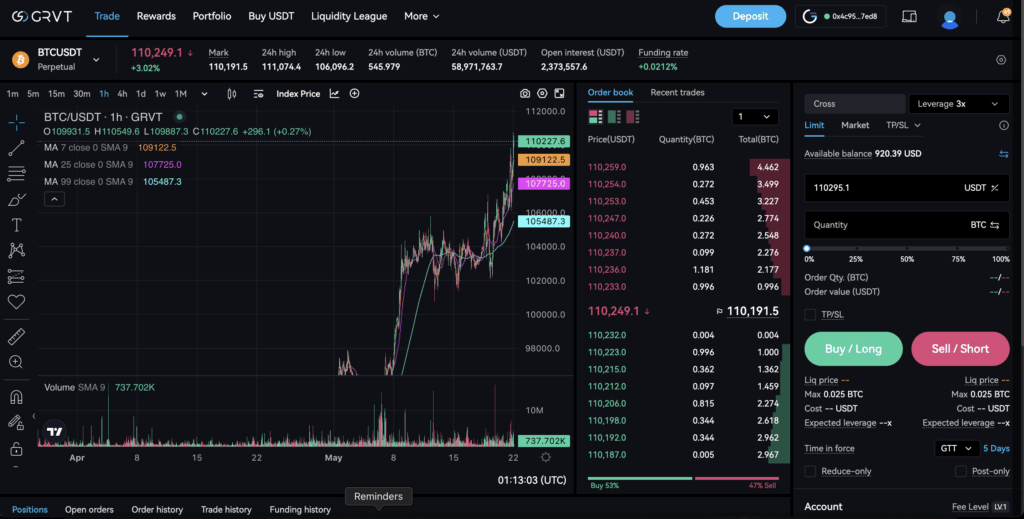

| GRVT | Hybrid | zkSync-powered exchange with self-custody features |

| XT.com | CeFi | User-friendly, copy trading, and deep liquidity |

| Polynomial | DeFi | Options vaults on Optimism; passive strategies |

| gTrade | DeFi | Zero-slippage perps with up to 150x leverage |

| HyroTrader | Hybrid | AI-integrated signals with direct execution |

Custody, Speed, Yield, Access

-

Custody

-

CeFi: Assets are custodial, meaning users rely on centralized entities to safeguard funds.

-

DeFi: You hold your own keys via wallets like MetaMask or Rabby — full control, full responsibility.

-

Hybrid: Platforms like GRVT allow off-chain matching with on-chain settlement.

-

-

Speed & UX

-

CeFi offers faster order execution and high-frequency trading tools.

-

DeFi is catching up, especially with L2s (e.g., gTrade on Arbitrum). However, complex interfaces may deter newcomers.

-

-

Yield Opportunities

-

DeFi wins here. Vaults, LPs, and staking pools generate real on-chain yield.

-

CeFi offers fixed APYs or event-based bonuses. Less flexibility, more predictability.

-

-

Access

-

DeFi = global, permissionless. No KYC needed.

-

CeFi = often requires ID verification but offers fiat on/off ramps and easier onboarding.

-

Risk vs Return Table

| Factor | CeFi (e.g., XT.com) | DeFi (e.g., Polynomial) | Hybrid (e.g., GRVT) |

|---|---|---|---|

| Custody Risk | Medium | Low (self-custody) | Low-medium |

| Speed | High | Medium | High |

| Yield Potential | Medium | High | High |

| Regulatory Risk | Low (licensed) | High | Medium |

| User Control | Low | High | High |

Trader Use Cases

New Traders:

Use XT.com or BingX for copy trading and easy onboarding.

Yield Farmers:

Stick with Polynomial, Dopex, or Friktion (DeFi options vaults).

High-Frequency Traders:

Prefer GRVT or centralized desks like Bitunix for lower latency.

Privacy-Focused Users:

gTrade or Desk.exchange offer high leverage with no KYC.

Power Users:

Use hybrid platforms like HyroTrader to sync AI strategies with execution across DeFi and CeFi.

Key Takeaways

In 2025, there is no one-size-fits-all. Your choice should depend on your experience level, risk appetite, and strategy preference:

-

CeFi is ideal for ease of use and regulated access.

-

DeFi provides greater upside and control but comes with complexity.

-

Hybrid models are the future — offering security, speed, and sovereignty.

Best approach? Diversify across all three.