What is Deepcoin?

Deepcoin is a crypto trading platform operated by DEEPCOIN LIMITED. It is largely a cryptocurrency derivatives trading platform that supports leveraged trading with Perpetual and CFD contracts. Eagle Huang is the founder and CEO of Deepcoin. The company claims to have a team with wide ranging expertise and experience working at companies such as Binance, Morgan Stanley, Google, Chicago Mercantile Exchange, IBM, Citigroup, and more.

Deepcoin officially established its contract trading system in 2018. The following year, the exchange made spot trading and futures contracts trading available to the public. The exchange also claims to have obtained at least 3 major international financial regulatory licences. Deepcoin has now opened their services to the Russian, Japanese, Canadian, South American and African markets. According to Crunchbase, based on SEMRush data, the Deepcoin website has diverse users with some traffic coming from places such as the Philippines, South Korea, Egypt, Pakistan, Peru, etc.

What features does Deepcoin trading platform offer?

- The app has some decent reviews on the Google Play Store.

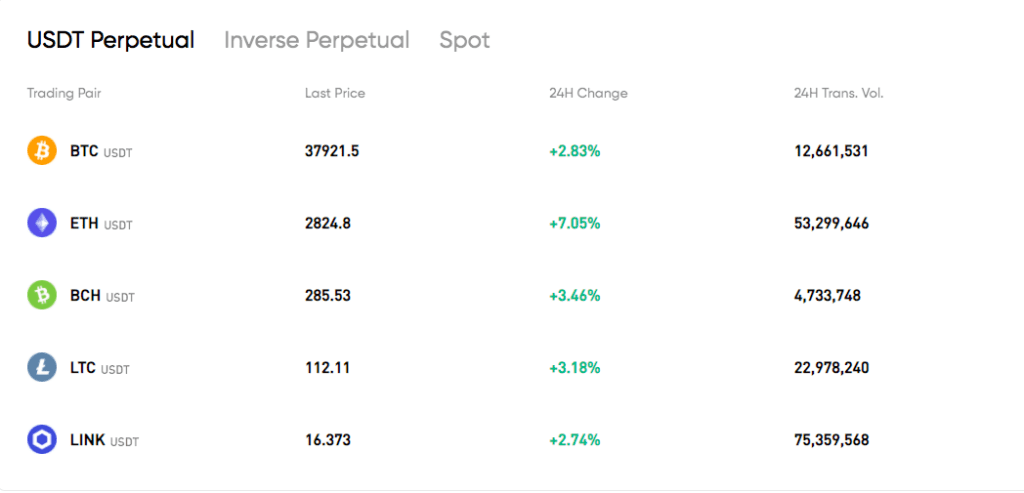

- Spot market – Deepcoin offers approx 100 different digital assets for trading on their spot exchange.

- On their derivatives market, users can find USDT Perpetual Contracts and Inverse Perpetual Contracts.

- Deepcoin claims to have a third-generation, robust transaction system.

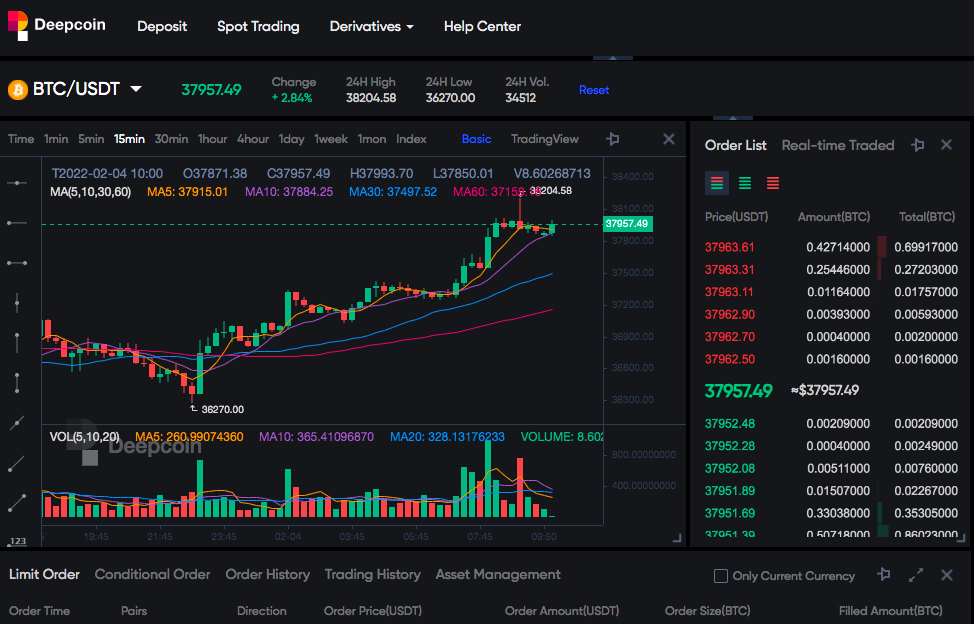

- They launched their K-Line Quick Trading function which is meant to allow one-click K-line trading that makes it faster and more efficient to handle and execute orders. This feature essentially provides users with the option to place trades and edit them directly on the chart without the need to switch back and forth between the order page.

- The platform also allows users to complete various trading operations on the K-line in an efficient manner. This includes setting leverage, setting Take Profit or Stop Loss (TP/SL) prices, and adjusting orders. With Deepcoin users have access to at least 3 TP/SL modes that can assist with risk control and profit management. First is the ability to set a TP/SL for the whole position amount. Alternatively, a user can also set a TP/SL with a partial amount of the position margin. In addition a user can also set a conditional TP/SL which would allow them to set a trigger price which essentially triggers the position to close at a specific price. What’s unique about this feature is that users have the ability to set take-profit and stop-loss points at any time in open positions and pending orders, for the purposes of having greater flexibility as far as risk control is concerned. Furthermore, Deepcoin also makes it possible for users to effectively set up to 50 take-profit and stop-loss orders for the same position, with different amounts of the margin, and at different prices. Limit orders are included in this – meaning that a user can be better prepared to manage risk at any stage of their investment cycle.

- Provides an ability to order up to 20 positions with split leverages or merge leverage up to 125x, and set up to 50 TP/SL positions on every position. Effectively, users are able to hold multiple positions with different leverages in the same currency. Setting a split position allows the user to pretty much choose and adjust leverage across multiple entry points in an independent fashion. Users are able to also add margin to the position and even merge separate ones together as they wish.

- Other features include Deepcoin’s dual-price liquidation, trailing stop, etc.

What is Deepcoin Token (DC token)?

DC token is described as an ecological token. It is an ERC-20 token running on the Ethereum network. DC token is said to have a max cap and never carries a public subscription. DC doesn’t focus on token burning after releasing a lot of supply onto the market, instead it supposedly associates the unlocking of tokens onto the public market with the token price and each unlocking round is said to be able to add up to 1% to the total supply. Deepcoin also introduced the concept of DC points whereby corresponding holders, according to the proportion of DC points they hold, are rewarded with DC tokens that are purchased on secondary spot markets. The DC token data is currently untracked on Coinmarketcap.

Conclusion

According to Deepcoin, they offer multi-language support including English, Chinese, Japanese, Russian, and Portuguese. The platform offers Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and other digital assets. They are also known for their derivatives trading services. There isn’t a lot of information about Deepcoin on review sites such as TrustPilot for example, so it’s always advisable to do your own research before using any trading platforms.