Curve Finance – Decentralised Exchange Liquidity Pool for Stablecoin Trading

Review of the Curve Finance decentralised exchange liquidity pool for stablecoin trading.

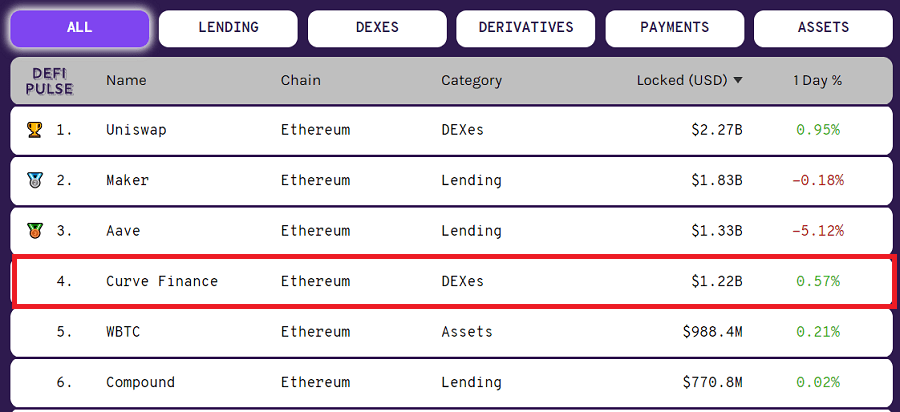

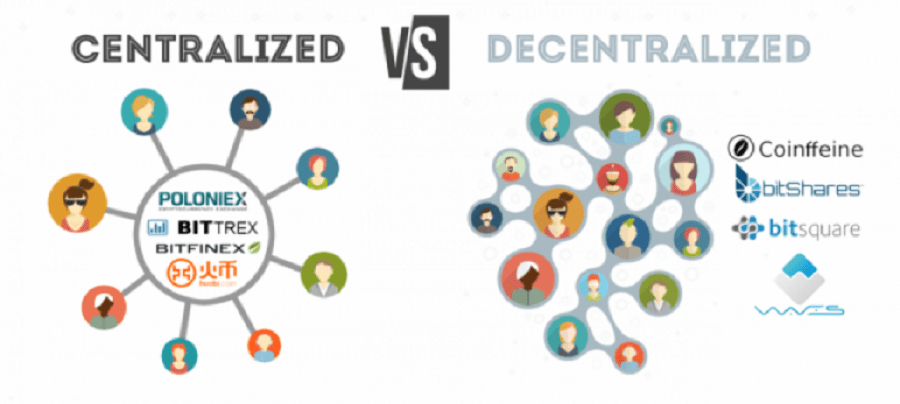

Some of the most fascinating platforms in decentralized finance are decentralized exchanges (DEXs). DEXs provide the same services as regular (centralized) cryptocurrency exchanges such as Binance or Coinbase. However, instead of a centralized party being in control of all cryptocurrency funds, they are automatically managed and traded using smart contracts – automated applications built on the Ethereum blockchain. Not only that, but no personal identification is required to use DEXs. Curve Finance is one of these DEXs.

Who created Curve Finance?

Curve Finance was created by Michael Egorov, a Russian physicist with many years of experience working in cryptocurrency. He has founded many successful cryptocurrency companies, most notably NuCypher, a blockchain encryption service which raised tens of millions of dollars in funding. Curve Finance was released in January 2020 and is still in development. For the time being, it only offers trades between stablecoins. Stablecoins are cryptocurrencies which mirror the price of a fiat currency, usually the US dollar.

How does Curve Finance work?

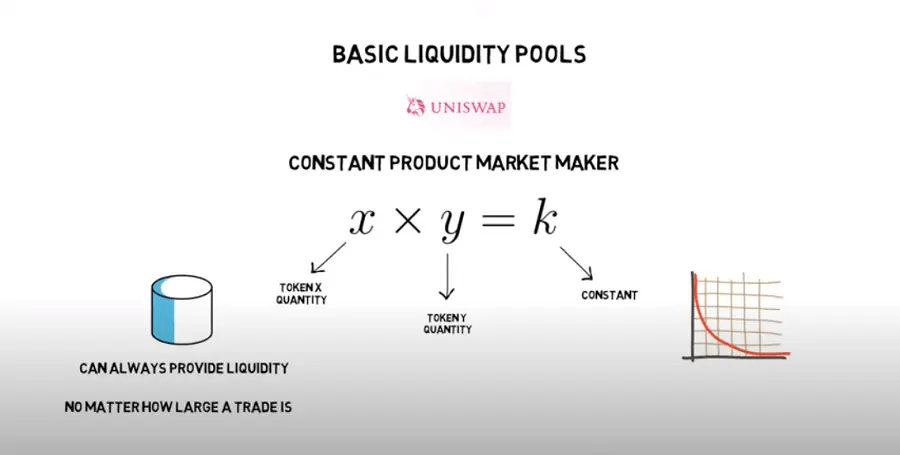

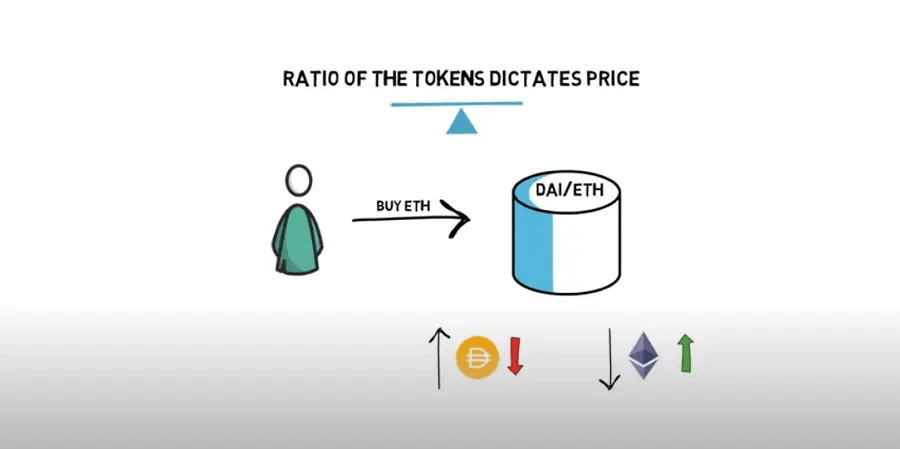

Curve Finance and other decentralized exchanges are also often called Automated Market Makers. This refers to the smart contracts they use to determine the price of an asset. On regular (centralized) exchanges, the price of an asset is determined by a tug of war between buyers and sellers. On DEXs like Curve Finance, the price of an asset is determined based on the ratio between two assets in a given pool. As such, you can imagine DEXs such as Curve Finance as a series of pools, where each pool contains 2 types of cryptocurrencies. Here is a simple example.

Suppose you have a pool containing 10 Ethereum and 1000 USDC (a stablecoin pegged to the price of the US dollar). When you do the math, each Ethereum is worth 100$ (1000 divided by 10). Imagine someone buys 1 Ethereum from the pool for 100$. When you do the math, the price of Ethereum is now 111$ for the next person who comes to buy.

This gives incentive for traders to go to a different exchange and buy Ethereum for the actual market price (100$) and sell it for a profit on a DEX by adding 1 Ethereum to the pool. This restores the ratio between the assets and brings the price of Ethereum back to what it should be (100$). The more cryptocurrency there is in a pool, the less the price will shift when someone buys or sells a cryptocurrency that is in the pool.

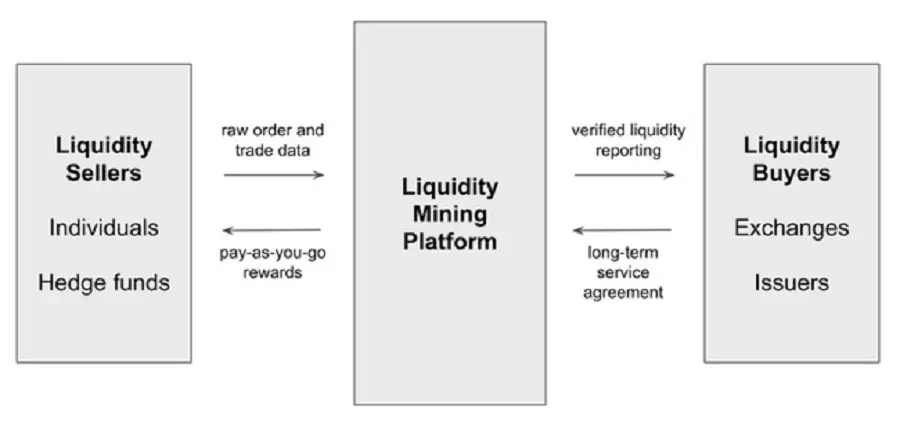

To make sure these pools stay large enough so that the prices stay within the appropriate range, Curve Finance and other DEXs give users incentive to deposit their cryptocurrency into these pools. They do this by giving them a high interest rate on the funds deposited into them. These interest rate rewards come from giving a cut of the trading fees on the platform to people who are providing cryptocurrency to the pools. The more in-demand a certain pool is, the higher the interest rates will be for those lending their assets. Lenders are also able to withdraw their cryptocurrency (along with the interest they have earned) at any time with no penalty.

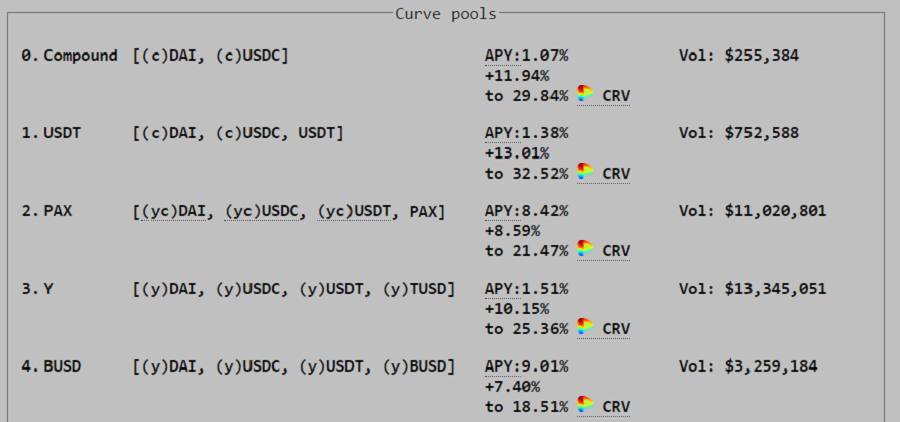

Since Curve Finance only deals with stablecoins for the time being, it “lends” its pools to other lending platforms in DeFi such as Compound Finance. This means that anyone who deposited their stablecoins into a pool on Curve Finance which is being “lent” to Compound Finance will earn interest from Compound Finance, plus the trading fees on the Curve Finance platform. This can give incredibly high interest rates on deposited funds of over 200% depending on market conditions. As you may have guessed, these interest rates fluctuate.

Why is Curve Finance important?

DEXs like Curve Finance allow you to trade cryptocurrency without having to trust a centralized third party. Many regular cryptocurrency exchanges have been hacked in the past and user funds have been lost. The only risk with DEXs is in the code used to build them. If they are built properly, they cannot be altered, hacked, or manipulated by anyone. DEXs like Curve Finance also makes it possible to earn high interest on deposited funds with no penalties when you remove them, which can be done at any time. Finally, Curve Finance is critical to another very powerful DeFi platform called yearn.finance, which we have also written about.