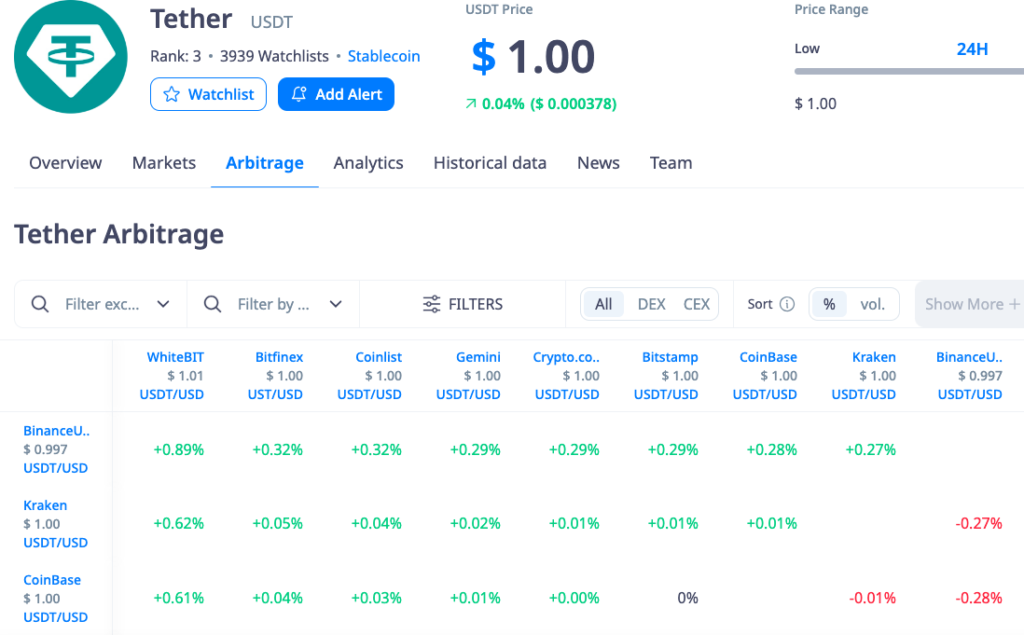

Cryptocurrency Arbitrage: How to Profit & Reduce Risk

How to Crypto Arbitrage Using $USDT (Tether).

Cryptocurrency arbitrage is a trading strategy that exploits the price differences of a single asset across various exchanges. Traders can secure a risk-adjusted profit by buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another.

Why Focus on Stablecoins Like USDT?

Stablecoins, such as USDT (Tether), offer a unique advantage for arbitrage strategies due to their price stability. They are pegged to stable assets like the US dollar, reducing the volatility commonly associated with cryptocurrencies. This stability makes USDT an ideal candidate for arbitrage, as it allows traders to navigate the crypto market’s unpredictability while capitalizing on price discrepancies.

How Does Crypto Arbitrage Work?

- Identifying Opportunities: Arbitrageurs scan multiple exchanges to find significant price differences in USDT or other cryptocurrencies.

- Execution Speed: Successful arbitrage requires rapid trade execution to capitalize on the fleeting opportunity before the market corrects the price difference.

- Risk Management: Despite the lower risk profile of stablecoins, traders must account for transaction fees, transfer times, and liquidity, all of which can impact profitability.

Types of Arbitrage Strategies

- Simple Arbitrage: Buying and selling the same asset on different exchanges.

- Triangular Arbitrage: Exploiting price differences between three currencies on the same or different exchanges.

- Cross-border Arbitrage: Taking advantage of price differences for the same asset on exchanges in different countries, considering the implications of exchange rates and local regulations.

Challenges and Considerations

- Fees and Costs: Trading and withdrawal fees can eat into profits. It’s crucial to calculate these costs beforehand.

- Regulatory Environment: The legal framework for cryptocurrencies varies by country. Understanding and adhering to these regulations is vital to avoid legal issues.

- Market Liquidity: Low liquidity can lead to slippage, affecting the execution price and potential profits.

Getting Started with USDT Arbitrage

- Research and Planning: Understand the mechanics of the exchanges you intend to use and plan your trades considering all potential costs.

- Tools and Technology: Utilize trading bots and arbitrage tools to enhance execution speed and efficiency.

- Continuous Learning: Stay informed about market dynamics and regulatory changes that could impact arbitrage opportunities.

Example of Crypto Arbitrage:

How to Arbitrage Using $USDT (Tether) on DiMAX

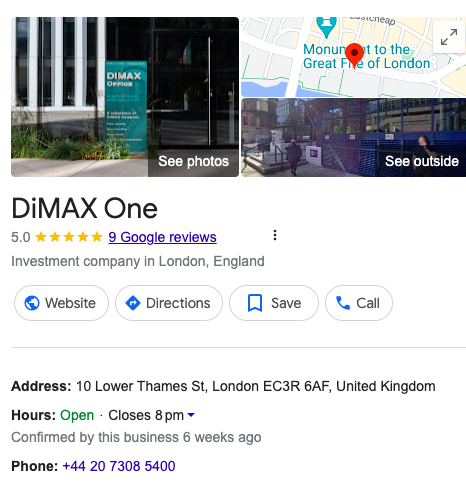

DiMAX is a platform that makes it possible to take advantage of Cryptocurrency Arbitrage, even without special knowledge and skills.

According to the company, they perform Inter-exchange Crypto-Arbitrage using the Stablecoin – Tether, which has the highest liquidity and market cap in the crypto space.

Their proprietary software is said to be designed to allow users to avoid most known risks and make it possible to make profit with crypto arbitrage.

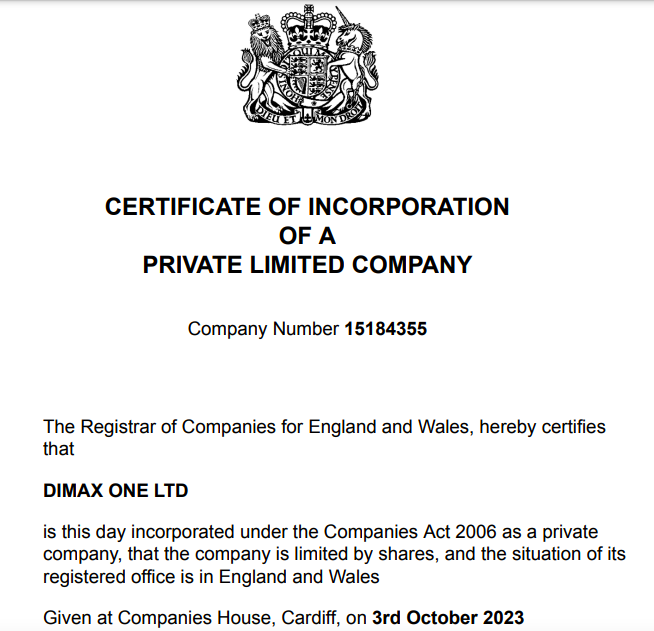

According to public records, the company is based in the UK. The registered office location is in London, England.

The company’s registration details can be found on the Company’s House website.

How Does DiMAX Work?

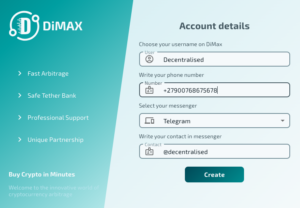

First, you need to open an account on the platform.

Once you confirm your email, you can then access the platform. Next you need to complete your account details including username,

Next you need to complete your account details including username,  DiMAX offers resources for users to learn more about the platform.

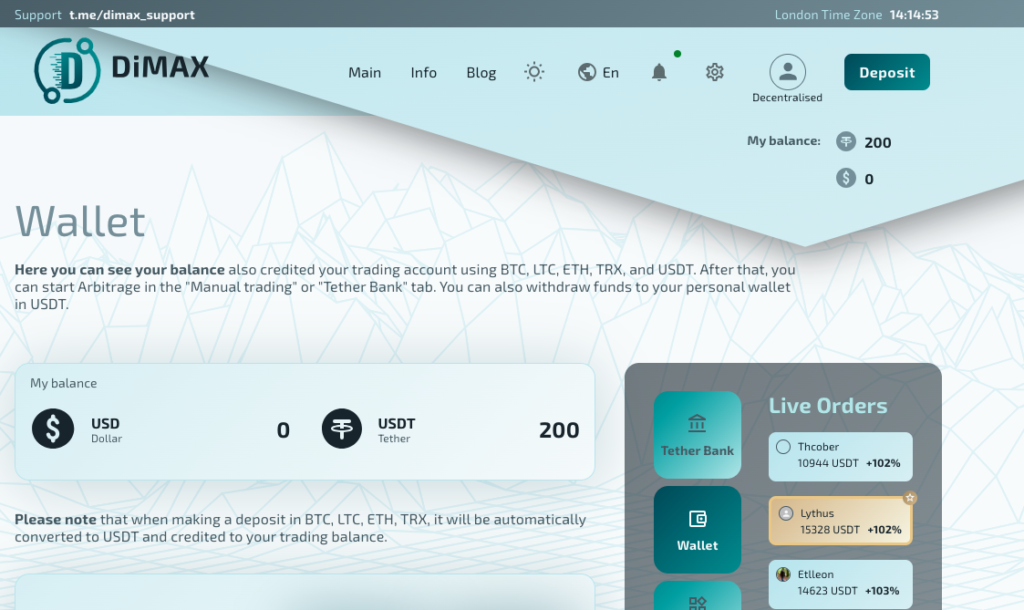

DiMAX offers resources for users to learn more about the platform.  To perform cryptocurrency arbitrage on the DiMAX platform, users need to make a deposit in the “Wallet” section. Users can deposit a range of digital assets including USDT, BTC, LTC, ETH, or TRX.

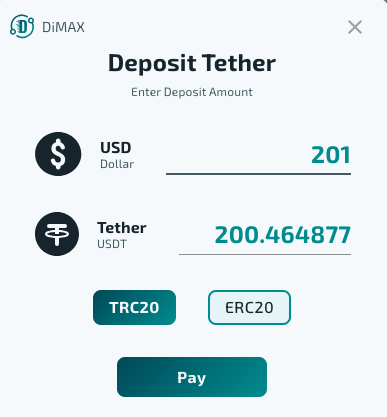

To perform cryptocurrency arbitrage on the DiMAX platform, users need to make a deposit in the “Wallet” section. Users can deposit a range of digital assets including USDT, BTC, LTC, ETH, or TRX. It is important to note that since DiMAX trades using the USDT/USD pair, users deposited digital assets will be automatically converted to Tether and credited to the trading account.

It is important to note that since DiMAX trades using the USDT/USD pair, users deposited digital assets will be automatically converted to Tether and credited to the trading account.

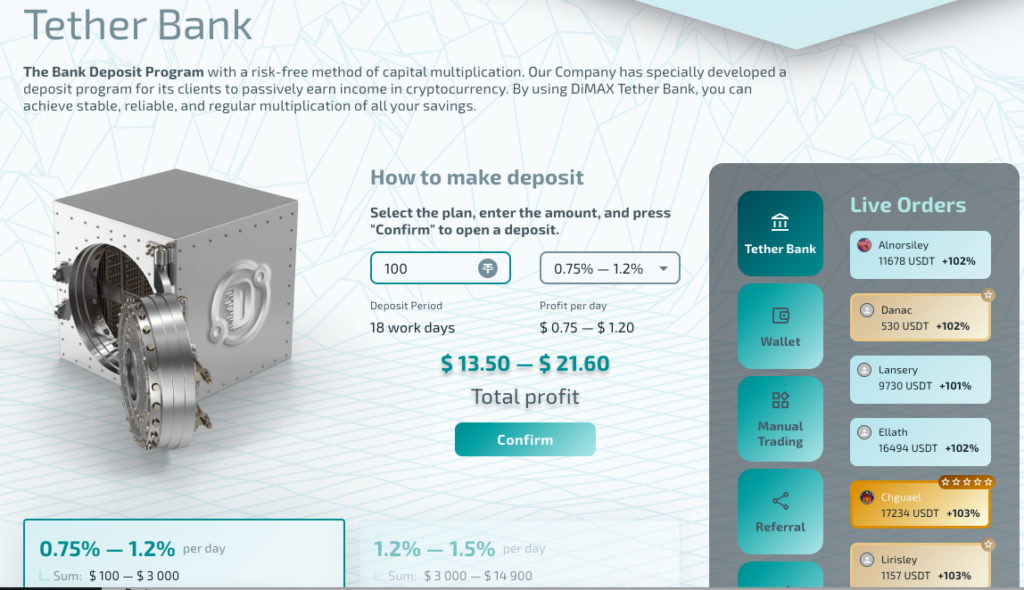

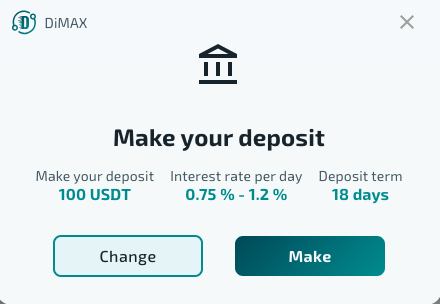

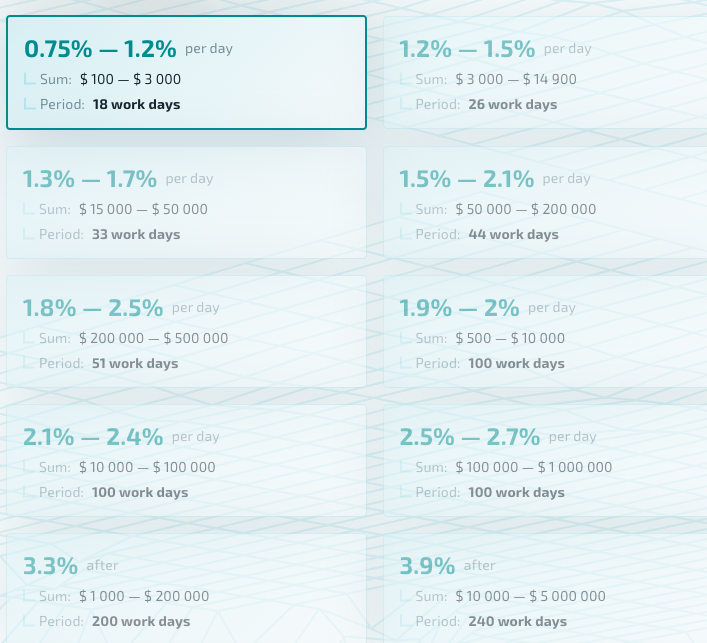

DiMAX Tether Bank Deposit Program

The Bank Deposit Program aims at multiplying depositors’ capital. DiMAX has specially developed a deposit program for its clients to passively earn income in cryptocurrency. By using DiMAX Tether Bank, users can achieve stable yield.

Once the transaction is processed, you’ll will get confirmation.

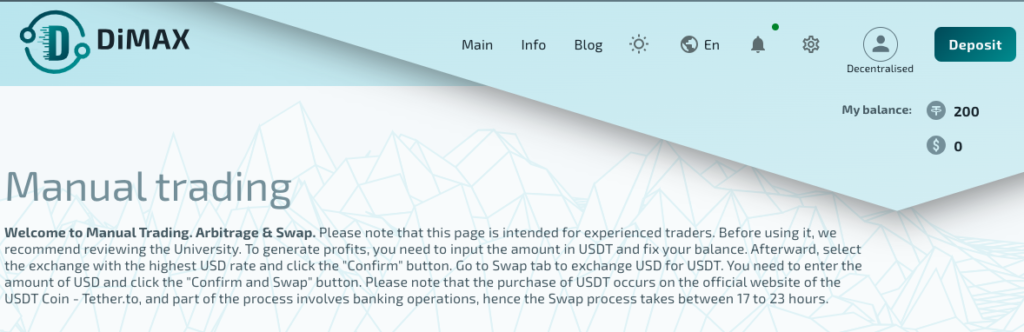

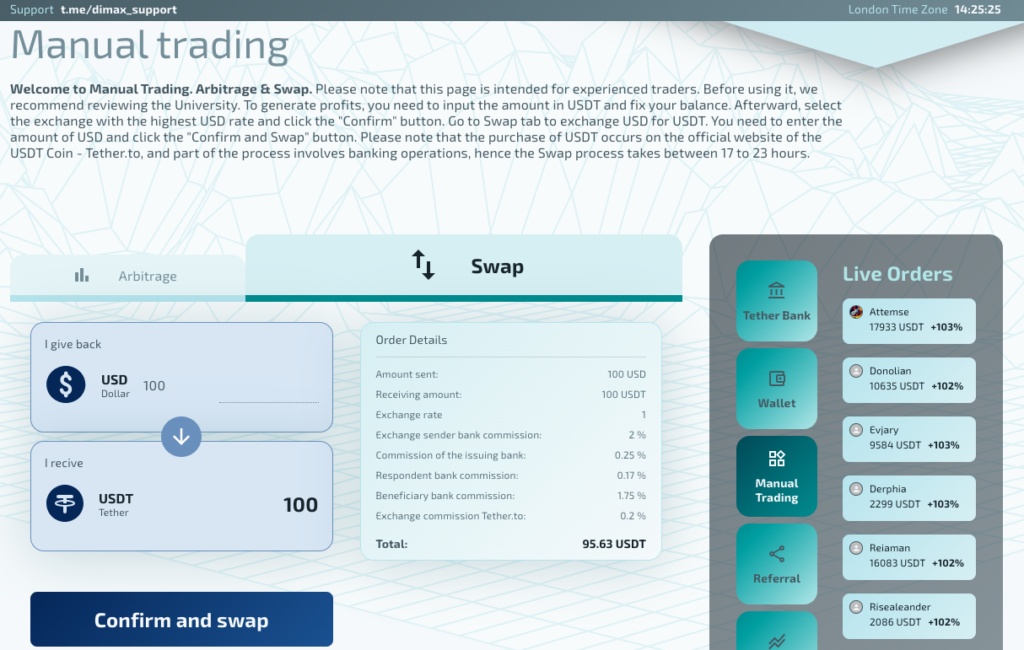

Manual Trading on DiMAX

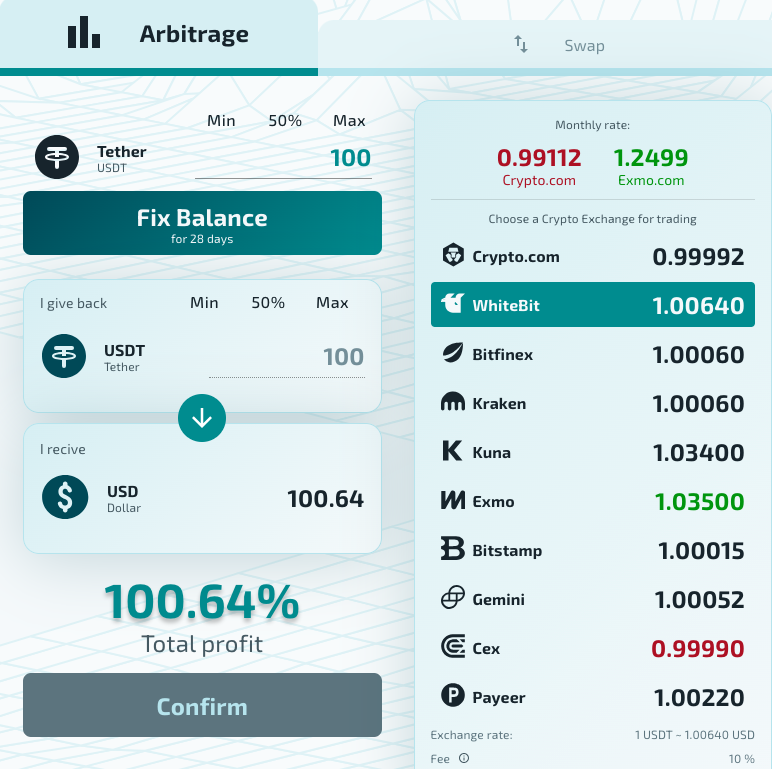

To engage in arbitrage, you should open the ‘Manual Trading’ page and select the ‘Arbitrage’ tab. Then enter the amount for the trade, choose the exchange with the desired rate, and click the ‘Confirm’ button.

The Manual Trading feature is designed to give users the opportunity to explore the arbitrage process and customise orders. Users will be able to control the amount of the arbitrage, choose on which crypto exchanges funds will be traded on, and also choose the most

desirable rate and time of opening a profitable order, which will allow the user to maximise profits.

According to DiMAX, the purchase of USDT occurs on the official website of the USDT Coin – Tether.to, and part of the process involves banking operations, hence the Swap process takes between 17 to 23 hours.

DiMAX offers different rates of arbitrage earnings.

Users’ requests are sent to the exchange of choice, where the arbitrage will take place, which only takes a few minutes.

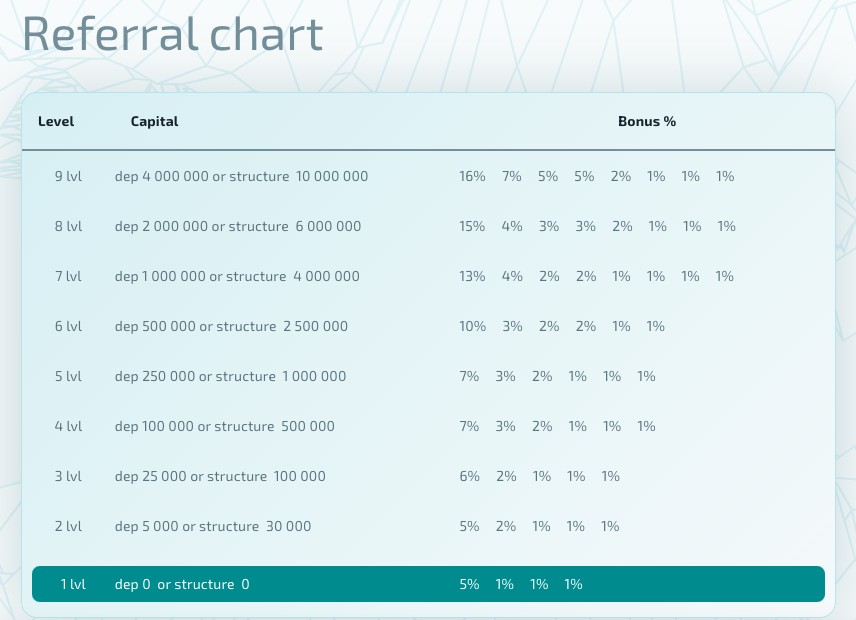

DiMAX Referral Program

Users have an additional opportunity to make passive income with the DiMAX referral program.

The first type of referral program is Piggy Bank. Enrolment in Piggy occurs after opening a deposit in a Tether bank or fixing a balance in manual trading by your referrals (such deposits are called active) which allows you to earn from all deposits, all your referrals, on a regular basis!

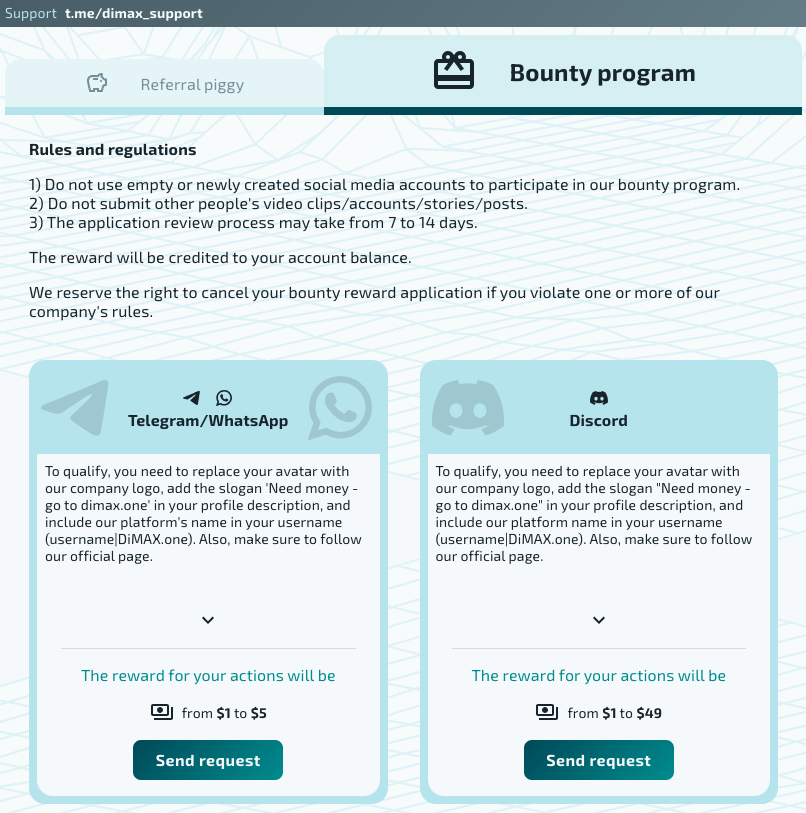

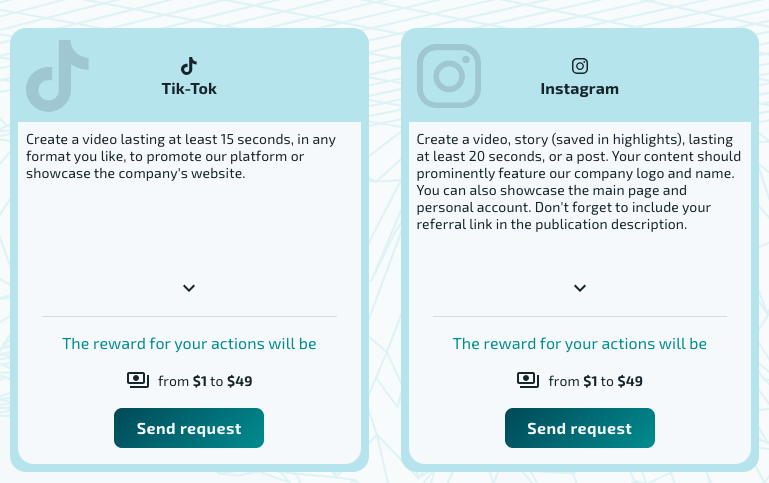

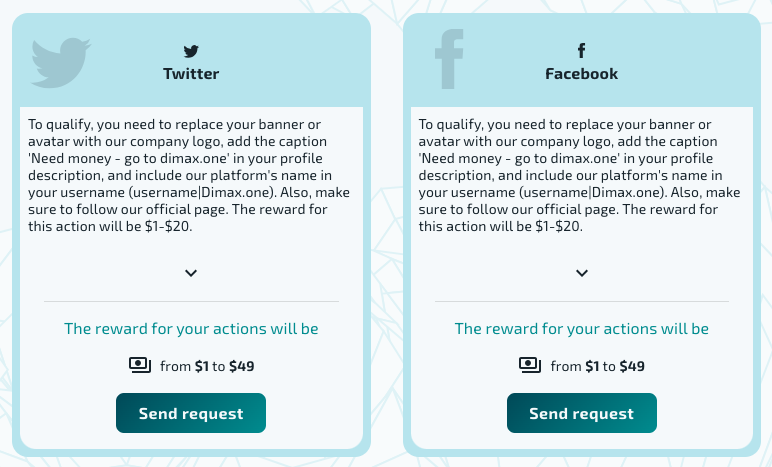

Please Note: You will be rewarded with each Active Deposit from your referrals on a regular basis. The second type of referral program is “Bounty”, where the company gives you the opportunity to earn regularly without any investment for promoting our project.

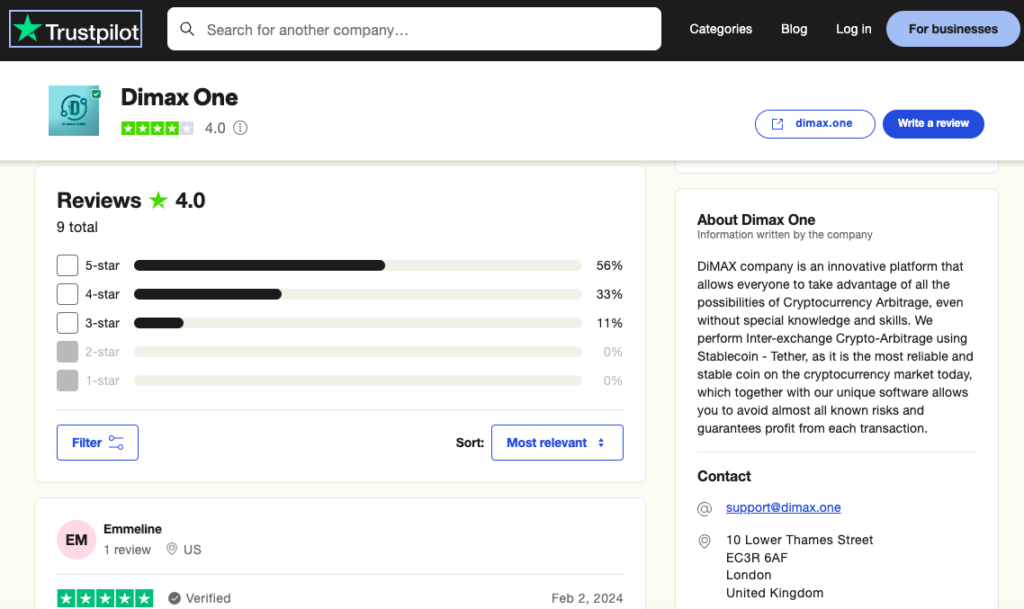

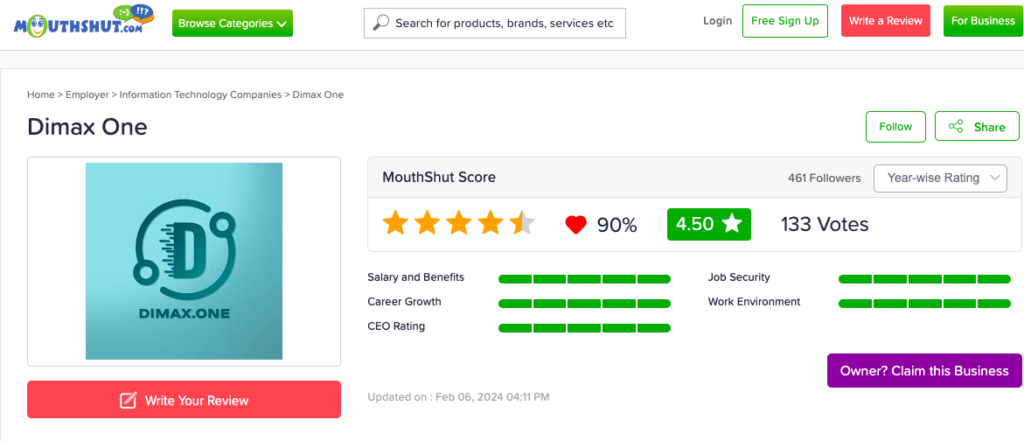

DiMAX Reviews

DiMAX has favourable reviews across different review sites.

It is important for users to conduct through due diligence and make sure they assess all risks before using any platform including DiMAX.

Conclusion

Cryptocurrency arbitrage, particularly with stablecoins like USDT, presents an appealing strategy for traders looking to exploit market inefficiencies. While it offers a more stable route compared to volatile crypto assets, success in arbitrage requires diligence, fast execution, and a deep understanding of the cryptocurrency market’s nuances. As with any trading strategy, it’s important to start small, learn continuously, and prioritize risk management to ensure sustainable profitability.

This guide synthesizes general principles and strategies for engaging in cryptocurrency arbitrage, emphasizing the unique opportunities and challenges presented by stablecoins like USDT.