Crypto Options Vaults: How to Earn Yield with Automated Derivative Strategies

Options trading can be daunting — but what if the complexity could be automated and transformed into passive

Options trading can be daunting — but what if the complexity could be automated and transformed into passive yield? That’s where crypto options vaults come in. These DeFi-native strategies are revolutionizing how both retail and institutional investors extract returns from volatility. In this article, we break down how they work, where to find them, and what risks you should be aware of.

What Are Crypto Options Vaults?

Options vaults are automated smart contracts that execute recurring options strategies, typically selling covered calls or cash-secured puts. The goal? Generate steady yield from market volatility without active management.

Platforms popularizing this model include:

-

Polynomial (Optimism) – Weekly call-selling strategies

-

Ribbon Finance (Ethereum) – Structured products with BTC/ETH exposure

-

Friktion (Solana) – Institutional-style options strategies with transparent risk modeling (sunsetted but foundational)

Think of them as robo-advisors for crypto options.

Weekly Rolling Strategies Explained

The most common strategy is a weekly covered call:

-

Deposit ETH into the vault

-

The vault sells out-of-the-money (OTM) call options

-

Earn premiums each week

-

If ETH price stays below the strike, you keep the yield

-

If price goes above, your ETH is sold at the strike price

Some vaults also run put-selling strategies to accumulate assets cheaply.

Vault Returns vs LP Farming

Yield farming in DeFi often depends on liquidity mining incentives. Options vaults generate real, sustainable yield from market pricing and volatility — not inflationary token emissions.

Icons & Quick Comparison:

-

Options Vaults: Real yield from options premiums

-

LP Farming: Yield often from inflationary rewards

-

Spot Staking: Yield from network inflation or transaction fees

Passive Vaults vs DIY Options

Vaults (e.g., Polynomial, Ribbon):

-

✅ Easy to use

-

✅ No need for options experience

-

❌ Less flexible

-

❌ Subject to vault capacity limits

DIY Options (e.g., Lyra, Dopex):

-

✅ Full strategy control

-

✅ More instruments (calls, puts, spreads)

-

❌ Requires deep knowledge

-

❌ Higher complexity and gas fees

Risks: What to Know

-

IV Crush: When volatility drops, premiums shrink

-

Market Neutrality: Strategies may underperform in trending markets

-

Vault Capacity: Popular vaults often cap deposits

-

Slippage/Settlement: Some options settle off-chain, increasing risk

Platform APR/APY Comparison

| Platform | Strategy | Est. Weekly Yield | Chain |

|---|---|---|---|

| Polynomial | ETH Covered Calls | 0.5–1.5% | Optimism |

| Ribbon | BTC/ETH Options | 0.3–1.0% | Ethereum |

| Stryke (formerly Dopex) | SSOVs (Vaults) | Variable | Arbitrum |

| Derive (formerly Lyra) | AMM + Options | Active Strategy | Optimism |

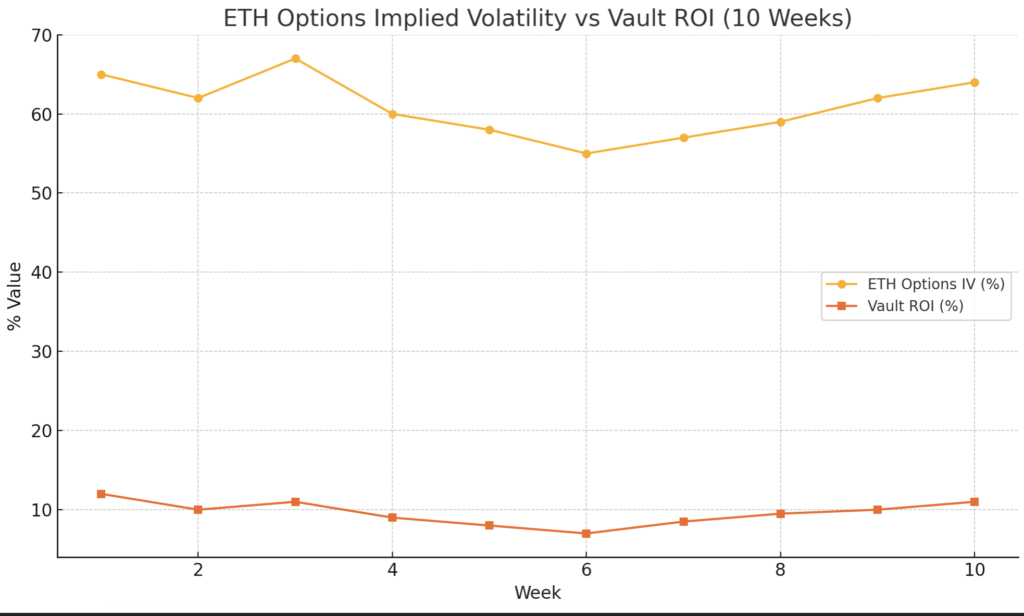

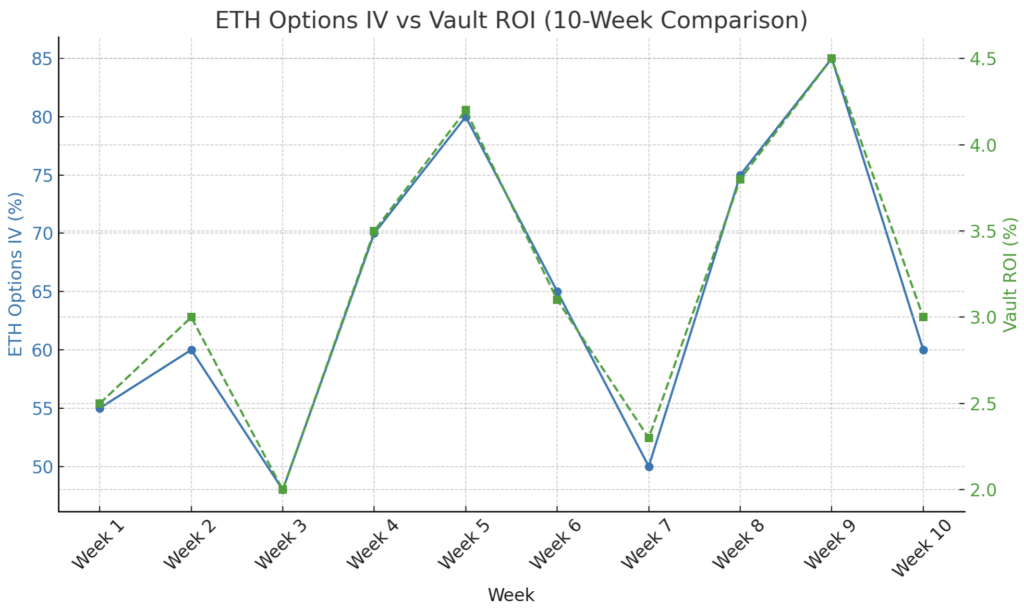

Chart: ETH Options IV vs Vault ROI

The chart above shows how vault returns trend closely with implied volatility. In weeks of elevated IV (≥70%), ROI tends to peak, highlighting the importance of timing entries.

Should You Use Vaults?

If you want passive exposure to derivatives without managing positions, options vaults are one of the most compelling innovations in DeFi. They’re not risk-free, but they offer a new class of structured yield farming based on market pricing inefficiencies — not token inflation.

Best For Beginners:

-

Polynomial

-

Ribbon

Best For Advanced Traders:

-

Stryke (formerly Dopex)

-

Derive (formerly Lyra)