Cream Finance – decentralized peer-to-peer lending platform

Review of the Cream Finance decentralised p2p lending platform.

As more and more unique applications are introduced into cryptocurrency’s DeFi space, the demand for a one-stop-shop has been increasing. Enter Cream Finance, a rapidly growing DeFi platform which seeks to be that one-stop-shop for DeFi applications.

What is C.R.E.A.M. Finance?

C.R.E.A.M. Finance is a decentralized lending protocol that offers financial services to both individuals and protocols. The protocol is transparent, permissionless, and non-custodial.

Presently, C.R.E.A.M. operates on Ethereum, Binance Smart Chain, and Fantom. The smart contract money markets of C.R.E.A.M. Finance are specifically designed for longtail assets, with the objective of increasing the capital efficiency of all assets in the crypto markets.

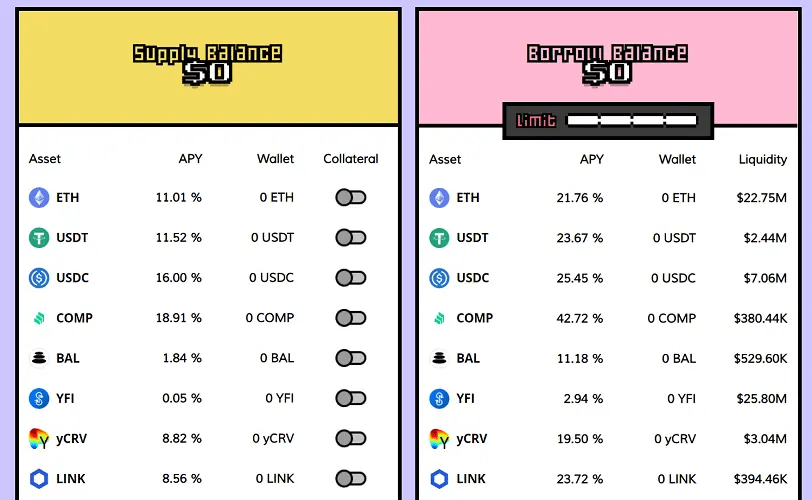

Users can lend any of the supported assets on the markets and utilize the provided capital as collateral to borrow another supported asset. The money markets of C.R.E.A.M. offer a diverse range of tokens, including stablecoins like USDT, USDC, BUSD, interest-bearing stablecoins such as yCRV and yyCRV, defi tokens like YFI, SUSHI, CREAM, and LP-tokens like USDC-ETH SLP and WBTC-ETH SLP, as well as other cryptocurrencies like ETH and LINK. It’s important to note that this list is not exhaustive.

Who created Cream Finance?

Cream Finance was founded by Taiwanese entrepreneur Jeffrey Huang. Huang is also the creator of a semi-popular cryptocurrency application called Mithril. Mithril is a decentralized social media platform inspired by Huang’s hugely successful centralized social media platform, Machi 17. Although not very well known outside of Asia, Machi 17 has over 42 million users.

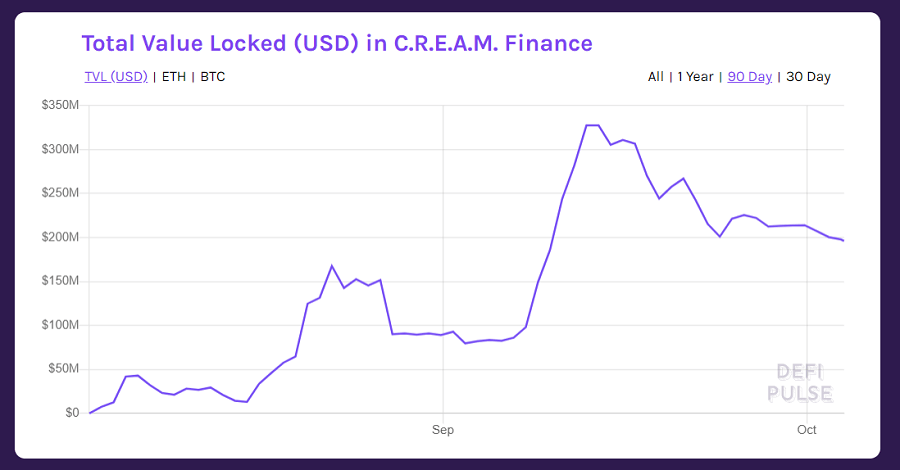

Cream Finance was announced on July 16th 2020 and officially launched on August 3rd 2020. Development updates have been announced by Cream Finance almost every other day since its August release. Since that time, Cream Finance has grown to custody over 200 million USD of cryptocurrency assets on the platform and its CREAM token has been listed on well-known exchanges such as Binance.

How does Cream Finance work?

Since most DeFi applications are open source, this makes it possible for anyone to create a clone of the original application (albeit under a different name and on a different website). As mentioned previously, Cream Finance offers multiple different applications which are currently popular in DeFi.

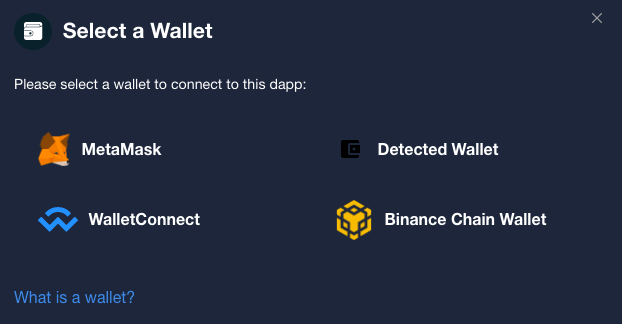

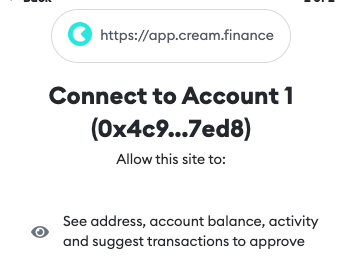

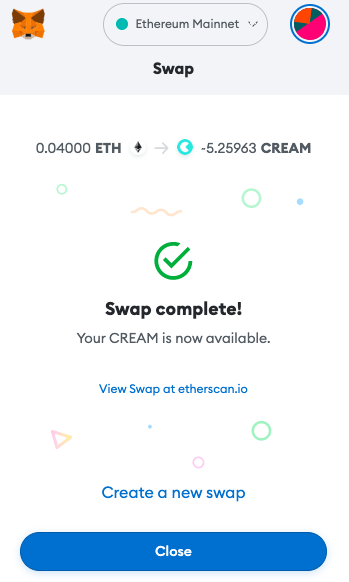

Like other popular DeFi platforms, Cream Finance is built on the Ethereum blockchain. Ethereum can be simply understood as a network sustained by multiple computers. As you may already know, Ethereum is also a tradeable cryptocurrency. To interact with Cream Finance, all you need is a Web 3.0 wallet like Metamask (a simple browser plug-in) which gives you access to the Ethereum network.

For its borrowing and lending application, Cream Finance copied the open source code of Compound Finance, one of the largest lending and borrowing applications in DeFi. Compound Finance was/is not upset about this. On the contrary, they are supporters of the project and are even one of the entities which ensures Cream Finance’s security.

Cream Finance copied parts of the open source code of popular decentralized exchanges Balancer and Uniswap to create its own decentralized exchange, titled Cream Finance Swap. It is also finalizing development of a more advanced decentralized exchange called CreamY, which is built using open source code from Curve Finance.

Cream Finance also offers cryptocurrency staking via its liquidity mining incentives. To briefly recap, liquidity mining involves rewarding those who deposit cryptocurrency into a DeFi application by giving them a high level of interest on their staked funds. These rewards usually come from the trading fees that other users pay when interacting with applications on the platform. Staked assets can be withdrawn at any time without penalty unless otherwise noted.

It is best to read our other articles about DeFi, Compound Finance and Curve Finance to understand how all of these elements work in detail. The last thing to mention is that Cream Finance rewards all users which interact with their applications with small portions of CREAM tokens. This Ethereum-based cryptocurrency gives users the ability to vote to decide how the various applications on Cream Finance should be changed.

Why is Cream Finance important?

DeFi applications in cryptocurrency often take quite a bit of time to learn how to use. Not only that, but these applications are often spread out across different websites and have their own unique interfaces. Cream Finance takes these complex applications and presents them in a user friendly way, all in one place.

To purchase CREAM tokens, simply use a web3 wallet such as MetaMask.

Cream Finance offers decentralized lending and borrowing, cryptocurrency staking, and even offers two unique decentralized exchange applications. Contrary to first impressions, Cream Finance is not a homage to the dairy product of the same name. Cream stands for “Crypto Rules Everything Around Me”.