Copy Trading Crypto Futures and Perps in 2025

Unlocking passive income through copy trading.

What Is Copy Trading? How It Evolved

Copy trading is an investment strategy where individuals automatically replicate the trades of experienced traders. This method allows less experienced or time-constrained individuals to benefit from the techniques of successful traders without having to execute trades manually.

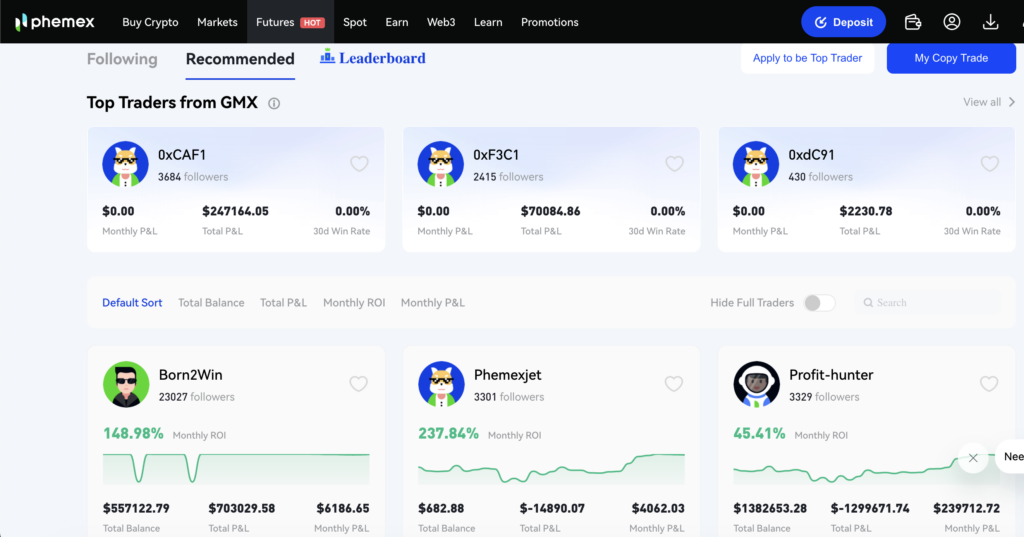

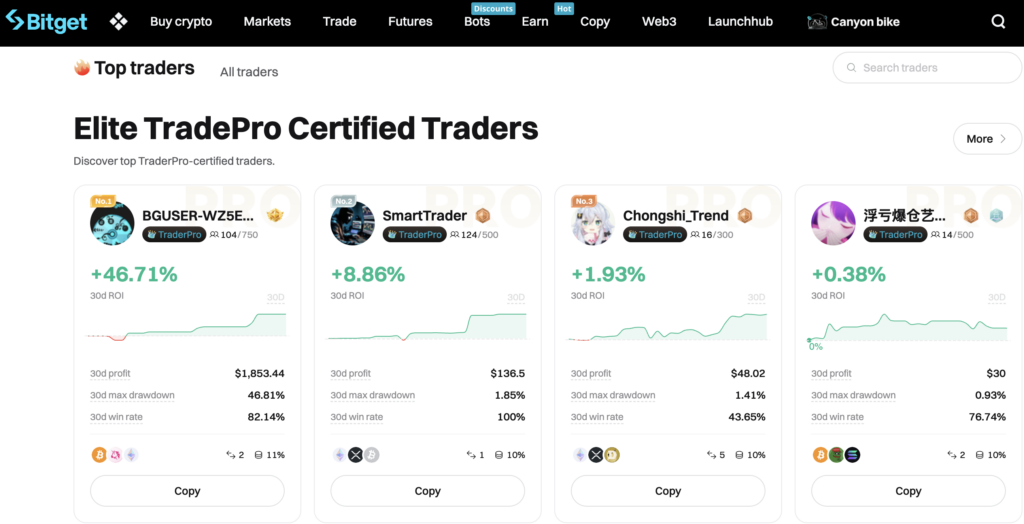

Initially popularized in traditional financial markets, copy trading has found a significant foothold in the crypto space, especially with the rise of derivatives trading. Platforms like Bitget, BingX, Phemex, and BloFin have integrated copy trading features, enabling users to mirror the strategies of seasoned traders in real-time.

Derivatives-Specific Copy Trading Strategies

In the realm of crypto derivatives, copy trading encompasses various strategies tailored to market conditions:

-

Short Scalping: Rapid trades aiming to profit from minor price movements in a declining market.

-

Perpetual Grid Trading: Placing buy and sell orders at set intervals to capitalize on market volatility.

-

Martingale Strategy: Doubling down on losing positions to average out the entry price.

-

CTA (Commodity Trading Advisor) Strategies: Algorithm-driven approaches based on quantitative analysis.

These strategies are often employed by master traders on platforms like Bitget and BloFin, allowing copiers to select approaches that align with their risk tolerance and investment goals.

Platform Review: BingX, Bitget, Phemex, BloFin

| Platform | Key Features | Notable Aspects |

|---|---|---|

| BingX | Social-driven copy trading, integration with TradingView | Offers a seamless experience with low fees and diverse asset options. |

| Bitget | Extensive trader base, transparent performance metrics | Hosts over 100,000 elite traders with a user-friendly interface. |

| Phemex | Advanced copy trading features, intuitive interface | Provides customizable copy order criteria and detailed performance metrics. |

| BloFin | Comprehensive trader analytics, robust security measures | Supports all trade pairs for copy trading with no limit on the number of pairs. |

Risk Profiles of Top Traders

When selecting a trader to copy, it’s crucial to assess their risk profile. Key metrics include:

-

Return on Investment (ROI): Indicates the profitability of a trader’s strategy.

-

Maximum Drawdown: Reflects the largest loss from a peak to a trough.

-

Win Rate: The percentage of profitable trades.

-

Trading Frequency: How often the trader executes trades.

Platforms like BloFin categorize traders based on these metrics, allowing users to choose between aggressive, moderate, or conservative strategies.

How to Audit Performance and Detect Fake PnL

To ensure the authenticity of a trader’s performance:

-

Verify Historical Data: Examine the trader’s performance over an extended period.

-

Cross-Reference Metrics: Compare ROI, drawdown, and win rate for consistency.

-

Monitor Trade Consistency: Look for patterns in trade execution and strategy adherence.

-

Beware of Unrealistic Returns: Extremely high returns may indicate unsustainable strategies.

Platforms like Bitget and Phemex provide transparent performance metrics, aiding users in making informed decisions.

Copy Trading Flow & Earnings Breakdown

Flow Diagram:

-

Select a Master Trader: Choose based on performance metrics and strategy alignment.

-

Allocate Funds: Decide on the amount to invest in copy trading.

-

Automated Execution: Trades by the master trader are mirrored in your account.

-

Monitor Performance: Regularly review returns and adjust allocations as needed.

-

Profit Sharing: A percentage of profits is shared with the master trader, typically around 10%.

Tools: Signal Tracking Bots, Smart Wallets

Enhance your copy trading experience with:

-

Signal Tracking Bots: Automate the process of identifying and copying trades.

-

Smart Wallets: Manage multiple copy trading strategies and allocations efficiently.

-

Performance Dashboards: Visualize returns, drawdowns, and other key metrics.

Platforms like BingX and Bitget offer integrated tools to streamline the copy trading process.

Conclusion

Copy trading in crypto derivatives offers a pathway for both novice and experienced traders to engage in the market with reduced effort. By selecting the right platforms and traders, and utilizing available tools, users can potentially achieve consistent returns while mitigating risks.