Compound Finance – Decentralized Lending Protocol

Decentralised finance interest rate protocol review.

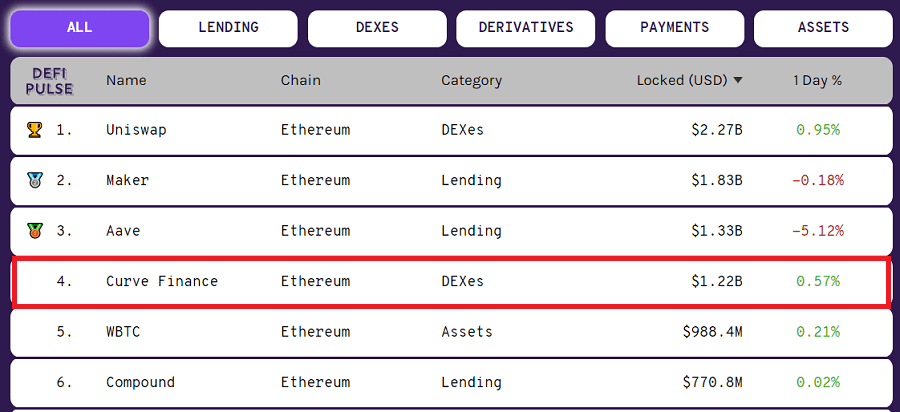

There are dozens of different platforms in the world of decentralized finance. The most popular DeFi platforms are decentralized cryptocurrency lending and borrowing services. These offer incredible benefits to both lenders and borrowers, primarily because there is no third party in the middle requiring elaborate paperwork and taking a cut of all transactions. Compound Finance is the first DeFi lending platform to become popular in the cryptocurrency space, mainly because of the incredibly high interest rates users could earn for lending their funds to the platform. $COMP is the native ecosystem token for Compound Finance and the digital asset can be exchanged and traded on marketplaces such as Binance, Bybit, KuCoin, Coinbase, Kraken, OKX, Poloniex and Gateio, among others. You can also acquire $COMP via decentralized exchanges including Uniswap.

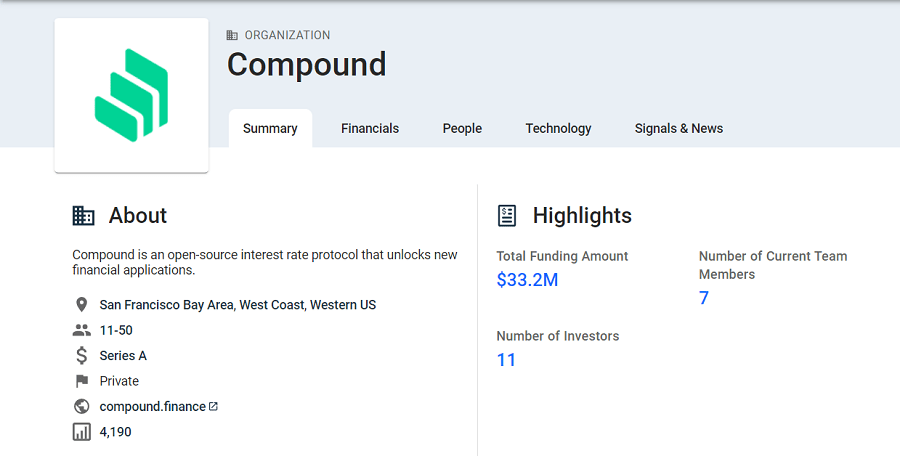

Who created Compound Finance?

Compound Finance was created by California-based Compound Labs. Compound Labs has been developing the platform since 2018. The goal of the platform is to allow users to put their idle cryptocurrency to use. This was and continues to be an attractive selling point since many investors in the cryptocurrency space simply hold on to their cryptocurrency until the market goes up before selling. Compound Finance wants lenders to be able to earn interest on this cryptocurrency which otherwise sits in their wallets and give easy access to cryptocurrency lending services to borrowers.

How does Compound Finance work?

Like most other DeFi platforms, Compound Finance is built on the Ethereum blockchain. As you may already know, Ethereum is a cryptocurrency which also lets you build custom platforms. Every platform built on Ethereum consists of smart contracts – programs which automatically execute a series of transactions. You can think of smart contracts like automated applications that cannot be modified once released. Every DeFi platform is fundamentally a collection of automated applications (smart contracts) working together.

In Compound Finance you can lend and borrow Ethereum-based cryptocurrencies. This includes Ethereum, as well as multiple ERC-20 tokens – cryptocurrencies that are built using Ethereum’s template (instead of from scratch). No credit checks or personal identification is required to lend or borrow cryptocurrencies, and there are technically no time limits on when borrowed cryptocurrency must be paid back.

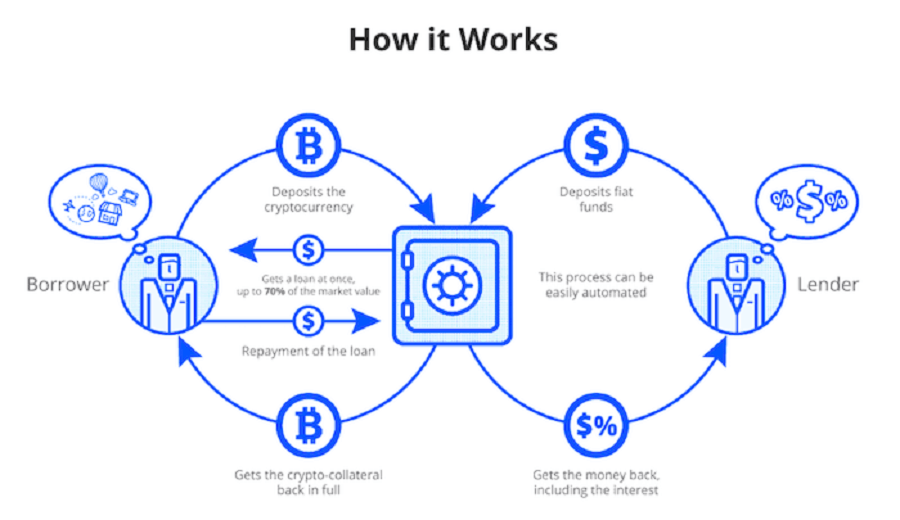

This is possible because in order to borrow cryptocurrency on Compound Finance, you must first deposit an amount of cryptocurrency which is greater (in USD) than the amount you will be borrowing. This is called overcollateralization and is what makes it possible to borrow cryptocurrency without a regulatory body. Instead, incentives to be responsible are built into the system using smart contracts.

If the USD amount of the cryptocurrency which was deposited to take out a loan falls below a certain threshold, the cryptocurrency locked up by a borrower can be liquidated – sold at a discount to other users on the platform. Overcollateralized loans are useful as loans for those with Ethereum-based cryptocurrency assets who do not want to sell them but need extra cash to cover an expense. Many experienced cryptocurrency traders also use these loans to make extra money by making risky trades on cryptocurrency exchanges.

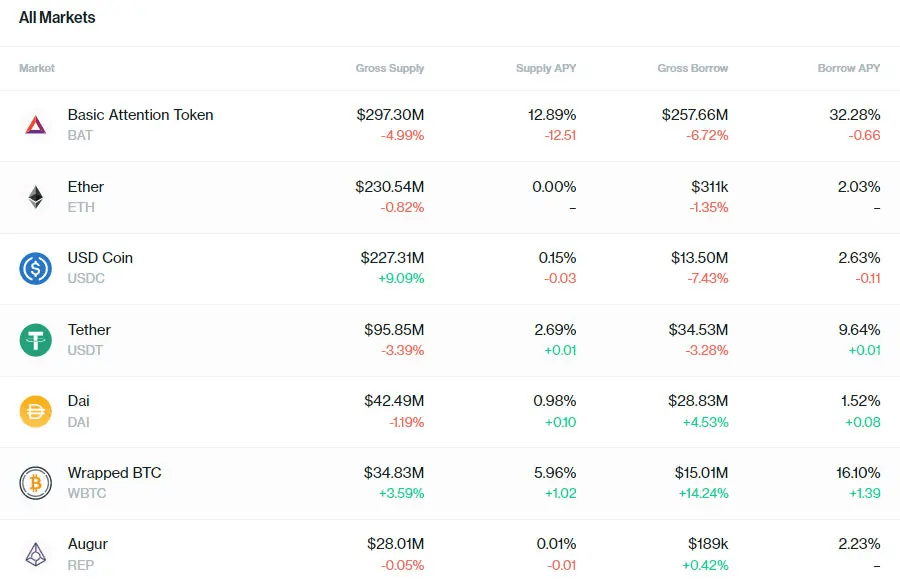

To make it possible for borrowers to borrow other types of cryptocurrencies besides the one they deposited as collateral, Compound Finance motivates lenders to deposit their cryptocurrencies into lending pools which borrowers can take from. This allows lenders to earn handsome interest rates of up to over 30% on some assets. Since these pools are incredibly large, it makes it possible for lenders to remove their assets from the platform at any time with no penalties.

The interest rate for borrowers and lenders depends on supply and demand. If the demand is high and the supply is low, the interest rate increases to motivate lenders to deposit more funds and to deter borrowers from taking too many. Interest is accrued continuously every second for both parties. As you may have guessed, the interest rate owed by borrowers is always higher than the positive interest rate earned by lenders.

Why is Compound Finance important?

DeFi lending platforms like Compound Finance show us what is possible when you remove the middleman and automate the process of lending and borrowing. Not only does it make these financial services accessible to everyone, it also makes it more profitable for those participating in the system regardless of if they are lenders or borrowers.

The high interest rates that can be earned for lending cryptocurrency have made it possible for both individuals and institutions to keep their savings growing even while legacy institutions such as banks cut interest rates. Not surprisingly, platforms like Compound Finance are on the radar of companies both inside and outside of the crypto space.