Historically, the real estate industry has lagged in adopting new technology. However, research shows that implementation of blockchain technology can have a range of benefits for the sector going into the future. According to Deloitte blockchain technology has recently been adopted and adapted for use by the commercial real estate (CRE) industry.

CRE executives are finding that blockchain-based smart contracts can play a much larger role in their industry. Real estate interactions are third-party dependent making them costly and time-consuming. From rentals to larger commercial deals, smart contract technology can be deployed to make for real estate transactions safer and easier. Blockchain can potentially transform core commercial real estate operations such as property transactions like purchase, sale, financing, leasing, and management transactions.

Blockchain technology can also assist in the creation of new business models connecting potential buyers and sellers. Asset tokenisation on blockchain has opened up another huge market because it enables property to be traded similar to other exchange-based securities. It also presents the opportunity to sell into new market segments as a result of lower costs. The opening of new geographical markets as a result of secure identities and widening of investment opportunities through new options for asset-funding is also made possible by blockchain.

Through asset tokenisation opportunities for new investment products and new revenue sources created by direct connection to end investors, bypassing the wholesale market and distribution platforms are available. Furthermore blockchain enables enhanced data management capabilities, ore efficient post-trade processes, more efficient reporting and oversight, reduced counter-party risk and enhanced collateral management on top of reduced costs.

Use Cases for Blockchain Applications in Real Estate

Property Search

Blockchain can allow a property listing to exist on a single decentralized database and market participants could access more reliable data at a lower cost. With data distributed across a peer-to-peer network, brokers would be able to have more control over their data, as it would be more difficult for it to be interfered with by any third parties. Imbrex is an example of such a blockchain-based property listing platform.

Property Management

Property management is highly complex, with many stakeholders involved — including landlords, property managers, tenants, and vendors. Most properties are currently managed either offline through manual paperwork, or through multiple software programs that generally don’t integrate well with one another. Through the use of a single decentralised application that uses blockchain-backed smart contracts, the entire property management process, from signing lease agreements to managing cash flow to filing maintenance requests, can be conducted in a secure and transparent manner.

In residential real estate, for example, a landlord and tenant could digitally sign a smart contract agreement that includes information such as rental value, payment frequency, and details of both the tenant and property. Based on the agreed upon terms, the smart contract could automatically initiate lease payments from the tenant to the landlord, as well as to any contractors that perform periodic maintenance. Upon termination of the lease, the smart contract could also be set to automatically send payment of the security deposit back to the tenant.

Titles

Blockchain could make title investigations much easier for those in the real estate business. The result will be faster closings and lowered risk for error during title transfers.Blockchain can provide better property ownership record tracking, and improve efficiencies for title companies and title insurance. Most property titles are paper-based, creating opportunities for errors and fraud. According to the American Land Title Association, title professionals find defects in 25% of all titles during the transaction process. This means property owners often incur high legal fees to ensure authenticity and accuracy of their property titles.

Title fraud also presents a risk to homeowners. In the US, losses associated with title fraud reportedly averaged roughly $103,000 per case in 2015, which contributed to large numbers of property buyers purchasing title insurance.These title management issues could potentially be mitigated by using blockchain technology to build immutable digital records of land titles. This approach could simplify property title management, making it more transparent and helping to reduce the risk of title fraud and the need for additional insurance.

Some companies and governments are looking to implement blockchain technology for the title management process. In 2017, the company partnered with the Brazilian Cartorio de Registro de Imoveis (Real Estate Registry) to establish pilot programs. Ghanaian blockchain company Bitland has been working on a similar solution for Ghana, where it is estimated that almost 80% of land is unregistered, according to Forbes. Those that possess unregistered land find it more difficult to prove legal ownership, increasing their exposure to the risk of land seizures or property theft.

Bitland is seeking to create secure digital public records of ownership on its blockchain platform, with the aim of protecting land owners from title fraud. Bitland has expanded to operate in 7 African nations, India, and is also working with Native Americans in the US.

Real estate giant RE/MAX has also been exploring blockchain use cases. RE/MAX partnered with blockchain company XYO Network to explore using blockchain technology to build a decentralized online land title registry in Mexico. XYO Network’s first project with RE/MAX involves tying location coordinates to unique digital tokens that represent land titles. As a property changes owners so will the digital token (with the transaction being recorded on a blockchain), establishing a transparent history of land ownership.

Safewire is another enterprise leveraging blockchain technology in the title management space. The company helps title agents verify client identities, bank account ownership, and securely transfer wire information. Its platform seeks to reduce losses from fraud and bring down operational costs.

Real Estate Investing

Real estate investing has historically only been available to those able to put down large sums of capital. In addition, real estate investing often involves expensive intermediaries such as fund managers, further raising the barrier to entry.

However, blockchain technology it looking to disrupt real estate investing by providing a way to decentralise the process through crowdsourcing and tokenisation. This approach makes it easier to establish a market for property “micro-shares,” creating the potential for a property to effectively have numerous co-owners with a stake in potential returns.

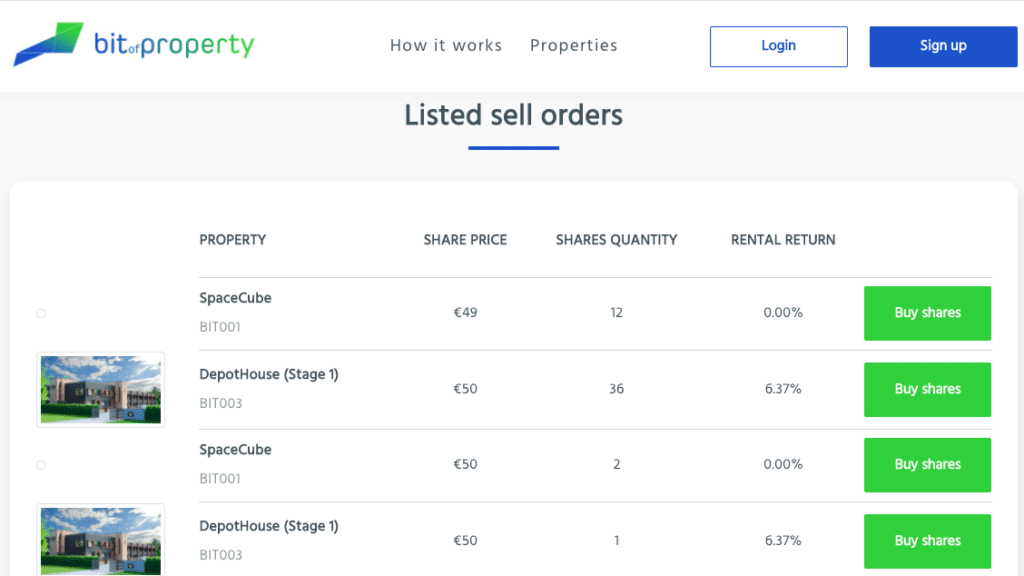

There are many blockchain-based real estate investment platforms that currently exist, though most are still in the development phase. One that is more established is BitofProperty. The Singapore-based company has built a blockchain-based crowdfunding platform that allows users to invest in both residential and commercial rental properties. Users receive monthly income from the properties they have invested in. Another example is Brickblock, a smart contract platform which is seeking to use tokenized real estate to help developers raise capital for projects. Brickblock has received almost $6M in funding from Finch Capital and has several partnerships, including with JTC Group, solarisBank, and Peakside Capital.

Real Estate Investment Trusts (REIT)

Blockchain applications and REIT are a match made in heaven. From shareholder communication to dividend distribution, REIT can benefit end-to-end from decentralization. Smart contracts can execute upon event according to predetermined conditions. REITs can crowdfund using digital IPOs. Investors can receive funds in a timelier fashion not having to wait for REITs to make good on paper contracts.

Smart Contract Escrow

This might be the most viable use case for blockchain applications in real estate. Smart contracts double as escrow and create a safe repository for funds to then be trustless-ly released to the verified parties when triggered by event confirmation. Rather than tenants sending landlords checks every month in the mail, tenants can have a multi-signature transaction with the use of public-private key cryptography. Security deposits can be held in escrow for the duration of the lease and only returned at the end upon two out of three parties (third being an arbitrator) using their private key.

Blockchain Notarisation

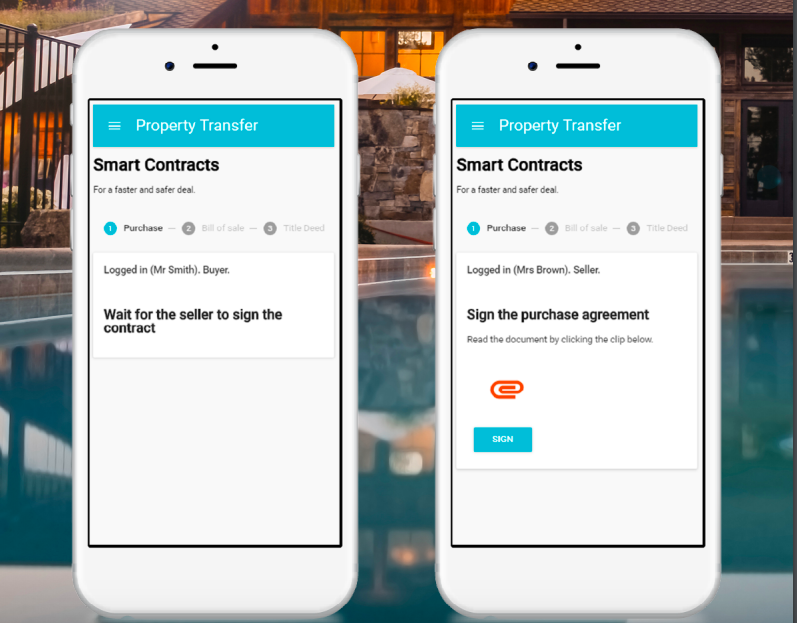

Real estate paperwork authentication often requires a notary. Buyer and seller sign an agreement and then the transaction can be recorded on the smart contract, and this agreement then receives designated a hash. The buyer then can obtain the address of the smart contract to send the funds to the correct blockchain-based locale. Notarisation can now happen on-chain as the seller goes to the notary with the smart contract address and sign the final document without the presence of the buyer. The notary is then able to use their private key to mark the deal executed on the blockchain. In the future, as governments accept blockchain transactions as trustless, the notary can be eliminated from the process.

Ownership Verification

Property history databases are never up-to-date and are certainly not transparent in their origins or motives. Using blockchain to track the history of repairs and issues a property experiences can later help sellers improve resale value or make buyers aware of the property’s troubled past. A home inspection would also be either unnecessary or a less involved task. Home inspectors could contribute to databases to make sure property issues are part of the immutable records. This would help buyers feel more confident in their purchases knowing the full history of the property.

Financing and Payment Systems and Lending Process

Depending on a bank to approve a loan and set interest rates for mortgages can be lengthy and expensive, sometimes impossible process. P2P lending facilitated by on-chain technology can break down the barriers for home ownership for those with bad credit or past debt who otherwise should be eligible for a loan. Borrowing from a network of lenders rather than just one results in lower interest rates and service fees, above all else, it creates an opening for those who would otherwise be ineligible or face incredible interest rates.

Due to the extensive documentation required and the involvement of various intermediaries, existing modes of financing and payments for property transactions are currently slow, expensive, and opaque. These issues are especially pronounced when a property is financed through a mortgage and when international transactions are required.

The current process for mortgage approval for residential properties takes on average around 30-60 days to complete, according to the National Association of Realtors. For commercial real estate – which is more complex to process than residential real estate – the time it takes to get approved can be even longer, often requiring around 90 days.

This process could be simplified and made more transparent when blockchain technology is applied. For example, verifiable digital identities for properties could allow a reduction in both due diligence and loan documentation time, thus speeding up the mortgage approval process.

The borrower and lender could also use blockchain technology to execute an immutable smart contract-based loan document, fully accessible by all legal parties involved. Adoption of blockchain technology could save the US mortgage loan industry up to 20% in expenses per year, according to a report published by Moody’s Investor Service, which would amount to $1.7B in annual savings.

ShelterZoom is a startup aiming to streamline real estate transactions by putting all the processes on the Ethereum blockchain.

Real estate agents, buyers, sellers, and renters can view offers and acceptances on the platform, which also allows access to property titles, mortgages, legal documents, and home inspection reports.

ShelterZoom has partnered with over 90 brokerages around the world, including RE/MAX Revolution in Boston, Massachusetts.

Ripple connects banks and payment providers on RippleNet, its private blockchain, seeking to provide a payment platform for transferring money globally. One use case for Ripple is facilitating cross-border real estate payments. All parties involved in a real estate transaction can be connected on an online platform, view past transactions between parties, and make payments. The company claims that its approach allows transactions to be secure, quick, and low cost – a compelling proposition compared to the high fees and multi-day wait associated with traditional international payment systems.

Tenant Screening and Leasing Process

Manual pen and paper tenant screening is still common practice in the real estate industry. Landlords do not have a centralised hub to verify tenants through immutable data stores detailing rental history. Landlords have to conduct background checks with only the information provided to them by the tenant. Renter fraud is a common woe for property owners who have no tried and true way to screen tenants. Instead, they are forced to conduct credit and rental history checks themselves. If landlords and tenants could use blockchain to complete all rental-associated tasks on a p2p network, this could help standardise pre-authenticated on-chain renter and landlord profiles with immutable histories and reputation scores to help tenants avoid slum lords, and landlords prevent rent dodgers. P2P rental networks could also help renters crowdsource deposits to reduce the need to hold their own funds in a smart contract for a year or more.

Due Diligence and Financial Evaluation Process

Physical paper documents for proof of identity are still the norm today. This approach requires the commitment of significant time and effort for due diligence and financial verification. This manual verification process also increases the likelihood of errors and can involve multiple third-party service providers. These factors can be costly and slow down the due diligence process.

Using digital identities on the blockchain, this entire process can be taken online in a secure manner – increasing efficiency, lowering costs, enhancing data security, and reducing the chance of manual errors.

For example, a real estate property’s digital identity could consolidate information such as vacancy, tenant profile, financial and legal status, and performance metrics. A digital blockchain-based solution is currently being developed by Lantmäteriet, the Swedish land authority, in collaboration with blockchain startup ChromaWay, Swedish telecommunications giant Telia Company, and several real estate enterprises.

Its goal is to digitise contracts for sale and property mortgages that are authenticated by blockchain technology. This solution streamlines the process of transferring property titles while also adding some layers of security. All parties involved in the process, including the buyer, seller, real estate agent, the buyer’s bank, and the land registry, have their own digital identities.

Each can use a single application to securely send and sign official documents using blockchain-verified smart contracts. All actors can view the associated documents and information, with verification of the steps that have taken place during the process.

ChromaWay announced that it had completed a full transaction on the platform in June 2018. Other organisations around the world are also making blockchain real estate strides. Bank of China Hong Kong (BOCHK), for example, stated in mid-2018 that it processes 85% of real estate appraisals using its own private blockchain.

BOCHK’s General Manager of Information Technology Rocky Cheng Chung-ngam said, “In the past, banks and [real estate] appraisers had to exchange faxes and emails to produce and deliver physical certificates. Now the process can be done on blockchain in seconds.”

Managing Commissions

Smart contracts aren’t just used for buyer-seller or renter-landlord interactions. They can also be used to help real estate companies better manage their resources and fund distribution. It is common for multiple agents to be working on a single listing creating commission distribution hiccups. For multi-broker listings, everyone gets paid a percentage of the commission as described in paper commission-splitting agreements. Smart contracts can easily automate this process and companies can avoid the associated overhead that is involved in figuring out who gets what, how and when. Brokers and agents benefit from automated commission splitting as they will no longer have to wait for their funds, they can receive payment the same day the deal is closed.