A blockchain that uses a proof-of-stake consensus mechanism, Cardano is an open-source project that was founded in 2015 by one of Ethereum’s co-founders, Charles Hoskinson. The team behind its development is from the company IOHK that operates with Hoskinson as CEO with the collaboration of EMURGO and the Cardano Foundation, an independent Swiss-based non-profit. The project was named after the famous Italian polymath Gerolamo Cardano from the 16th century. The project’s native token ADA was also named after computer programmer Ada Lovelace. ADA tokens give users voting rights when it comes to implementing changes to the protocol.

Cardano intends to facilitate the development of decentralised apps and smart contract technologies within its ecosystem. Cardano’s Shelley upgrade is said to have made the blockchain more decentralised and the Alonzo hard fork introduced smart contract functionality to the blockchain network.

Popular Tokens in the Cardano Blockchain Ecosystem

1) Cardano (ADA)

ADA is the native token of the Cardano blockchain. It is estimated that about 16% of ADA supply was given to the project’s founders and the rest went to investors. The trading volumes of ADA tokens are in the billions of dollars daily. The maximum supply of tokens is 45 billion and over 30 billion tokens are circulating on the open markets. ADA tokens can be found on exchanges such as FTX, OKEx, Coinbase, KuCoin, Bitfinex, Kraken, Huobi, Bittrex, Bybit, Phemex, Upbit, FMFW, Crypto.com, Gate.io, and many others.

2) ADAX (ADAX)

Apparently an automated liquidity protocol, ADAX is meant to facilitate decentralized and non-custodial trades within the Cardano ecosystem. ADAX tokens are currently available on ExMarkets. There’s quite frankly not enough information on this project but they have a 0.3% Swap fee distribution structure where it’s 0.125% is for the maker and 0.175% for the taker and there’s no platform fee. You can check out the Whitepaper here.

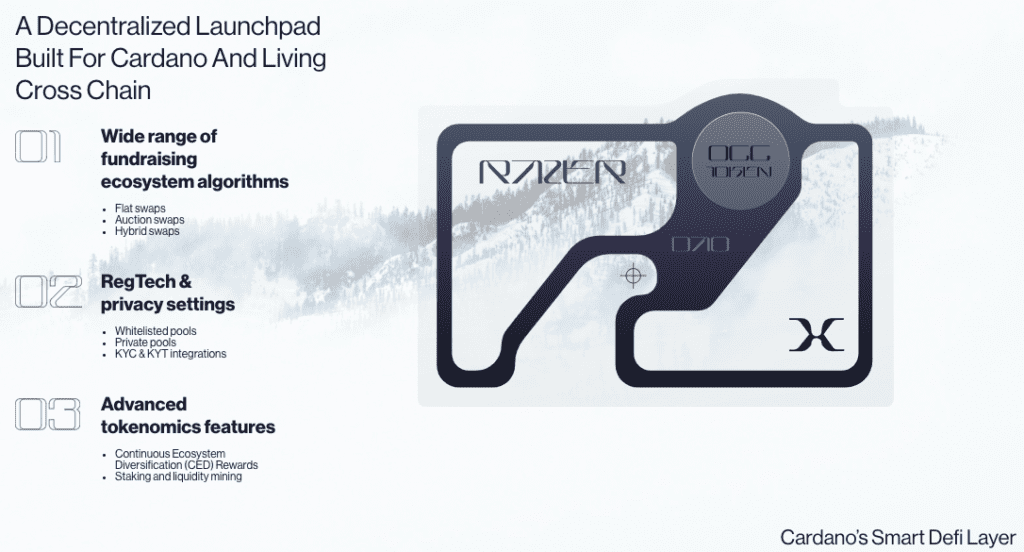

3) Occam.Fi (OCC)

Dubbed a suite of DeFi solutions that are tailored for Cardano, Occam.fi is said to be designed to offer launchpad capabilities, DEX tools, and liquidity pools. OccamRazer is the launchpad or decentralised funding platform in the Occam.fi ecosystem. Applications being built on Cardano have an opportunity to raise funds through Initial DEX Offerings (IDOs) on OccamRazer. OCC tokens can be traded on exchanges such as HitBTC, Gate.io, Uniswap and others.

4) CARD.STARTER (CARDS)

CardStarter is a decentralized accelerator and swapping platform. Some of the projects they are working on launching on their platform include Credefi which is meant to connect crypto lenders & SME borrowers and enable decentralized and secured lending. ITSMYNE is another project the team is working on and it’s described as a social-plus marketplace for officially licensed sports NFTs. Another project is PhotoChromic which supposedly tokenizes peoples’ identities through universally addressable and digitally secured NFTs that are programmable and verifiable. CARDS tokens can be traded on Gate.io, ZT, Hoo, Uniswap, etc.

5) Ardana (DANA)

Ardana is described as a DeFi hub that is built on the Cardano blockchain. It’s meant to provide Cardano’s users with DeFi primitives to spur ecosystem development. The first is a decentralized stablecoin platform which is aimed at ensuring that users can leverage Cardano native assets by generating stablecoins against them. As an on-chain asset-backed stablecoin protocol, Ardana is meant to provide a decentralized exchange stable asset liquidity pool on Cardano. To facilitate borrowing, the stablecoin is overcollateralized with on-chain Cardano native assets.

The second offering is their stableswap DEX called Danaswap which is aiming to make it possible to swap between stable asset-sets and also provide an opportunity for liquidity providers to earn DANA token rewards and fees for their liquidity provisioning.

6) MELD (MELD)

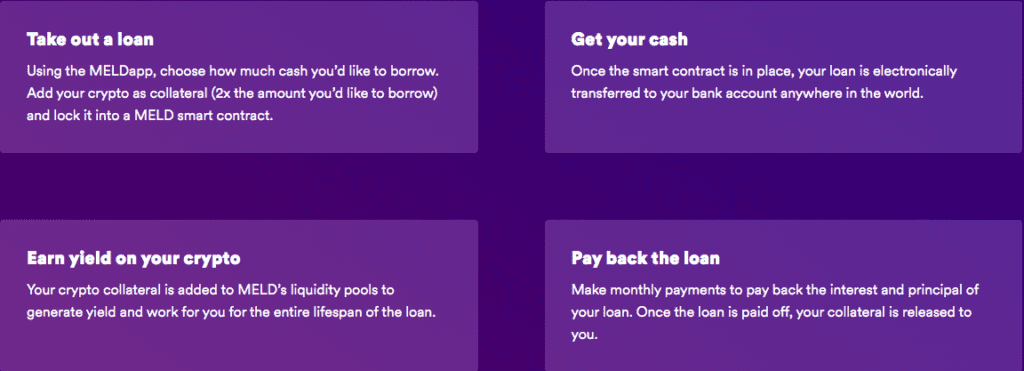

MELD is described as an open-source, decentralized, non-custodial liquidity protocol for earning yield on deposits and for borrowing fiat (USD and EUR) against crypto collateral.

The governance token of the protocol is called MELD token and holders can earn yield by staking.

MELD claims to be the first to incorporate fiat loan capabilities in the digital currency ecosystem in order to facilitate better transactions between crypto and fiat positions. The development team is looking to make the MELDapp available on web browsers, iOS and Android devices so that users can easily lend, borrow or manage their crypto assets.