What is BTSE Exchange?

BTSE Holdings Limited, a company incorporated in the British Virgin Islands owns and operates the BTSE VFA Exchange Platform that uses a high-frequency trading engine, horizontal scaling infrastructure and self-hosted servers.

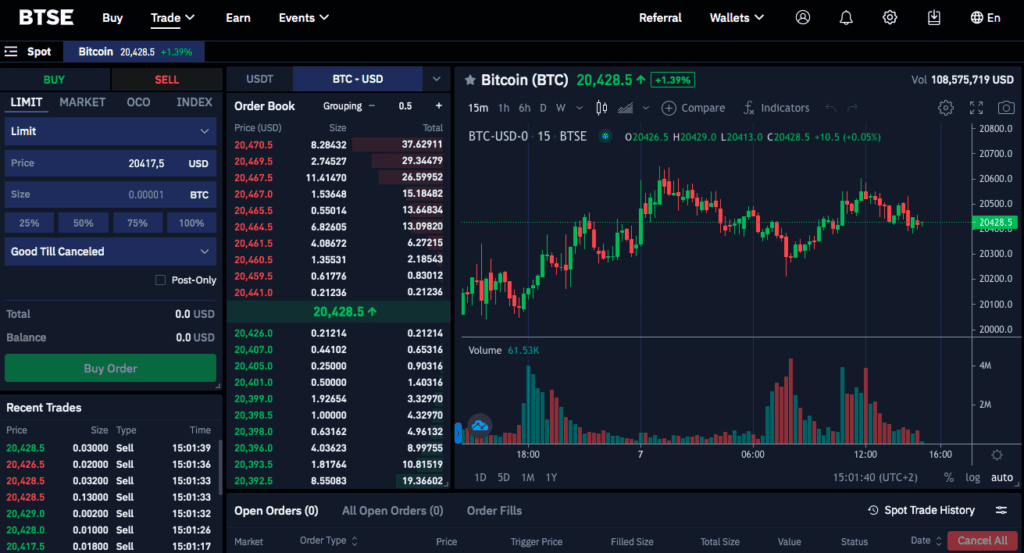

Users of BTSE can buy crypto safely with the all-in-one order book for deeper liquidity and best crypto rates. For faster account funding, users can purchase crypto using credit card top-ups.

BTSE offers multi-currency spot and derivatives trading. In addition, it also offers NFT and exchange white labels, over-the-counter (OTC) trading, asset management, and payment gateways.

Prioritising security is a key strength of BTSE which also has an insurance fund and claims to hold more than 99% of assets in cold storage. There are no withdrawal limits on over 12 fiat currencies and 100 cryptocurrencies.

BTSE is available on desktop and mobile – both iOS and Android devices.

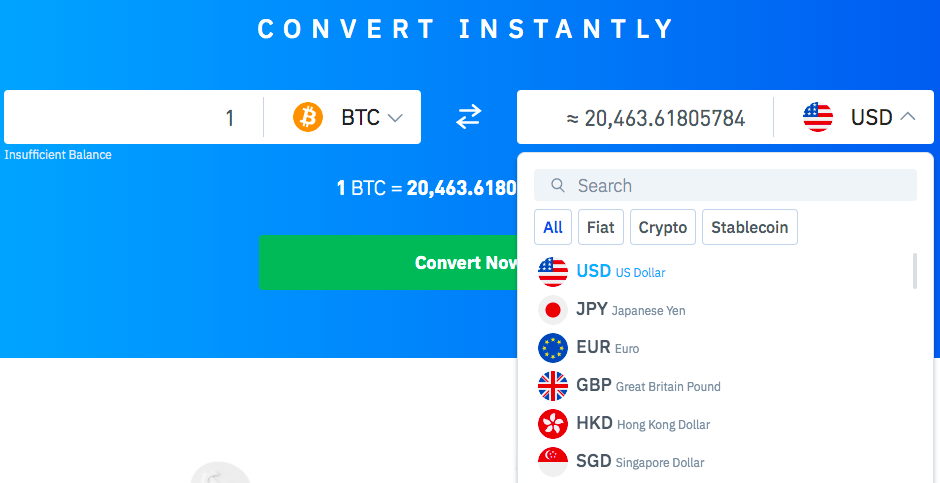

BTSE offers multiple fiat on-/off-ramps and provides a one-stop solution for deposits/withdrawals, trading and conversion of funds.

A user can find all trading pairs in one order book and also has the ability to automate their trading strategies.

A user can download and use the margin’s trading terminal on BTSE by simply downloading and installing the Margin software based on their operating system e.g. Windows, MacOS and Linux. They can then obtain their API Key and Secret via their BTSE account by entering API Key Name, selecting key permission, and IP access restriction.

BTSE also has the static ping pong bot that places limit orders which is considered the simplest bot in Margin.

Some of the most popularly traded crypto assets on BTSE include Ethereum (ETH) and Bitcoin (BTC).

Futures Trading

Users of BTSE can trade futures with multi-asset margin and settlement in USD, BTC, or their choice of stablecoin, allowing them to freely combine their margin and select their preferred settlement currencies.

Leveraged Trading

BTSE also offers both perpetuals (futures without expiry dates) and futures with expiry dates as leveraged trading to its users. The maximum leverage level for their perpetuals and non-perpetuals is 100x.

OTC

BTSE operates a 24/7 OTC desk at no additional cost.

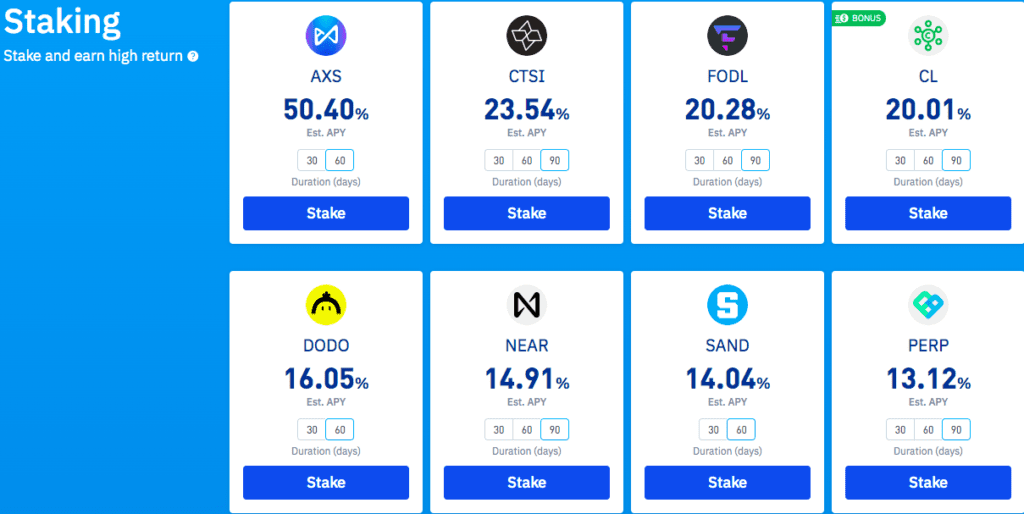

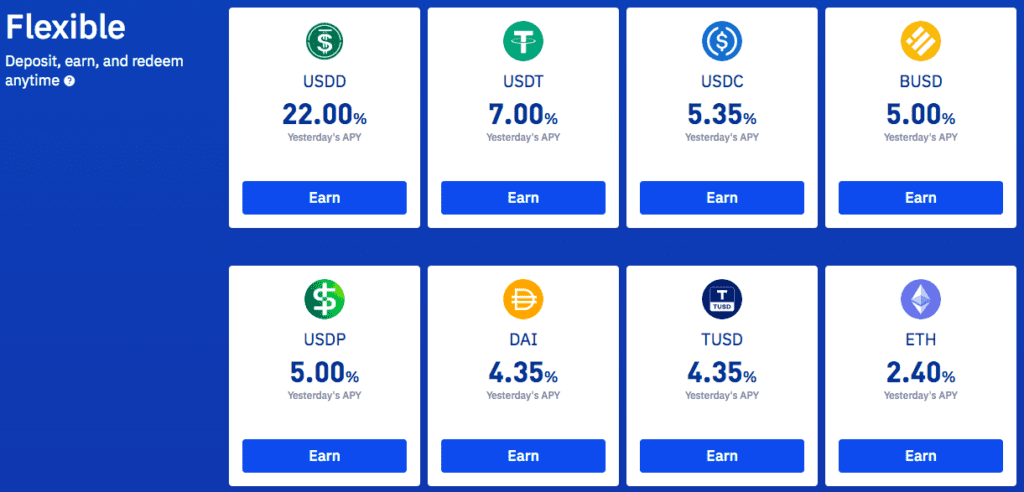

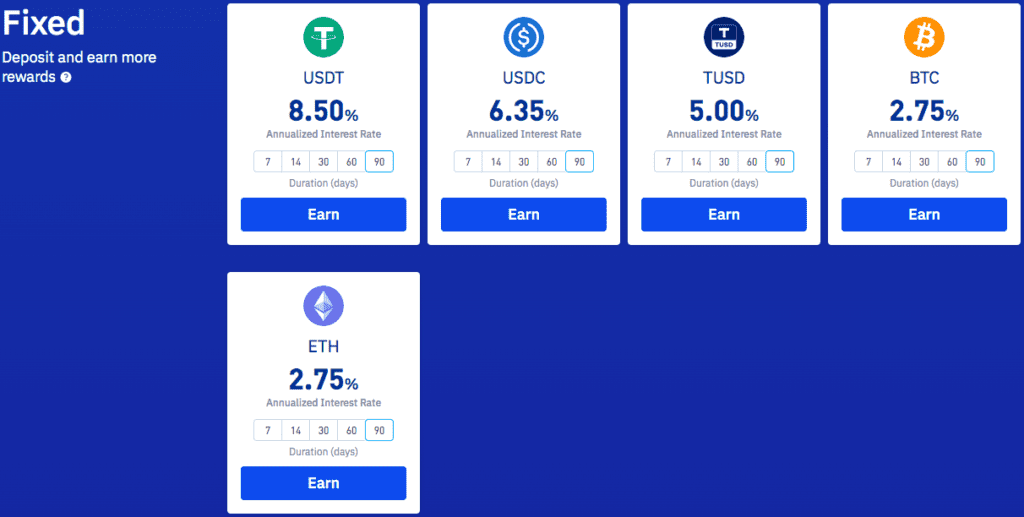

BTSE Earn and Lending Features

Users of BTSE can apparently earn with up to 8.5% annualized interest rate by staking and choosing from a range of flexible and fixed-term products. Users are also able to lend their idle assets to BTSE’s capital pool.

The interest payout period varies by product. Staking enables BTSE to offer interest on selected digital assets. Flexible term deposits can be redeemed anytime and the interest rates are variable with compounding interest pay-outs.

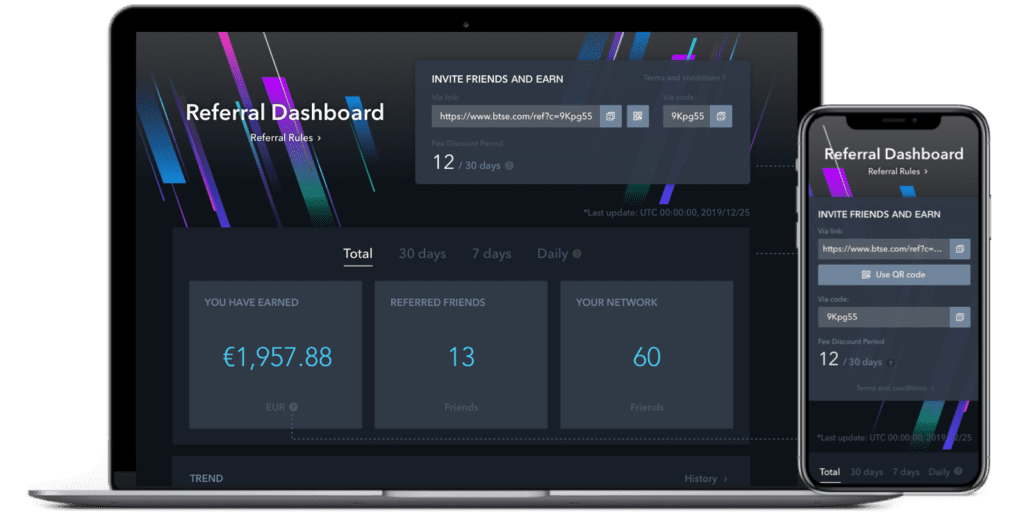

Referral Program

BTSE offers a referral program with unlimited commission levels and is valid for a lifetime. Users can earn a commission not only by introducing their friends to BTSE , but also through their friends’ friends, and their friends’ friends. The referral program has multi-level tiers and there is no limit to a user’s referral levels. Referees can enjoy trading discounts that include a 30-day discount on trading fees, including trades on spot and futures markets.

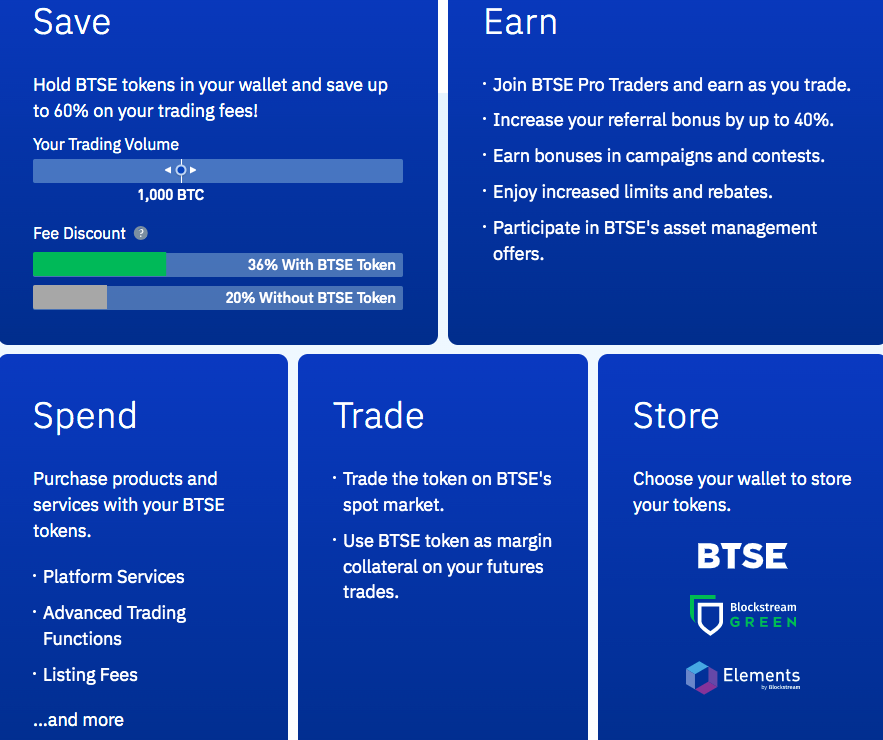

BTSE Token

BTSE has its own exchange token with the ticker BTSE which powers the BTSE ecosystem. It is designed to boost users’ trading experience and it is said to be the first exchange token built on Liquid, a Bitcoin sidechain-based settlement network for traders and exchanges.

Liquid is seen as providing a layer of security by levelling up a user’s privacy through the blinding of transaction amounts and asset types.Liquid also provides faster transactions since blocks are produced every minute, and each transaction is typically finalized within a matter of a couple of minutes. Liquid also offers inter-exchange settlement which is said to make it easier and faster to move funds between member exchanges.

BTSE Index Futures Products

Index futures are effectively futures contracts that are based on a financial index. The price of index futures is therefore derived from an underlying index that is supposed to measure the price movement of one or a basket of assets.

Index futures that derive their price from a basket of assets allow a user to control their exposure to the price movement of several assets at once. This is what makes index futures a popular and useful tool in derivatives trading when it comes to hedging against overall market volatility.

BTSE also offers the BNC-BTSE Composite Index Family (BBCX, BBAX, & BBDX) which is supposed to track the real-time market performance of a basket of large-cap crypto assets by free-float market capitalization.

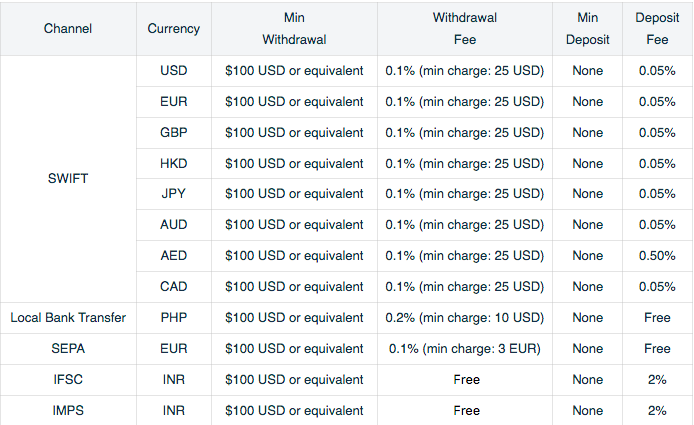

Fiat Currency Deposit and Withdrawal Fees

Users of BTSE should always keep in mind that any fiat deposits and withdrawals are subject to a bank charge / remittance fee / transfer fee. This means that the servicing banks, not BTSE, are responsible for the appropriate fee. There is a deposit fee of $ 3 USD that is applied to single deposits of less than $100 USD or its equivalent.

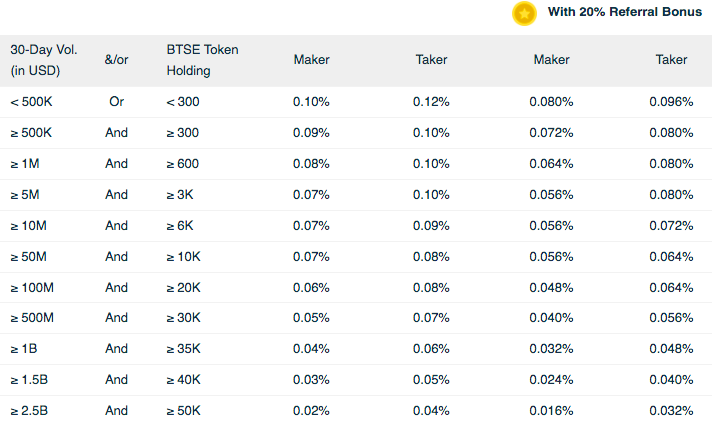

Spot Trading Fees

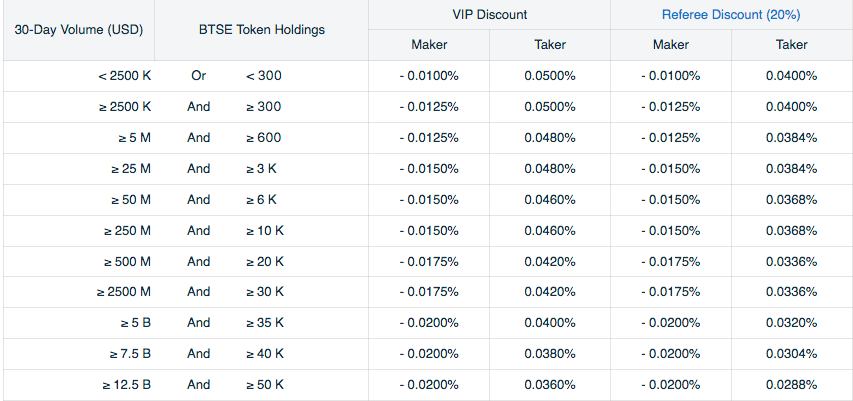

Trading fees are deducted from the currency a user receives. The account fee level is determined based on a 30-day rolling window of trading volume, and is recalculated daily at 00:00 (UTC). A user can view their current fee level on the Account Profile Page. Trading volume is calculated in BTC. In addition, non-BTC trading volume is converted into BTC equivalent volume at the spot exchange rate. BTSE doesn’t allow users to self-refer through multiple accounts.

Futures Trading Fees

Enter and settle positions for futures will be charged trading fees which are deducted from a user’s margin balance.

Futures Trading Fees (Market Makers)

Conclusion

BTSE exchange does over $100 million in daily trading volumes. It’s considered an all-in-one platform with diverse crypto product and service offerings and a wide range of digital assets available for trading. Users of crypto exchanges, both centralised and decentralised should always do their own research before using any trading platforms.