Breakdown & Analysis: CoinGecko’s “The State of Decentralized Perpetual Protocols (2023)”

Breakdown & Analysis: CoinGecko’s “The State of Decentralized Perpetual Protocols (2023)”.

CoinGecko, one of the biggest independent cryptocurrency data compilation platforms, tracks more than 9,000 different cryptoassets across over 700 exchanges around the world. Established in 2014 by TM Lee, the CEO, and Bobby Ong, the COO, CoinGecko‘s mission is to make crypto data access universal and provide users with insights that can guide their actions.

Key Takeaways

Amid heightened concerns of another crypto exchange breakdown, an increasing number of crypto users are turning to decentralized perpetual protocols to cater to their appetite for leveraged trading. Even during the recent bear market, perpetual exchanges have remained one of the few positive aspects in the otherwise dark landscape of DeFi, enabling users to execute leveraged trades in a permissionless manner and offering liquidity providers a way to secure sustainable fees in a yield-starved environment.

Overview of Decentralized Perpetual Protocols

Decentralized perpetual protocols have matured to enhance trading efficiency and introduce new earning avenues for users.

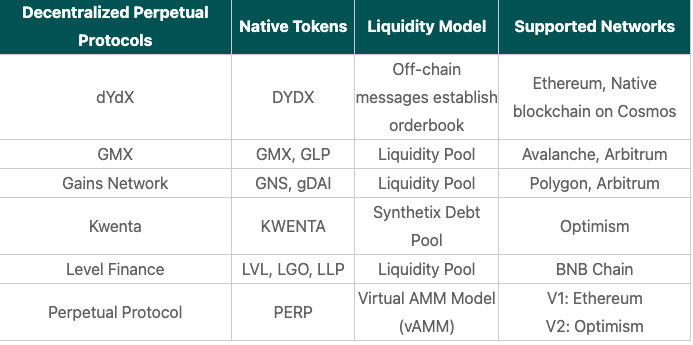

The leading six decentralized perpetual protocols, namely dYdX, GMX, Level Finance, Kwenta, Gains Network, and Perpetual Protocol, all function based on unique models and present different features, particularly regarding the assets they support and maximum leverage they offer.

From its peak in November 2021, open interest across the top 6 decentralized perpetuals has seen a significant drop of over 65%, with dYdX still holding 55% of OI. Corresponding with OI, trading volumes have also seen a decrease of 66.2% since its 2021 Q4 peak, as dYdX continues to dominate with a 58.9% share.

The distribution of holder revenue by decentralized perpetual protocols to governance token holders sparked the “real yield” narrative, leading to a surge in demand for these tokens.

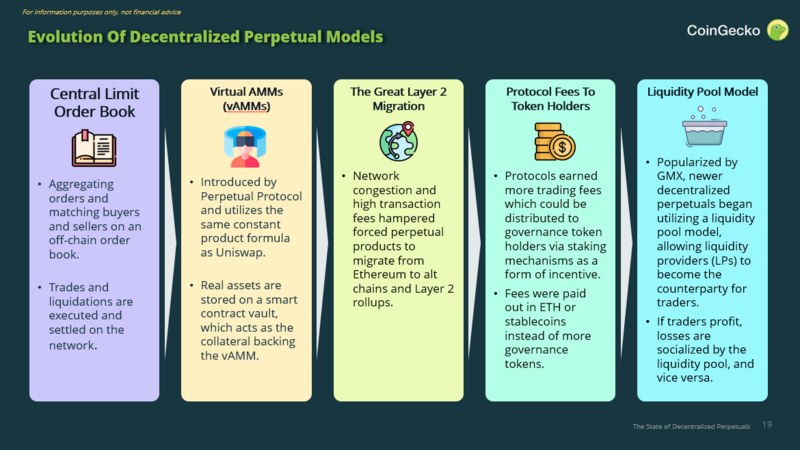

The Progression of Decentralized Perpetual Models

Source: CoinGecko

Several changes have been made to decentralized perpetual protocols to facilitate more efficient trading and other earning opportunities for users:

- Central Limit Order Book: Initially, decentralized perpetuals largely mimicked centralized ones by compiling orders and pairing buyers with sellers on an order book. While trades and liquidations are executed and settled on the network, the order book and order matching are processed off-chain.

- Virtual AMMs (vAMMs): Moving from off-chain order books, Perpetual Protocol introduced vAMMs that employ the same constant product formula as conventional AMMs like Uniswap. No actual assets are held in the vAMM. Instead, they are kept in a smart contract vault which then serves as the collateral for the vAMM.

- The Significant Layer 2 Migration: The first decentralized perpetuals were built on Ethereum, but network congestion and high transaction fees impeded their viability, which depended on high throughput and reduced costs. Therefore, protocols began shifting to alt chains and Layer 2 rollups. Perpetual Protocol V2 launched on Optimism, while dYdX V3 launched on Starkware.

- Protocol Fees to Token Holders: As trading volume increased, these protocols also generated trading fees that could be distributed to governance token holders via staking mechanisms as an incentive. These fees were dispensed in ETH or stablecoins instead of additional governance tokens, offering a “real yield” to holders that distinguishes them from typical DeFi yield farms.

- Liquidity Pool Model: Made prominent by GMX, newer decentralized perpetuals started using a liquidity pool model, allowing liquidity providers (LPs) to act as the counterparty for traders. If traders gain from their trades, losses are distributed among the liquidity pool, and the opposite is true. LP tokens appreciate in value as trader losses are reinstated into the pool.

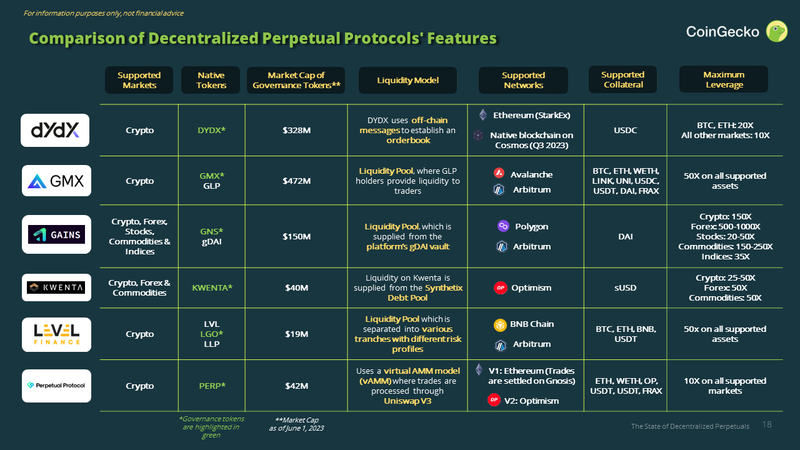

Analysing the Leading 6 Decentralized Perpetual Protocols

Source: CoinGecko

Each of the top 6 decentralized perpetual protocols employs distinct models and offers a range of features, particularly concerning supported markets and maximum leverage. dYdX and Perpetual Protocol were the first to launch decentralized perpetual protocols, and their services have evolved over time. The liquidity pool model introduced by GMX in September 2021 has been rapidly replicated by other protocols.

All of the top 6 decentralized perpetual protocols are built on Layer-2 networks such as Arbitrum and Optimism or use a Layer-2 solution like StarkEx to enable faster and greater number of transactions. While each protocol has its own main chain, the projects are progressively expanding to other Layer 2s or alternative chains.

Level Finance stands out as the only protocol utilizing a dual-token mechanism. LVL, the platform’s native utility token, can be staked to earn fees and LGO tokens. Meanwhile, LGO is the governance token, enabling holders to vote on proposals and influence the future of Level Finance.

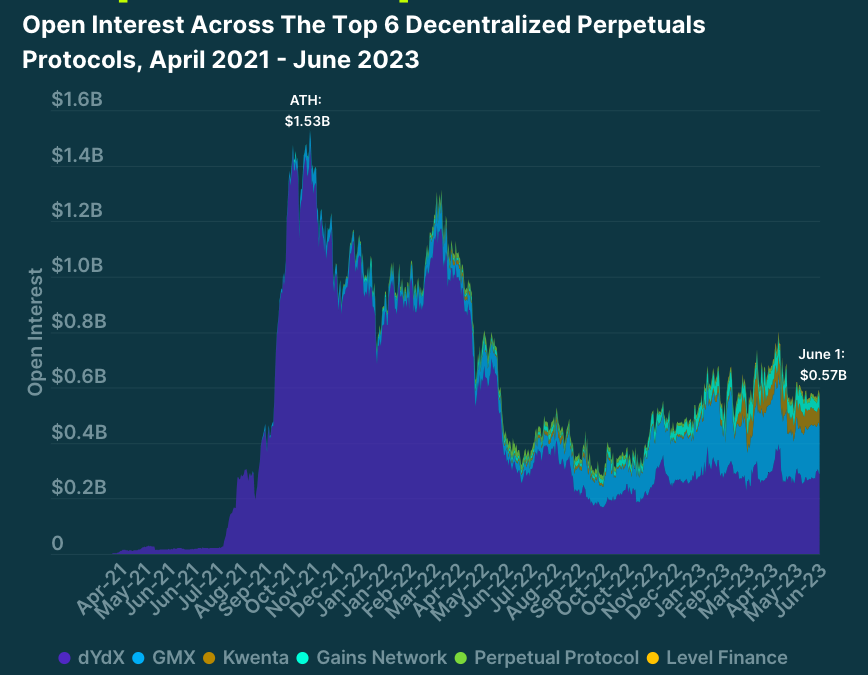

Drop in Decentralized Perpetuals Open Interest by 65% Since Peak

Following its all-time high in November 2021, open interest (OI) across the top 6 decentralized perpetuals has experienced a substantial decrease of over 65%, with dYdX maintaining 55% of OI.

During the latter half of 2021, the surge in BTC futures open interest (OI) by 65.5%, from $8.76B to $14.5B on centralized exchanges, was mirrored by a dramatic increase in OI on decentralized perpetuals. After reaching a record high of $1.53B in November 2021, OI sharply declined in 2022, hitting lows of $0.28B in October 2022 before steadily climbing back to $0.57B as of June 2023.

In 2021, dYdX dominated the sector, with OI rocketing by 540x from $2.8M to $1.4B on their platform. However, they have gradually relinquished OI share to new rivals like GMX. As of June 2023, dYdX holds 50% share of OI, with GMX coming second at 30%.

Notably, despite the crypto downturn in 2022, newer protocols have begun to compete for OI market share. Together, Gains Network, Kwenta, and Level Finance account for 18% of the total OI among the top 6 exchanges in June 2023.

Decentralized perpetuals represent only 3% or $600M of the $20B total OI on centralized crypto exchanges.

Decrease in Decentralized Perpetuals Trading Volume by 66.2% since 2021 Q4 Peak

The DeFi run of 2021 saw trading volumes on decentralized perpetual platforms hit a peak of $249.5B in 2021 Q4. Volumes have been on a downward trend since, except for a spike in 2023 Q1, in line with a general market rally. Yet, total volumes on decentralized perpetuals constitute just 2.2% of the $7 trillion in quarterly trading volume on CEXs.

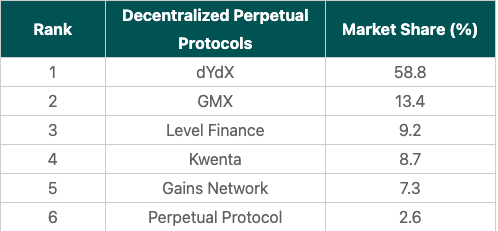

Market Share of Decentralized Perpetual Protocols As of June 2023, the largest decentralized perpetual protocol, dYdX, holds a 58.8% market share, trailed by GMX at 13.4% and Level Finance at 9.2%.

Perpetual Protocol held the majority of trading volume in the first half of 2021, peaking at 77.8% in 2021 Q2. However, in the second half of the year, dYdX saw a substantial increase in volume, surpassing Perpetual Protocol and reaching a peak market share of 94.8% in 2021 Q4.

Although they previously dominated the market, both dYdX and Perpetual Protocol have given up market share to newer protocols GMX, Level Finance, Kwenta, and Gains Network. These emerging protocols collectively accounted for 25.2% of the trading volume in 2023 Q2.

Notably, Level Finance, which launched in Dec 2022, accounted for 9.2% of trading volume in 2023 Q2, as of June 1, 2023.

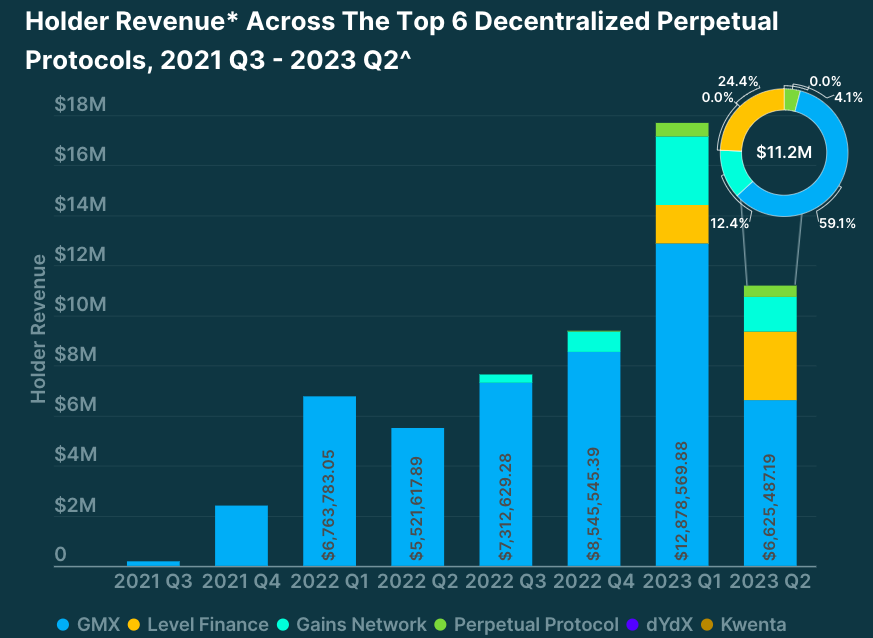

“Real Yield” Narrative Sparked by Holder Revenue Distribution, Boosts Token Demand

The ‘real yield’ narrative was ignited by the distribution of holder revenue to governance token holders by decentralized perpetual protocols such as GMX, Gains Network and Level Finance, leading to a surge in demand for these tokens.

From its inception in September 2021, GMX integrated a fee-sharing structure into its Liquidity Pool mechanism where 30% of all fees are given to staked GMX, while the remaining 70% is distributed to GLP holders.

This rewards system for governance token holders, alongside liquid staking tokens (LSTs), initiated the “real yield” narrative in DeFi, as rewards were paid in ETH or stablecoins rather than the protocol’s native tokens.

Subsequent decentralized perpetual protocols emulated this fee-sharing structure, with some variations in the actual fee-sharing calculations. Total holder revenue distributed by these protocols amounted to $17.7M in 2023 Q1.

This stimulated significant demand for these governance tokens, causing prices to soar.

Despite dYdX having the highest volume market share, it has never distributed any of its fees to dYdX holders. However, additional utility for dYdX may be on the horizon with their move to their own Cosmos chain. Similarly, Kwenta follows the same strategy and instead provides trading fee discounts for holding its native token.