BlockFi Crypto Lending & Borrowing Platform Review

BlockFi Crypto-backed Loans & Interest Accounts Review

Is BlockFi Safe, Legit, and Worth Your Time?

UPDATE: On November 28, 2022, BlockFi filed voluntary cases under Chapter 11 of the U.S. Bankruptcy Code. Additional information about their filing can be found on their blog here. The guide below was written before the aforementioned filing.

BlockFi was founded in 2017 by Zac Prince and Flori Marquez. The mission being to provide credit services to markets that currently have limited access to products such as simple savings accounts.

BlockFi’s unique proposition and what sets it apart from other crypto asset service providers is that the company pairs market-leading rates with institutional-quality benefits. The company is the only independent lender with institutional backing from investors that include Valar Ventures, Galaxy Digital, Fidelity, Akuna Capital, SoFi and Coinbase Ventures.

Cryptocurrency holders with BlockFi accounts can earn interest on Bitcoin and stablecoins. Here are some of the benefits of having an interest earning portfolio with BlockFi:

- It provides investors with moderate returns on their digital assets (mainly Bitcoin, Ethereum, and GUSD).

- Your digital assets are said to be very secure; the Gemini Trust Company secures all crypto held by BlockFi under the regulation of the New York Department of Financial Services.

- It is readily available in any country; except those that have been sanctioned or are on a watch list.

- Easy withdrawal at any time. There is one free withdrawal available to users monthly.

- Ease of access and registration.

With a juicy interest rate and one which is quite competitive in both the crypto and traditional currency market, the BlockFi interest account seems very attractive. BlockFi also provides loans to interested parties which are obtained from the borrowed digital assets. This guide is to give a brief overview of BlockFi, its security, and how it operates.

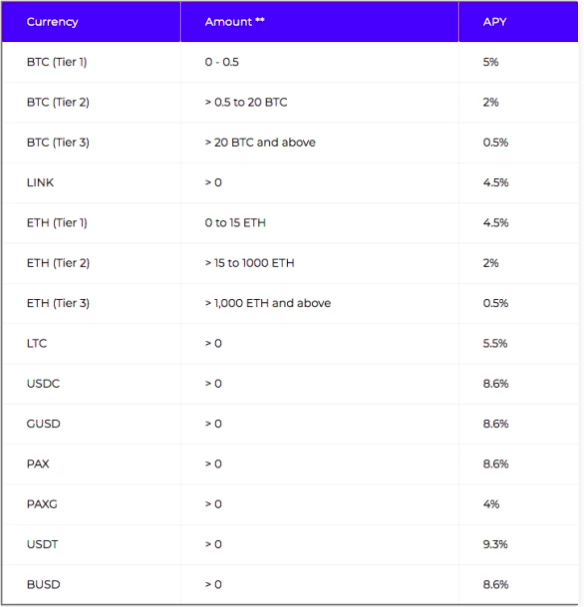

BlockFi Asset Review and ROI

BlockFi offers a moderate return on your digital assets, especially when you earn little to nothing on an interest-free wallet.

- Bitcoin: Account holders can get up to 6% in returns annually on deposits less than 5BTC. Anything above this attracts a 3.2% interest rate.

- Ethereum: Account holders are rewarded with around 5.25% interest annually if they deposit up to 500ETH, anything higher than that gets a 0.5% reward.

- Litecoin: Litecoin holders get interests of about 5% on all investments.

- USDC stable coin: This coin attracts a rate of around 8.6% interest rate on any amount funded.

NB: Please note that interest rates, withdrawal limits, and fees are subject to change.

BlockFi Interest Account

Clients can deposit their crypto and earn interest. Paid out at the beginning of every month, the interest earned by account holders compounds, increasing the annual yield for their clients.

***APYs reflect effective yield based on monthly compounding. Actual yield will vary based on account activity and compliance with BlockFi’s terms and conditions. Rates are largely dictated by market conditions, which are a key factor in a company’s ability to provide its clients yield on their crypto assets.

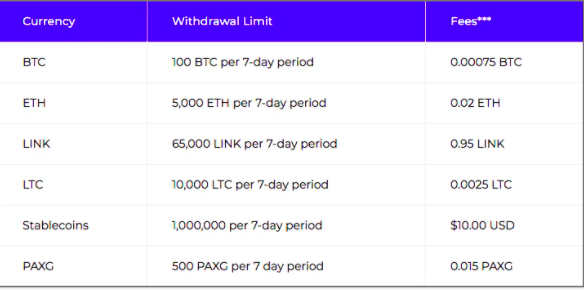

Account Withdrawals

You can withdraw your funds at any time. BlockFi currently offers one free crypto withdrawal and one free stablecoin withdrawal per calendar month. Any further withdrawals may be assessed a fee as listed below.

***All BlockFi Interest Account clients are entitled to one free crypto withdrawal per calendar month and one free stablecoin withdrawal per month. Each free withdrawal can only be applied to one currency each month. For each subsequent withdrawal request within that month, applicable withdrawal fees will be applied.

Crypto-Backed Loan Rates

The amount of USD you can borrow depends on the amount of collateral you post against the loan, and which loan-to-value (LTV) ratio you secure. LTV is determined by the amount of the loan divided by the value of the collateral for that loan.

***This information applies only to clients in the United States. Different terms apply to international clients. Additionally, 20% LTV is only eligible for BTC-backed loans of up to $20k USD. Certain restrictions may apply. Promotional terms can be read here. Rates for BlockFi products are subject to change.

How BlockFi makes Profit?

BlockFi makes its money by taking crypto investments with the promise of interest on the money it lends to interested parties through the platform. Ecosystem participants include:

- Traders and investment funds: These traders or brokerage firms require leverage in the financial market. They lend these digital assets as a hedge against price fluctuations in these volatile digital asset markets.

- Third-party market makers: These are individuals/entities that link buyers with sellers who prefer anonymity from public trading platforms. Usually, they are required to hold digital assets for when the buyers or sellers come around. Understanding the cost and risk involved in owning the digital assets, the third-party market makers prefer to lend on BlockFi.

- Other forms of businesses that offer liquidity pools to clients.

How Reliable is BlockFi?

Upon proper research and scrutiny, BlockFi has proven to be as secure and reliable as its investment holder Gemini. Gemini holds 95% of its crypto in cold wallets and the rest in an insured wallet with Aon.

Gemini is approved and under the supervision of the NYDFS and has also passed the compliance test with Deloitte. Even though the rates offered by BlockFi seem juicy, it is necessary to do your due diligence. Consider such things as what if:

- BlockFi gets compromised? Gemini currently holds all crypto as well as encrypted keys to access them, so there is little to no risk when investing your assets with BlockFi.

- There is a breach on an account? There have been no cases of lost funds since the commencement of the company’s operations, but in any case, if the account is breached, the account remains inaccessible for 7 days, and video verification with the account holder is done to be certain of the identity. Current account details will then be changed before the account can be used again.

- Lenders default on their loans? BlockFi only lends crypto to well-grounded financial firms willing to operate a debt-collateral system to pay for the crypto should they default.

How do I apply for a BlockFi Account?

Signing up is pretty easy, and all the registration process can be completed in less than two minutes;

- You can start up right here. Follow the link here to their website.

- Click on the “Get Started” option in the menu.

- Fill in your details and a password to create the account.

- Input the authentication code sent to your email.

- Fill in your personal information to get verified.

- Upload a government-issued ID and wait for confirmation from their support team.

Final Thoughts

All scrutiny and indications point to the crypto firm as a legitimate one with very few pointers that say otherwise.

This is not to say that there aren’t some complaints from dissatisfied users, but most of them are usually mix-ups or errors in currency payments. In the end, it all depends on whether or not you feel the need to invest with little to no risk associated.