Operational since 2011, Bitstamp is one of the longest serving digital currency exchange platforms in the cryptocurrency space. It was in fact, one of the very first exchanges that was originally established to facilitate Bitcoin trading as a competitor to the infamous Mt.Gox.

Bitstamp was acquired by NXMH, a Belgium-based company in 2018. The company is registered in Luxembourg with its headquarters based in the United Kingdom and the platform has over 4 million customers that include retail and institutional investors.

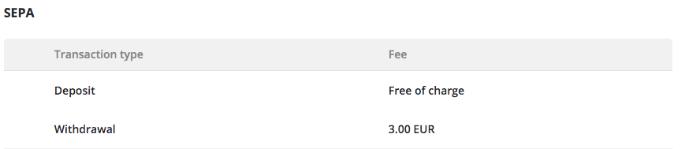

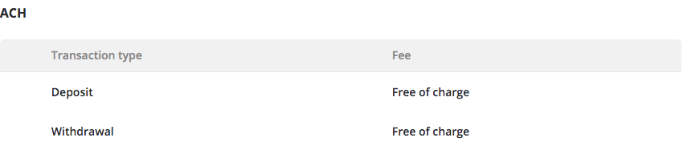

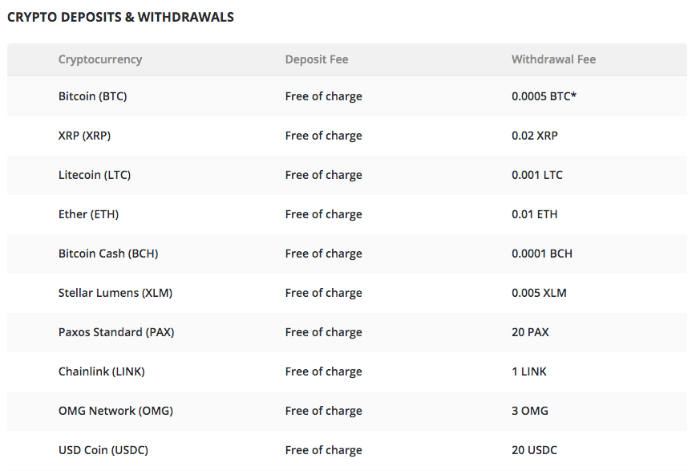

Bitstamp offers a web platform, mobile app and even APIs, providing users with tools to effectively trade digital currencies. Users can trade a variety of digital assets including Bitcoin, Litecoin, Ethereum, Bitcoin Cash, XRP, Chainlink, Stellar, OMG Network, Paxos Standard. A user-friendly exchange, Bitstamp’s interface is easy to use for both experienced and novice traders. Registered users of the platform can enjoy buying and selling of digital assets with others for fiat or other cryptocurrencies. Accounts on Bitstamp can be funded via wire deposit or automated clearing house deposits. Users can also perform instant purchase transactions using their credit or debit cards. It’s important to note that all credit and debit card deposits may carry a 5% fee, however, deposits and withdrawals made in Bitcoin, Litecoin, and Ethereum for example, are free of charge.

Bitstamp supports 28 EU countries and the following countries and many other countries including South Africa, Switzerland, Norway, Turkey, China, Singapore, Taiwan, South Korea, Australia, New Zealand, Japan, Argentina, Brazil, Israel, Chile, Kuwait, Qatar, Saudi Arabia, India, Lebanon, Puerto Rico, Peru, Mozambique and many others.

Bitstamp’s competitors include Coinbase, Binance, OKEx, KuCoin, Gemini, , and many other crypto exchanges that are vying for market share in the very competitive industry of digital asset trading.

Strengths

- Offers high liquidity with more than half a billion in volume traded on the exchange daily.

- Sophisticated trading platform.

- Supports bank wire transfers and bank deposits plus credit & debit card transactions.

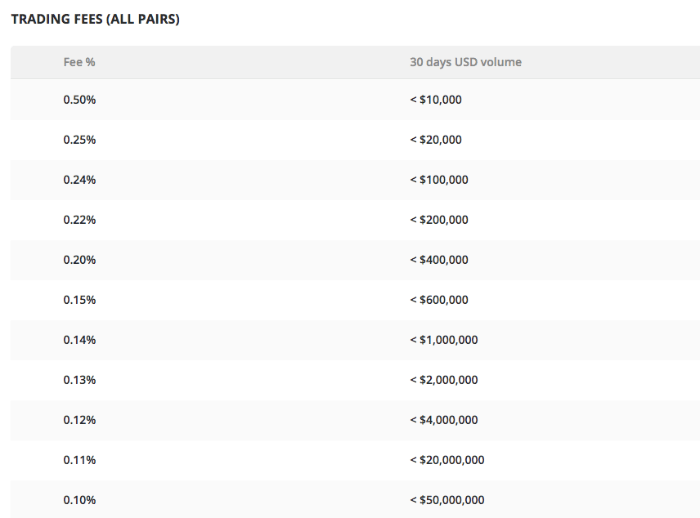

- Relatively low transaction fees.

- Supports instant deposits via BitGo.

- Bitstamp is a regulated exchange.

- Supports major fiat currencies such as USD and EURO.

- Available to all countries but only when it comes to crypto-to-crypto trading.

- Has decent charting tools.

- Offers 24/7 phone support.

Weaknesses

- Support doesn’t offer a chat facility and is reportedly slow which also means there are longer waiting periods for account verification etc.

- Strict KYC process.

- Offers a limited number of digital assets compared to other major exchanges.

- Deposit and trading fees are a little higher than competitors.

- Supports only a limited number of countries as far as debit or credit card deposits.

- Platform security has not always been robust. In 2015, a hack resulted in the loss of 19,000 Bitcoin.

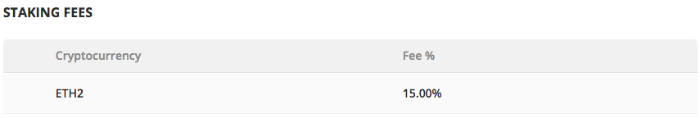

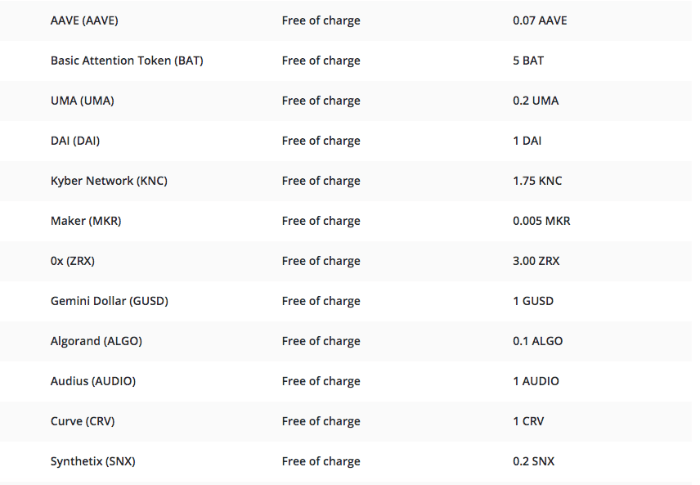

Fees (Source: Bitstamp)

Conclusion

Bitstamp is a decent exchange to use particularly for those in Europe. As one of the oldest cryptocurrency exchanges, it enjoys a pretty good reputation despite having had some hiccups in the past. Unlike decentralised exchanges such as Uniswap, Bitstamp is a centralised crypto exchange just like Coinbase, Binance, Luno, FTX, OKEx, Bittrex, KuCoin, and others. For the crypto enthusiasts who abhor stringent KYC, this exchange will not be ideal since users are required to endure rigorous KYC checks before they can trade on the platform.