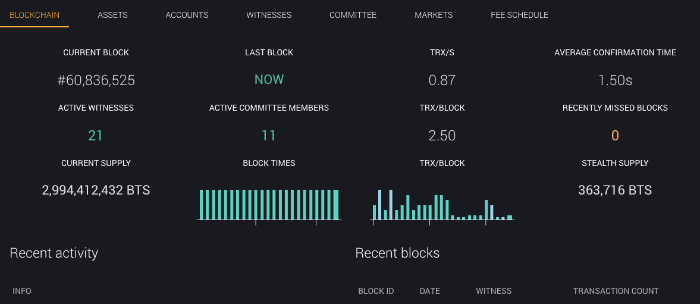

BitShares is a tech-first blockchain platform with an in-built decentralized exchange (DEX). The project initially launched in 2014 and is said to have one of the first DEXs to operate at scale. BitShares has more to it than just the DEX. The blockchain alone can perform 165158 transactions per bit over a second by a single block producer and transactions cost less than 3 cents of a dollar.

BitShares is essentially a peer-to-peer distributed ledger and network based on a Delegated Proof of Stake (DPoS) algorithm. It is based on Graphene, an open source C++ blockchain implementation, which acts as a consensus mechanism.

BitShares has the BitShares DEX, a native decentralized exchange that runs completely on the blockchain without the need for centralized services. Even its order matching mechanism is on-chain and thus transparent. You can see everything on their block explorer.

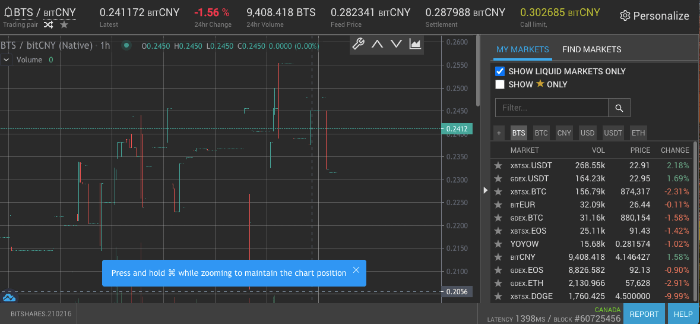

On the exchange, users can trade pretty much anything against everything, so long as the asset or token is available on the BitShares Blockchain. For tokens that are not native to the BitShares blockchain, there are external service providers popularly known as Gateways and Bridges that allow user to be able to trade digital assets such as Bitcoin (BTC) on the BitShares DEX by providing the user with their own IOU of it.

What Makes BitShares Unique?

BitShares has a vision to extend their innovation to revolutionise banking, stock exchanges, lotteries, voting, music, auctions and help with the creation of distributed autonomous companies (DACs).

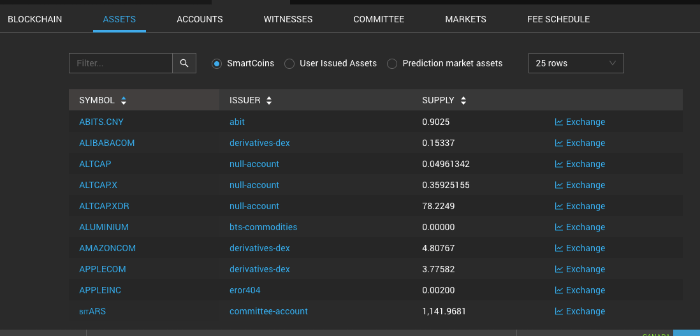

User Issued Tokens

BitShares makes it possible for individuals or businesses to create and issue their own tokens. There are unlimited use cases for user-issued assets (UIAs) which can range from simple things such as digital property, reward points, flight miles, fan credits, or event tickets. UIAs can also be used for selling company equity as stock, crowdfunding, or ownership tracking.

BitShares makes the process simple and users can simply create a new UIA with a few clicks of a mouse. The interface makes it easy for users to set the parameters for their token including ticker symbol, supply, description, choose the market pairs, and even define who is qualified to hold the token by using white- and blacklists. A user can instantly issue a token to anyone or sell them and actually see the token they created get traded against any other existing coin on the BitShares platform. All this can be done without the user needing to have any technical know-how. Users don’t need to worry about consensus algorithms, blockchain development or integration. They don’t even need to run any mining equipment or servers. The only downside to UIAs is centralized issuance of tokens. This can to some degree be managed by a hierarchical multi-signature issuer account which would be set up to prevent any single entity from issuing new assets without consensus among an arbitrary set of people. Users should be made aware that there is risk when creating such tokens since some regulations may apply to some token types depending on jurisdiction. BitShares also has some tools to help asset issuers with compliance.

BitShares Account/Wallet

BitShares allows users to create lifetime membership accounts with ease by using the BitShares UI wallet. Upon creating an account, a user is provided with the Private/public keys which they should keep safe and use to access the account using their username and key. The username you create is a unique ID that can also be used to communicate with other BitShares account users to send funds between each other like an email address instead of a cryptographic address. A user will have at least one account that can be used to interact with the blockchain and that username can also be seen as a kind of single banking account with an individual balance and full transaction history. It is thus advisable to use a pseudonym to ensure privacy. BitShares accounts can be secured by a Ledger hardware wallet.

If you register with a username and password, you’re provided with a ‘cloud’ wallet. Nothing is technically stored in the cloud though. The cloud wallet only allows for a single account to be accessed at a time. The local wallet creates a database within a user’s browser which means that access to the funds is tied to that browser only. If a user attempts to access their local wallet from any other browser or computer, they will not be able to do so unless they actively import their backup file from the original browser backup file.

BitShares provides owner, active and memo keys. Each key has a public key and private key. The entity with owner permissions has administrative powers over the entire account. Active Permission is an “online” permission that makes it possible to access funds and some account settings.

In order to fund an account, a user can receive funds from another BitShares account or deposit funds. If a user wishes to deposit or withdraw funds, either in fiat or from other blockchains, they can use a bridge or gateway service to do so. With a bridge service, a user has a way to deposit any other cryptocurrency other than BitShares, and receive a SmartCoin equivalent in return.

These SmartCoins have no counterparty risk, which means that the only risk a user experiences when using a bridge is during the short window that it takes to complete the transfer. This is better than a centralized exchange where users are always at risk of the exchange being hacked, shut down or going bankrupt. Gateways act in much the same way that the standard exchange model does where users depend on the solvency of the exchange to be able to redeem their coins. Gateways typically issue assets prefixed with their symbol. These assets are supposed to be backed 100% by the real Bitcoin (BTC) or Ethereum (ETH) or any other coin that people deposit with the gateways.

Bridges and gateways allow users to deposit and withdraw coins. The main difference is the level of trust a user needs to place in each of those service providers.

BTS Coin

Holders of the BitShares blockchain core coin BTS are able to vote on block producers (witnesses), committee members (blockchain governance), worker proposals (reimbursement for tasks and strategic decisions through BSIPs/Polls). By staking BTS tokens users can obtain voting power. BTS coins are publicly traded on other markets on crypto exchanges such as Binance and Huobi.

BitShares DEX & Fees

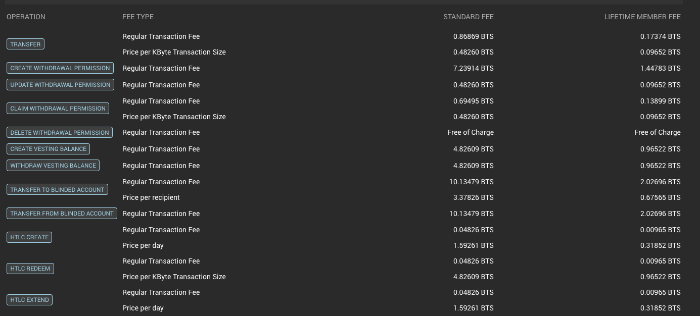

On the decentralized exchange, orders can be placed by providing the amount to buy/sell and the price at which to buy/sell. BitShares charges a small flat fee for placing an order. The fee is payable in USD, BTC, or Gold and it’s independent of the actual assets being traded.If a user happens to cancel an order that has not been fully or partially filled, 90% of the fee will be paid back to their account. However, this chargeback will be in BTS and not in the asset the user originally paid the fee in.

Every operation in the BitShares ecosystem is assigned an individual fee which is subject to change. The fee is nonetheless defined solely by shareholder approval, meaning that each and every shareholder of the BitShares core asset (BTS) has a say in establishing what the fee should be. If shareholders agree by consensus to reduce a particular fee then the fee is reduced automatically. Changes to blockchain parameters are proposed by members of the committee who are voted in by shareholders to ensure the flexibility and reaction rate improves.

StakeBTS

BitShares Management Group Limited offers Python-based automated software for the management of users funds or investments, including their liquidation and rewards. The company acts as custodian through the BitShares blockchain.

DeFi

Through its on-chain, in-built DEX, BitShares enables users to mint cryptocurrency smart-contracts. Smartcoins can be “borrowed into existence” by collateralizing BTS core tokens. There are liquidity pools, recurring payments, and hashed timelock contracts to reduce counterparty risk in decentralized smart contracts through the creation of a time-based escrow. Users can even download the DeFi wallet from the SnapStore – a desktop app for discovering, installing and managing snaps on Linux.

BitShares Corporate

BitShares 4.0 and 5.0 releases were activated in 2020. Stake-lock voting was introduced and replaced collateral voting. Voting decay was introduced, revised BitAssets1.0, and automated market making. The changes mean that the BitShares ecosystem now effectively filters users and investors by the core logic of the blockchain and actions they perform, all the while maintaining the integrity of the reserve pool and blockchain.

BitShares incorporated services and products around the BitShares brand through the brand protection of EU Trademark by Move Institute (Slovenia) which meant closure of many businesses on top of the BitShares blockchain. BitShares is supposed to be fully compliant with regulatory bodies and is able to accept accredited corporate investors who may be interested in making profits through the growth of the project. Since stopping the blockchain reserve pool funding system, BitShares has since invested its own funds, centralized the management of the decentralized technology but made sure that the management or corporate investors cannot have the ability to act in self-interest or abuse power.