What is Bitflex?

Bitflex is described as a technology focused company that is dedicated to developing a platform that makes crypto investment and trading more rewarding and accessible for people globally. The platform caters to both beginners and professional crypto traders.

The Bitflex crypto exchange is primarily a crypto derivatives trading platform for perpetual swaps.

How to Create an Account on Bitflex

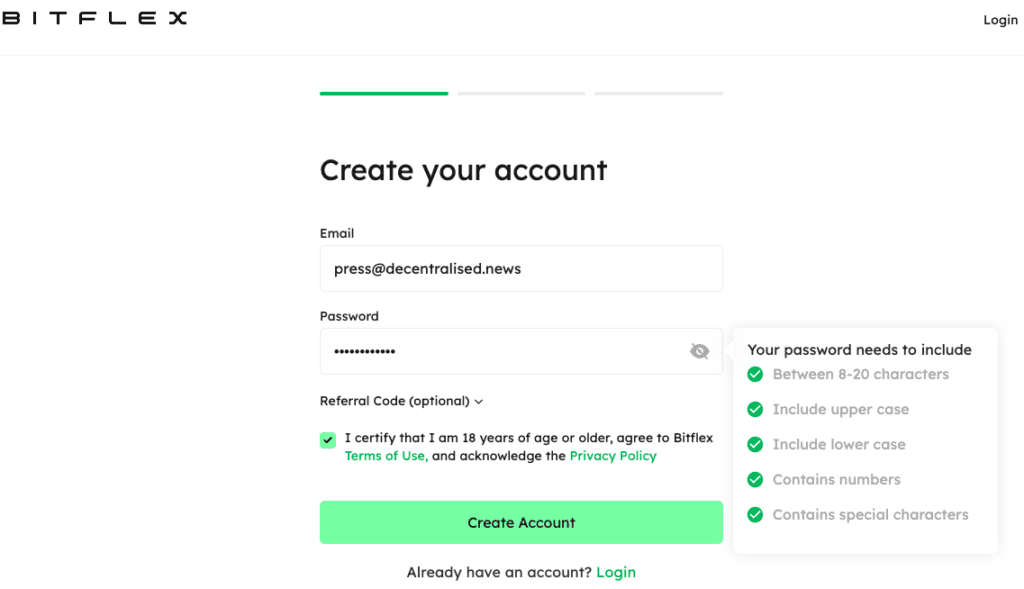

Getting started on Bitflex is straightforward. Users are able to simply Sign Up for an account. To register an account on Bitflex, a user can easily enter their email address, set a password, confirm the password and then click on send code for verification.

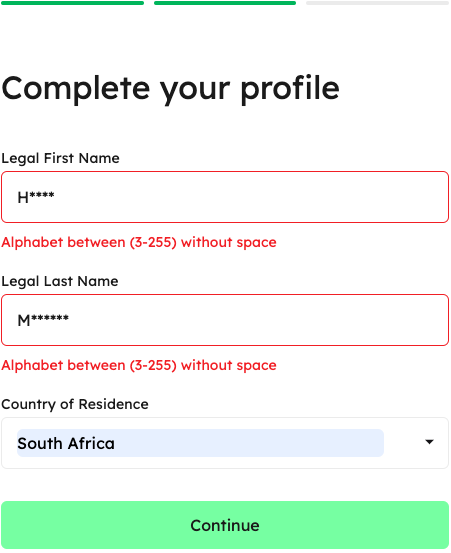

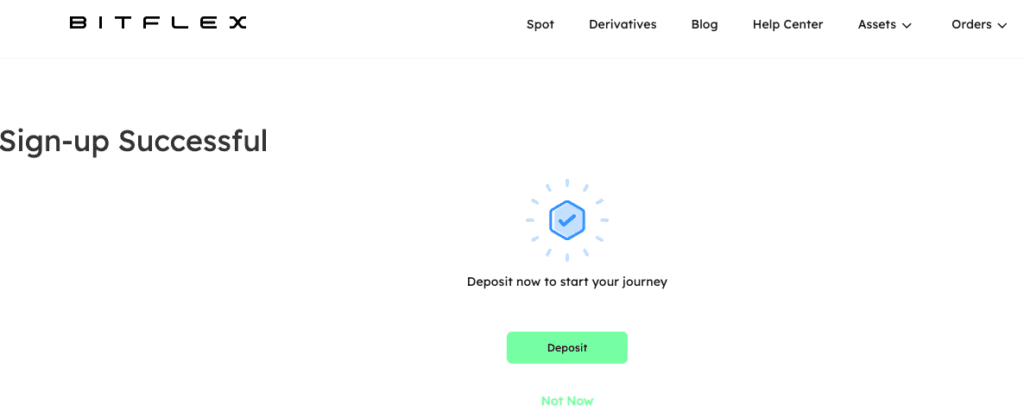

Upon creating an account, a user is prompted to complete a user profile.

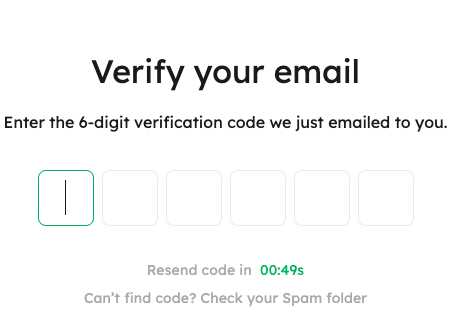

The user can then continue by pasting the verification code sent to their email address into the verification code field.

Once that’s done, a user can enter an invitation code e.g. OIehhv if they have one and they must make sure that they read the terms of use and privacy agreement, and check the box. Upon completion of this step, the user can then click on the sign-up button.

To continue, a user can simply log in to their new account using their credentials.

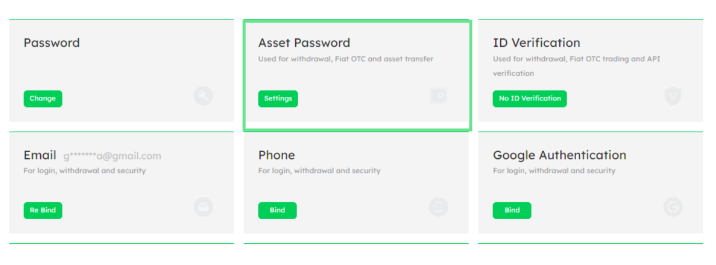

It’s important for users to secure their accounts. To make sure that your account is fully secured, follow these steps:

- Set Up an Asset Password – an asset password is a password required during withdrawing funds from Bitflex to an external exchange or wallet. To set up your asset password go to the Profile Icon on the top right corner and click on Settings as shown below:

Users can also enable mobile verification and 2FA.

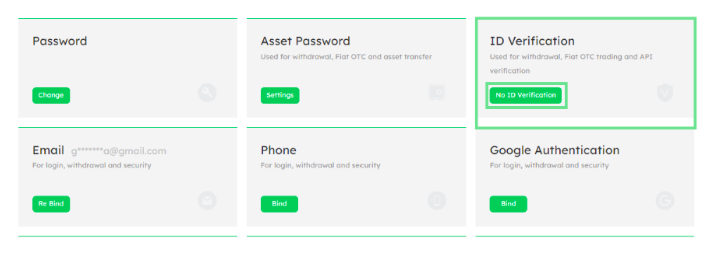

It is also recommended that users complete KYC in order to access full platform functions. KYC is mandatory on Bitflex for withdrawing funds, Fiat OTC trading, and API Verification. However, if you simply want to deposit crypto or trade perpetual swaps, it is not mandatory.

There are two levels to KYC Verification on Bitflex. The first is basic ID Verification, which is KYC1. The second level is advanced verification denoted by KYC2 on your profile. Users will need to upload a copy of their ID, a photo of themselves holding that ID, and a handwritten note with Bitflex written on it.

In order to complete KYC verification on Bitflex, users can simply go to the Profile Icon on the top right corner and click on Settings. On the settings page, you will see an ID Verification option, which will be showing No ID Verification. Click on the No ID Verification button.

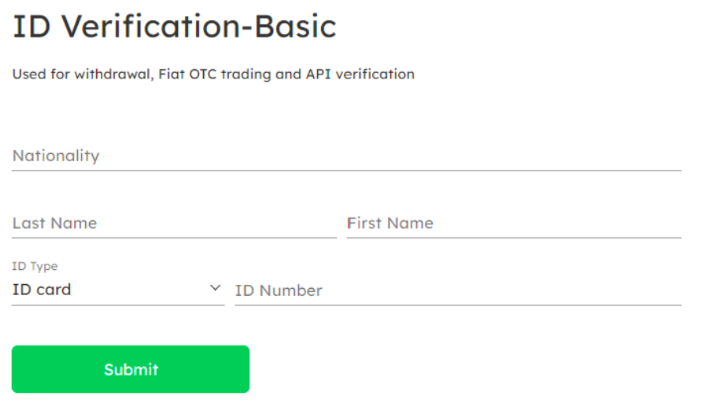

For basic ID verification, a user will need to enter their Nationality, First Name, Last Name, ID Type, and ID Number. Once they have entered all the relevant information, they can click on the Submit button.

If a user wishes to complete KYC2, they will need to:

- Upload a copy of their identification document. The identification document must be the same document whose information they entered in KYC1.

- Confirm their identity with a photo of themselves holding your ID and a handwritten note.

Once they have uploaded the following requirements, they can simply click on the Submit button. It usually takes no more than 24 hours for the documents to be verified by the Bitflex team. If a user fails KYC, they can check the reason and re-do it.

How to Make a Deposit on Bitflex Exchange

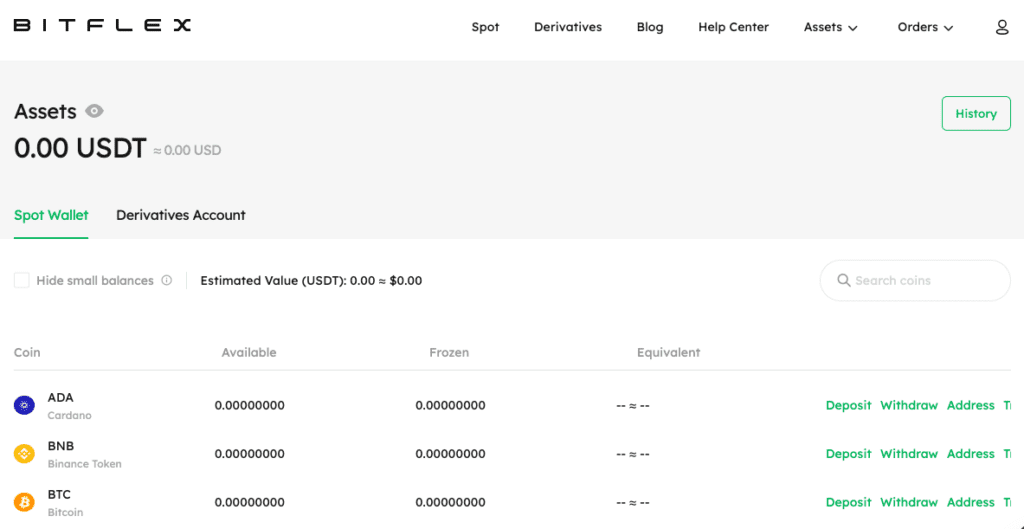

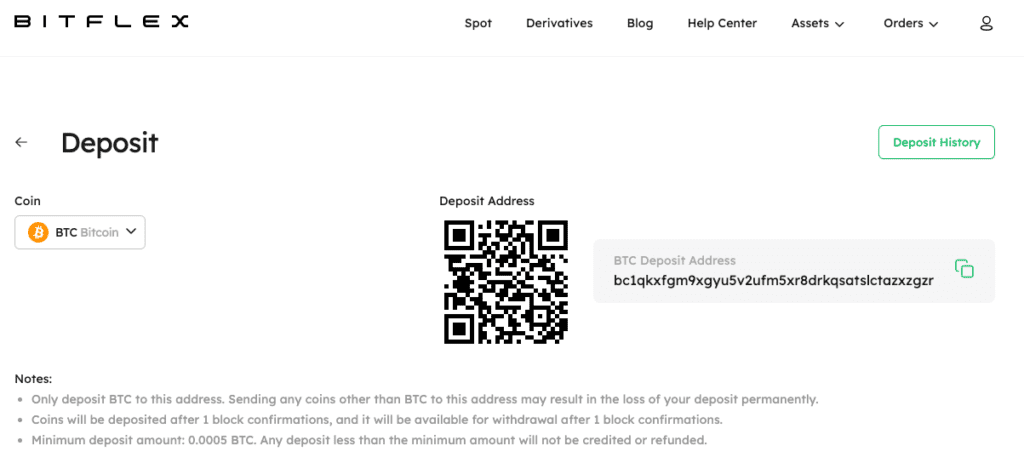

Once a user has secured their account, they can proceed to choose which assets to deposit to the Bitflex platform to begin trading.

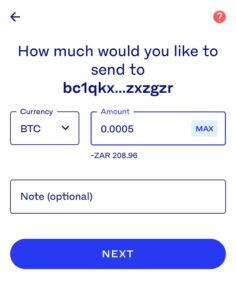

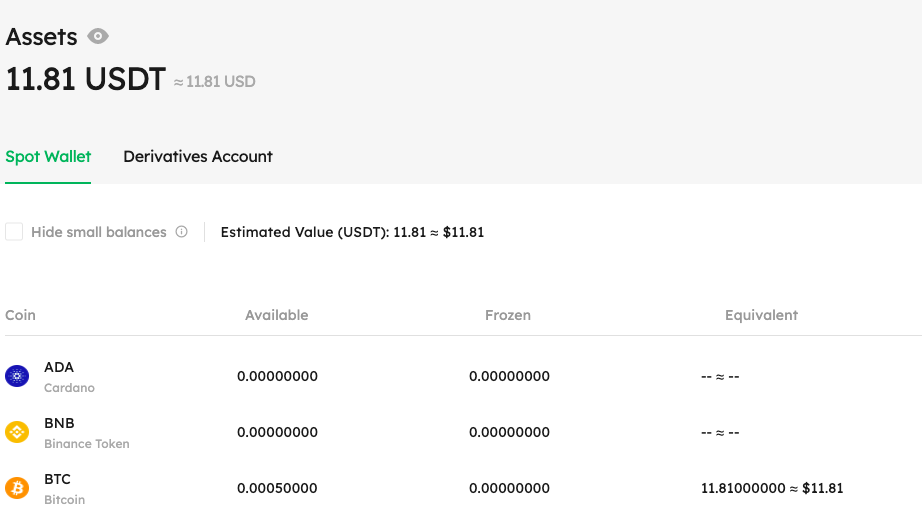

In this case, we chose to deposit the minimum required Bitcoin, which is, 0.0005 BTC.

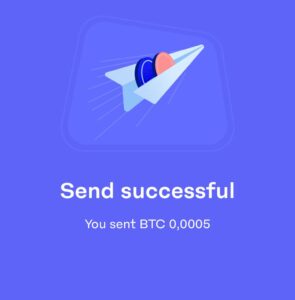

Since we already had some BTC in another exchange wallet, it was simply a matter of sending the minimum required as a test transaction to ensure the platform works as it should.

Once this was done, we waited to receive the BTC in our Bitflex account.

To confirm receipt of the funds, we simply checked the Bitflex wallet and indeed the BTC had been credited.

Bitflex is essentially a cryptocurrency derivatives exchange for trading perpetual swaps including BTC, ETH, XRP and more. Bitflex recently launched their Spot Trading function and currently supports spot trading for BTC, ETH, BNB, XRP, and ADA.

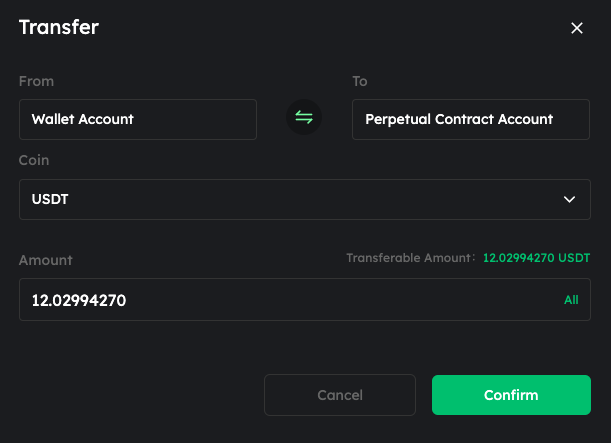

Bitflex also supports derivatives functions. In order for a user to access their derivatives wallet, they need to go to the Assets tab and click on Derivatives Wallet.

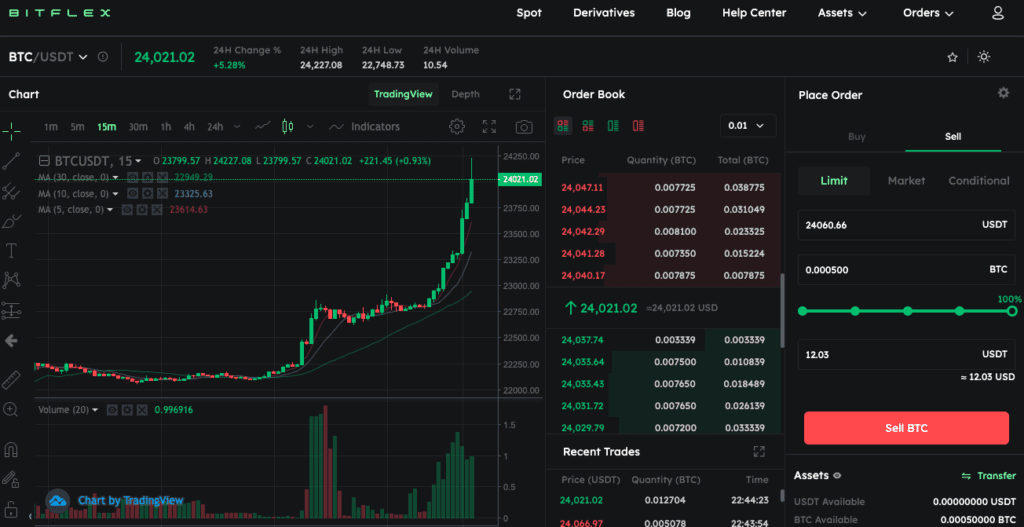

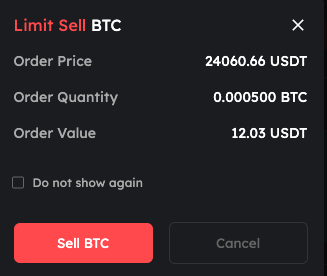

In order to trade perpetual swaps, we had to spot trade BTC for USDT and then transfer the USDT to the margin account to trade derivatives.

Bitflex supports linear perpetual swaps on eight contracts, which include BTC-USDT, ETH-USDT, ADA-USDT, BNB-USDT, XRP-USDT, DOT-USDT, FTM-USDT, and NEAR-USDT.

Now that we have some USDT we can proceed to transfer the USDT to the perpetual trading account.

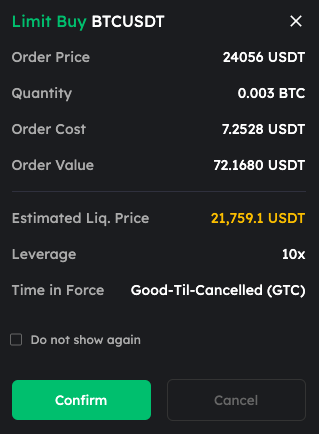

Now we can either open a long or short position. In this test trade we will go long with 10X leverage on about 76% of our asset value which is 0.003 BTC. The cost of our order is approx 7.25 USDT which makes the order value 72.16 USDT since we are using 10X leverage.

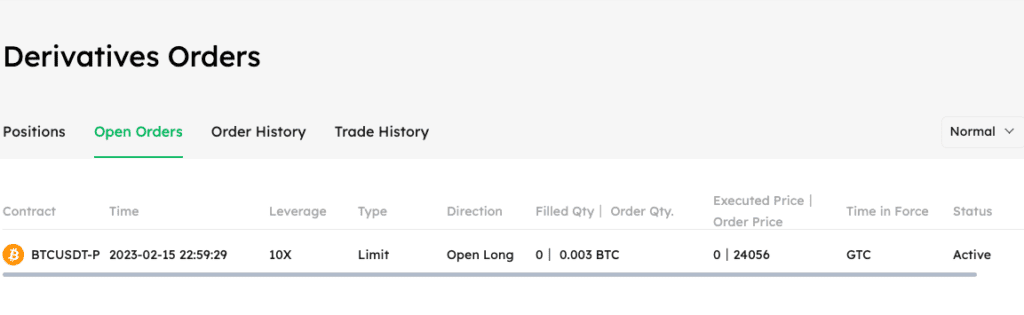

A user is able to check the order details and keep track of their trades easily on the platform.

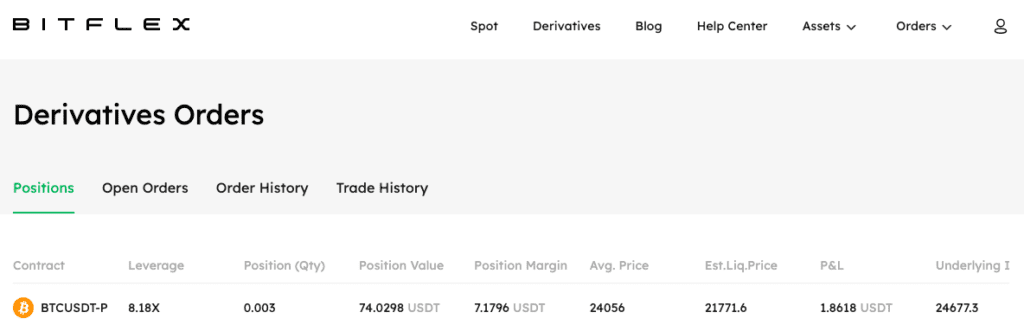

You can also see how your trades performs over time and track your profits or losses.

Bitflex has a lot of attractive offers for new and active users including:

- Exclusive Deposit Event: 1000 USDT Up For Grabs. Check out the campaign details here.

Campaign period: 13-19 Feb

- HODL & Earn Cardano: $1000 worth of $ADA Reward Pool

Campaign period: 20-26 Feb

Conclusion

Bitflex is a new platform for crypto spot trading and perpetual swaps.

Perpetual swaps are a type of cryptocurrency derivatives contract that allows traders to speculate on the future price of a cryptocurrency without actually owning the underlying asset. While they can offer certain benefits such as leverage, there are also several risks associated with trading crypto perpetual swaps, including:

-

High volatility: The crypto market is notoriously volatile, and perpetual swaps can magnify this volatility due to the use of leverage. This can result in rapid gains or losses, and traders can lose more than their initial investment if the market moves against them.

-

Counterparty risk: When trading perpetual swaps, traders are exposed to the risk that the exchange they are using may fail, either due to insolvency or hacking. This can result in the loss of funds or positions, and traders should take steps to mitigate this risk by using reputable exchanges and implementing appropriate security measures.

-

Liquidation risk: If the price of the underlying cryptocurrency moves against a trader’s position, their margin may be insufficient to cover the losses, and they may be forcibly liquidated. This can result in significant losses and should be managed through appropriate risk management strategies.

-

Regulatory risk: The regulatory landscape for cryptocurrency derivatives is still evolving, and there is a risk that governments may impose restrictions or bans on the trading of perpetual swaps. This could result in a significant loss of liquidity and value for traders.

-

Technical risk: Perpetual swaps are complex financial instruments, and their trading and settlement mechanisms can be subject to technical issues or errors. Traders should be prepared to manage these risks by monitoring their positions closely and having appropriate contingency plans in place.

Overall, it’s important for traders to be aware of the risks associated with perpetual swaps and to take steps to manage them effectively. This includes using reputable exchanges, implementing appropriate risk management strategies, and staying up-to-date with regulatory developments.

Users should always do their own research and exercise caution when using centralised and decentralised crypto trading platforms such as Bitflex, Bybit, Binance, OKX, KuCoin, Coinbase, gTrade, among many other exchanges.