Many people trade cryptocurrencies on various exchanges in attempt to generate profit. Without question, the trading volume for bitcoins is high since it is the most liquid digital asset in the world.

However, people can make a profit, without owning bitcoins, by capitalizing on price fluctuations. They achieve this through bitcoin perpetual swaps. Basically, a bitcoin perpetual swap is a derivative that enables people to buy and sell the value of the bitcoin without owning it.

In other words, people bet on the future price of bitcoin. If its price changes in line with the prediction of a trader, that person earns a profit. A person who predicts that the price of the bitcoin will rise will open a long position, while the one who believes that its price will fall opens a short position.

Therefore, people select a pair in order to open their positions. An example of a trading pair is BTC/USD. This means that the bitcoin price is estimated in United States dollars.

Example: Let’s assume that Gregory wanted to trade bitcoin swaps when the starting price of the bitcoin was $12 000, on 15 August 2020. Therefore, Gregory bet that the price of the bitcoin would rise. He purchased 5 BTC/USD perpetual. Let’s say he bought the 5BTC/USD swaps at a total cost of $60 000, which acted as collateral.

The figures at that time were $60 000/$12 000 = 5BTC/USD perpetual swap contracts.

However, from that time until 30 November 2020, the price of bitcoin had been rising constantly up to $19 000.

When he closed his position at a price of $19 000, his profit was:

$19 000 – $12 000 times 5 swap contracts

$7 000 X 5 = $35 000.

However, to find the net profit we also consider the funding rate fees and rebates.

Assuming that there were no rebates and funding rate fees, Gregory’s profit was $35 000. Interestingly, Gregory got this profit without buying, selling or owning any bitcoins. He simply benefitted from bitcoin perpetual swap trading. Remember, he purchased bitcoin perpetual swaps, not the actual bitcoins per se.

Notably, anyone can trade in bitcoin perpetual swaps. However, one can also make a loss, if the direction of the bitcoin price movement is opposite to the one an individual bets on.

An individual can leverage up to 100 times the amount he/she used as collateral when trading perpetual swaps on some exchanges.

Which platforms offer bitcoin perpetual swap trading?

There are many platforms where people can trade in perpetual swaps. The key trading platforms for bitcoin perpetual swaps include:

It is important to note that traders encounter costs during the trading process. These include the opening fee, the closing fee and the funding rate fees, where applicable.

Trading in Perpetual swaps on Huobi

We shall discuss how someone can trade in bitcoin perpetual swaps on Huobi exchange. However, a similar process takes place on other exchanges.

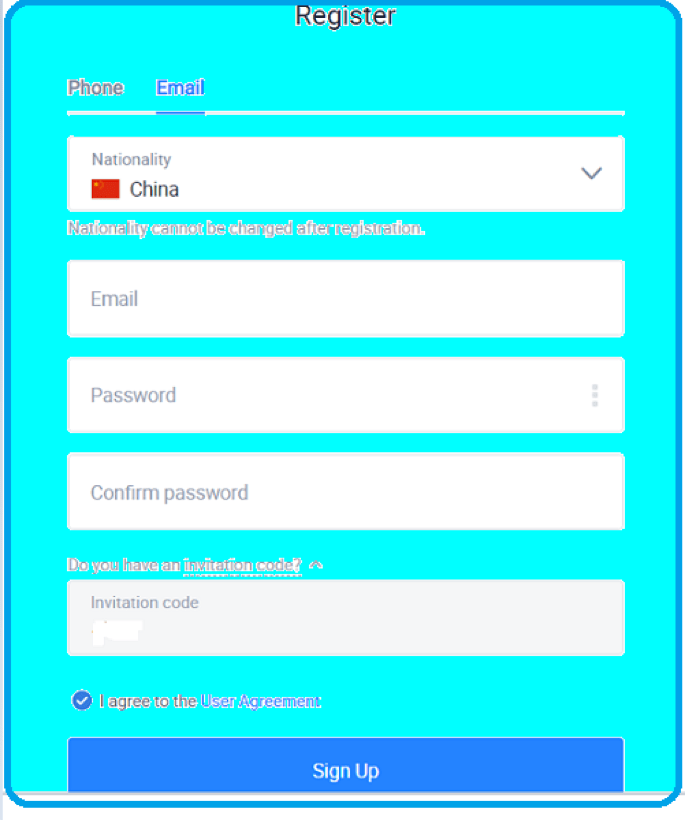

STEP 1: Open a Huobi Account at https://www.huobi.com/

The only required details are an email address, phone number, nationality, name, and password. After inputting these, you consent to its terms through clicking “Sign Up.”

Thereafter, you verify your identity by uploading your government-issued passport or driver’s license or national identity card.

Depositing the funds:

When you log in, you click on “Balances,” found on the top right side.

From there, select “USDT” and collect the wallet address. You should send USDT to that wallet.

STEP 3: Transfer USDT from your exchange wallet to your derivative account.

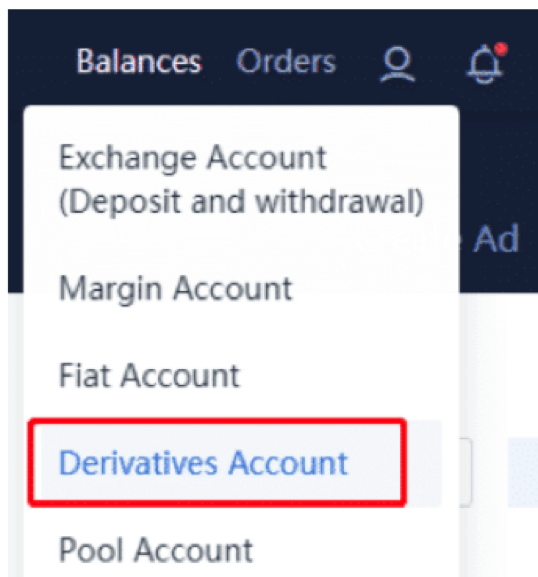

Click on “Balances” and select “Derivatives Account.”

Then click on “Transfer” and choose “Exchange Account” to “Derivatives Account.” Ensure to select the specific derivate account you need.

Finally enter the amount you want to transfer and click “Confirm.”

STEP 4: Trading process

Within the Huobi platform, select “Derivatives”, then, “USDT-margined swaps.”

From there, go to the “Trading” page and place your order.

If you think the price of bitcoins will rise, select “Open Long.” On the other hand, if you think the price will decrease choose “Open Short.”

Conclusion

Trading in bitcoin perpetual swaps can be profitable. However, trading risks may arise. Therefore, an individual should take due caution at all times.