Best Crypto Futures Strategies 2025

How Smart Traders Farm Yield from Funding & Basis Trades.

Behind every profitable crypto derivatives trade lies a web of mechanisms that many traders overlook. Sure, you’ve heard of leverage and liquidations, but the real yield often comes from less obvious places: funding rates, basis trades, and perp yield farming.

If you want to play in the derivatives big leagues—on platforms like Binance, Bybit, Bitunix, MEXC, OKX, and Deribit – understanding these three mechanics can be the difference between consistent yield and unexpected liquidation.

Funding Rates Explained

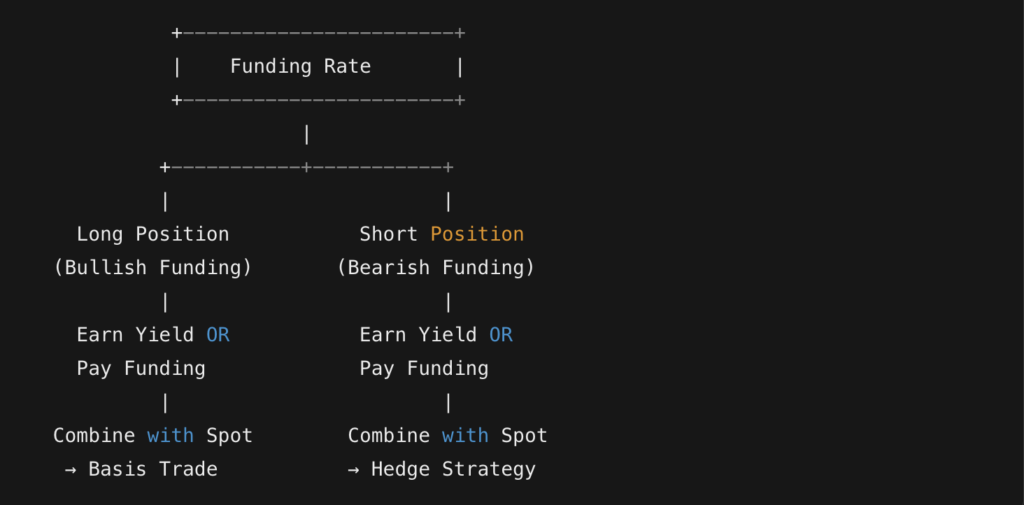

Funding rates are periodic payments exchanged between long and short positions in perpetual futures contracts. These rates are designed to keep perpetuals in line with spot prices.

-

Positive funding means longs pay shorts.

-

Negative funding means shorts pay longs.

Platforms That Use Funding Rates

| Platform | Funding Rate Interval | Typical Range |

|---|---|---|

| Bybit | Every 8 hours | ±0.01% to ±0.05% |

| Binance | Every 8 hours | ±0.01% to ±0.03% |

| Bitunix | Every 8 hours | ±0.01% to ±0.04% |

High funding rates = high opportunity (and risk). These small percentages compound—yielding annualized returns of up to 100%+ in some cases.

Basis Trading: Arbitrage Between Spot and Futures

Basis is the difference between the futures price and spot price.

-

If futures > spot, you can short the future and long the spot.

-

If spot > futures, you do the opposite.

This is the strategy behind basis trading, a favorite among hedge funds and prop trading firms.

💡 Example: On MEXC, BTC spot trades at $60,000 while the quarterly future trades at $62,000. By selling the future and buying the spot, you lock in a $2,000 spread—often realized at expiry or via convergence.

Yield Farming with Perps: Real Returns vs. Illusion

Some traders treat funding rates like DeFi yield—but not all funding is “free money.”

To earn the funding yield, you must:

-

Take the side opposite the crowd.

-

Withstand volatility and potential liquidation.

-

Stay delta-neutral (e.g., long spot + short future).

Platforms like Bybit, MEXC, Binance, and OKX make this easy with advanced margin tools.

But beware: when funding spikes, it often signals imminent volatility.

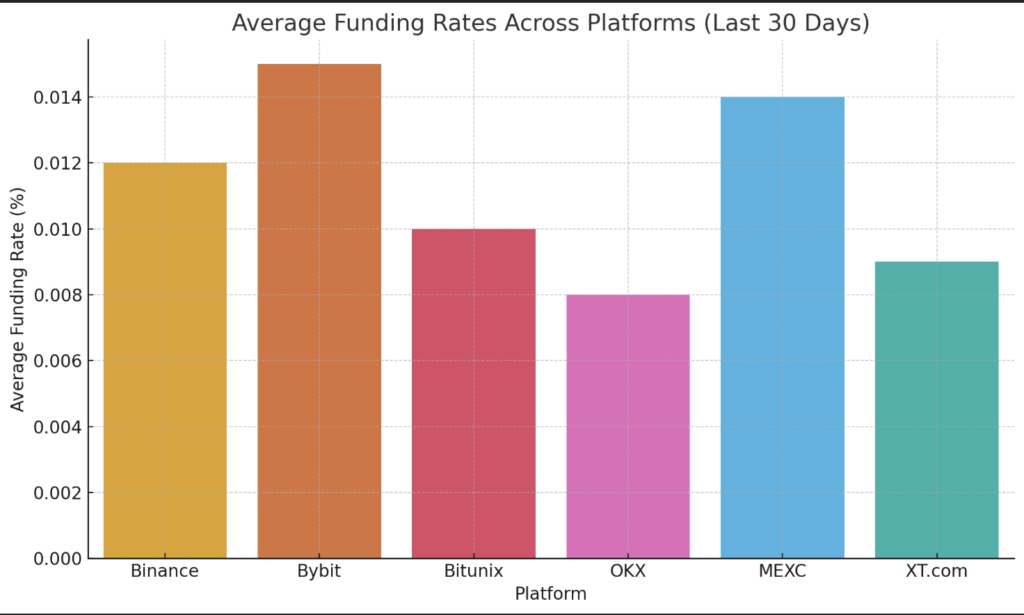

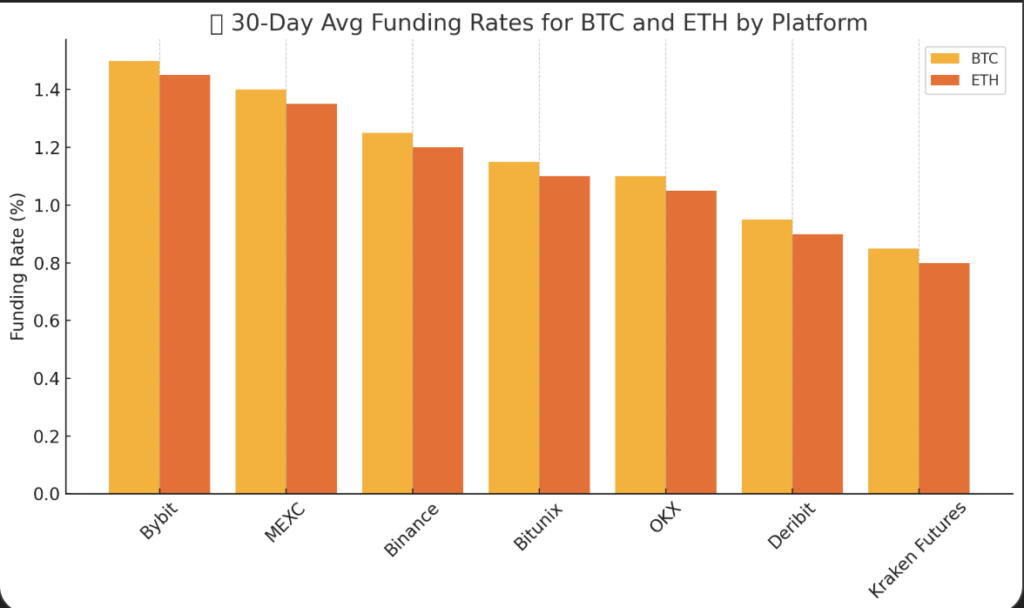

Platforms with Most Profitable Funding Rates (30D Avg)

| Platform | BTC Funding Rate (30D Avg %) | ETH Funding Rate (30D Avg %) |

|---|---|---|

| Bybit | 1.50% | 1.45% |

| MEXC | 1.40% | 1.35% |

| Binance | 1.25% | 1.20% |

| Bitunix | 1.15% | 1.10% |

| OKX | 1.10% | 1.05% |

| Deribit | 0.95% | 0.90% |

| Kraken Futures | 0.85% | 0.80% |

🧠 Pro Tip: Funding rates vary wildly with sentiment. Use tools like Coinglass or platform dashboards to monitor them.

Risks of Chasing Funding

🚩 Funding spikes often precede reversals or squeezes.

-

Being on the wrong side of the squeeze = liquidation.

-

Liquidity mining via perps only works with tight risk management.

Risks:

-

Flash crashes

-

Exchange downtimes

-

Auto-deleveraging (ADL) events

-

False funding signals from illiquid books

Smart Strategies for Retail Traders

Here’s how to safely leverage these hidden mechanics:

🔸 Delta-neutral Yield Farming

-

Long spot BTC

-

Short perp BTC with positive funding

-

Net profit = funding payments

🔸 Rolling Basis Trade

-

Monitor quarterly futures vs. spot

-

Capture premium before expiry

-

Ideal on OKX, Binance Futures

🔸 Funding Sniper Bot

-

Program a bot to switch positions based on funding

-

Platforms: Bybit APIs, Binance APIs, Bitunix custom bots

Conclusion

Crypto derivatives aren’t just for wild speculation—they’re profit machines if you know how to read the hidden signals. Funding rates, basis, and perp yield strategies are the bedrock of real returns for those who take the time to master them.

So next time you’re trading on Bybit, MEXC, Bitunix, or OKX, ask yourself:

Am I speculating—or am I farming yield from the hidden engine under the hood?