ApeX Pro Non-Custodial Derivatives Exchange Review

ApeX – Decentralized, Non-custodial, Perpetual Derivatives Protocol.

What is ApeX Protocol?

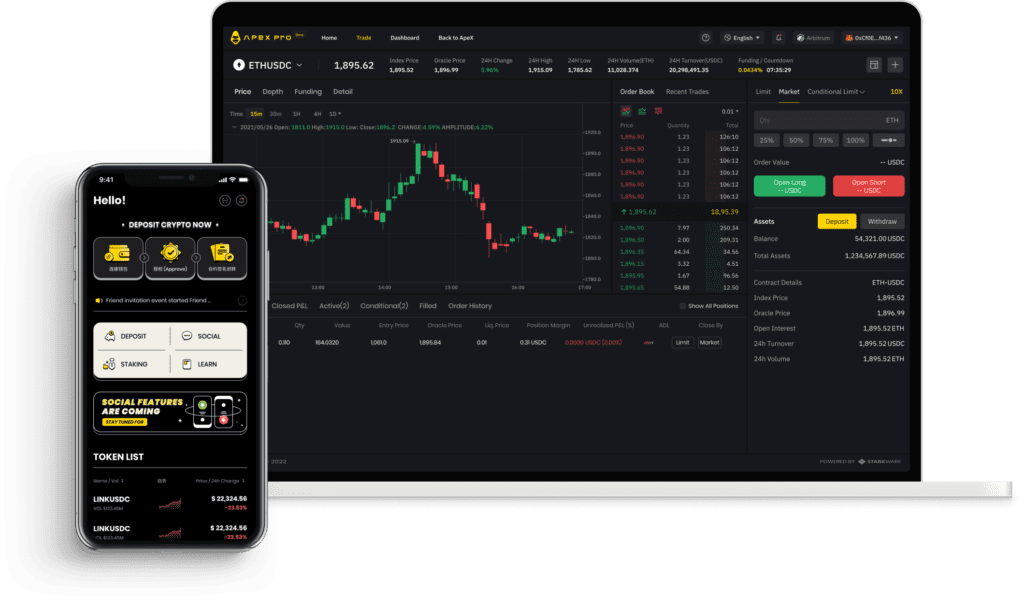

ApeX Pro is a non-custodial trading platform that is designed to provide users with cross-margined perpetual contracts. Its social trading framework and order book mode are meant to enable access to the perpetual swap market with speed, efficiency, security and transparency.

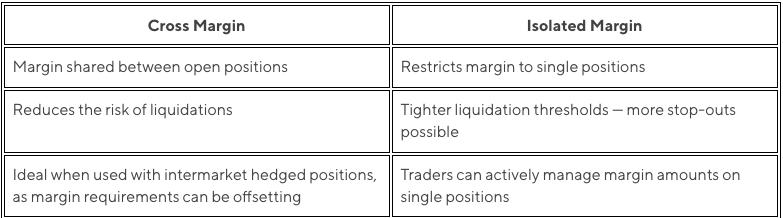

Unlike isolated margin where margin is assigned to a single position that is restricted to a specific amount, cross margin is best utilised by traders with multiple margin trading accounts since it allows for a reduction in initial margin requirements, fewer margin variations and smaller net settlements because of recognising intermarket hedged positions.

The major difference between cross margin and isolated margin is that cross margin shares margin between positions and accounts which can be helpful to long-term investors especially during periods of market volatility. It is seen as a risk-management tool for sophisticated portfolios that consist of digital assets or cryptocurrencies, options, or other derivatives.

The platform is built on ApeX Protocol which makes permissionless crypto perpetual contracts trading with leverage possible. ApeX Pro utilises an Elastic Automated Market Maker (eAMM) which provides a spot-like trading experience but also enables better capital efficiency by allowing single-asset provision as the BASE Asset while also synthesising the QUOTE asset.

ApeX’s Protocol Controlled Value (PCV) model is designed to provide a solution to the ‘mercenary capital’ issue that is often problematic for most DeFi protocols. In a PCV model, all assets locked in smart contracts are not redeemable by users and are in essence owned by the protocol. The reason for this is to guarantee liquidity of each perpetual contract market so that users are able to be certain that no liquidity provider can pull out the protocol-owned liquidity.

What makes ApeX Protocol unique?

- ApeX not only offers USDC-collateralized contracts, users of the platform can also provide liquidity on any tokens and relegate crypto derivatives on the Ethereum blockchain while maintaining control of their private keys.

- The order book model on ApeX Pro uses StarkWare’s Layer 2 scalability engine StarkEx for a better trading experience.

- ApeX’s long-term vision is to establish a social trading platform to provide added benefits to more experienced traders by presenting avenues for earning passive income by allowing the less experienced traders to follow and replicate their trades, signals and trading strategies.

- ApeX Protocol makes it possible for users to trade any Web3, DeFi, GameFi and even Meme tokens on the derivatives market with 10X leverage.

- With ApeX, users can create liquidity pools and add liquidity to any pairs.

- Users can also purchase $APEX token via the Bond program and stake to earn yield e.g. users can stake to earn the governance tokens and transaction fee rewards.

How to Trade on ApeX Decentralised Derivatives Exchange?

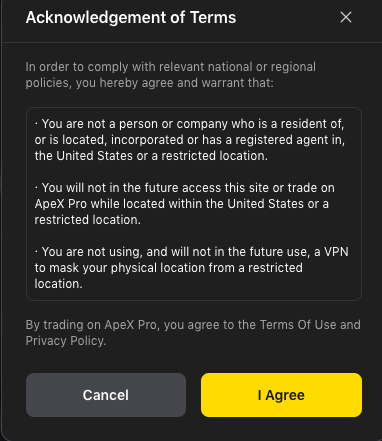

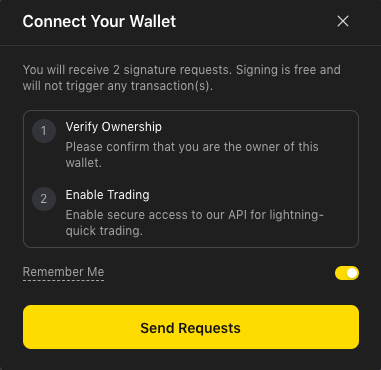

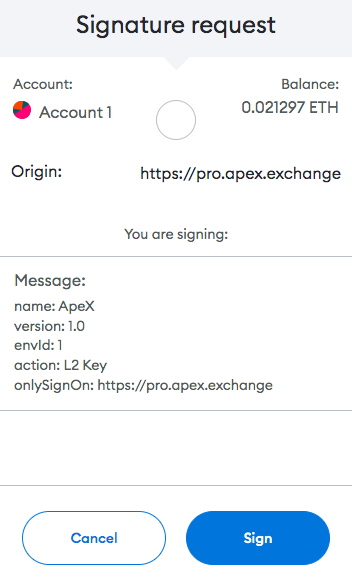

To use Apex Pro, simply visit: https://apex.exchange/ and launch the app or click ‘Trade now” to connect your Web3 wallet e.g. MetaMask. After you choose to agree to the terms, you can then proceed to verify ownership of your wallet and enable trading.

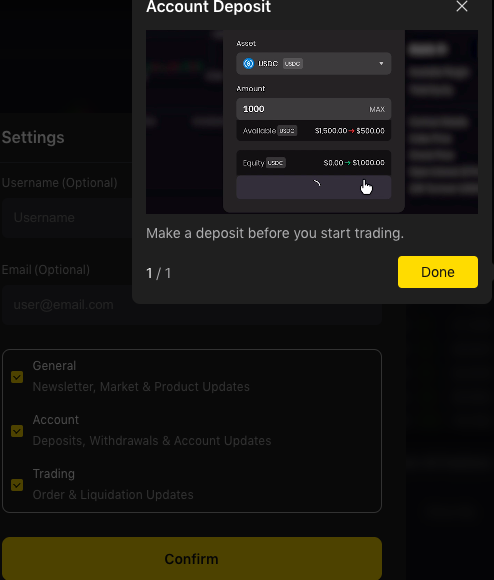

Once you’ve finished that quick procedure, you can go ahead and deposit funds to trade on the DEX.

Depositing assets will open up the opportunities for you to start executing different orders on the platform.

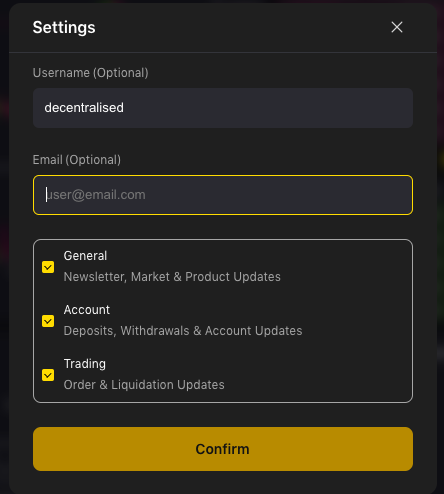

But first, set up your wallet account details if you wish to.

If you want to receive alerts or notifications related to your trading activity then you can also choose to set up email alerts.

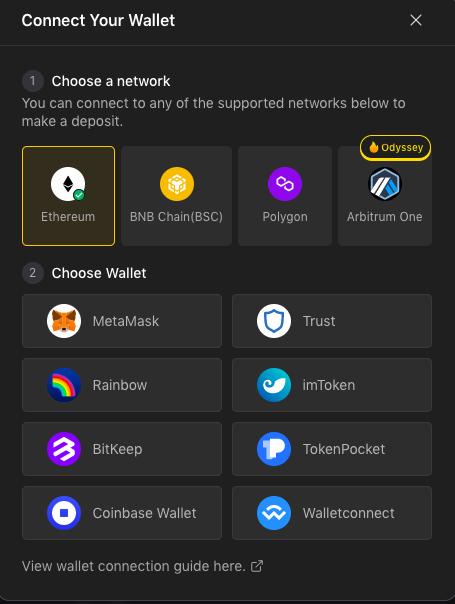

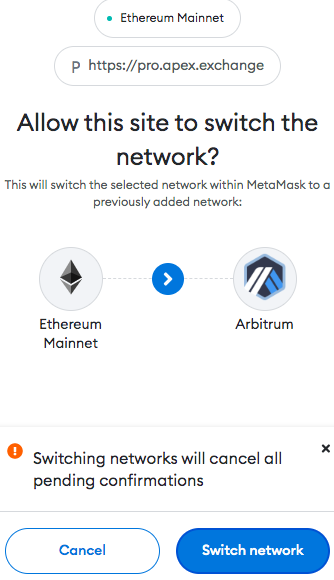

Allow your wallet to interact with ApeX. You can choose the blockchain network you’d like to use. In this example, we choose Arbitrum because it offers cheaper transaction fees.

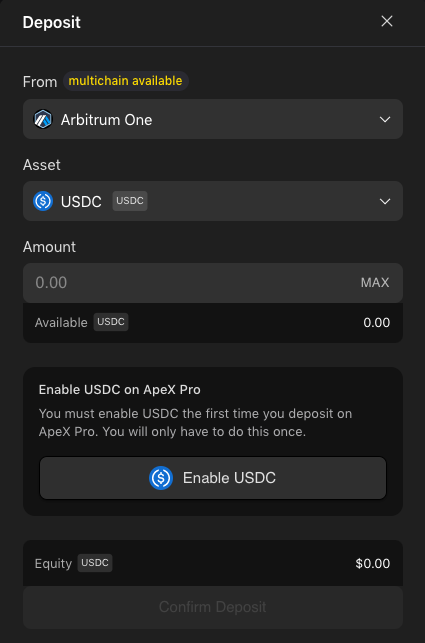

ApeX offers USDC-collateralized contracts, so you will be asked to enable USDC deposits.

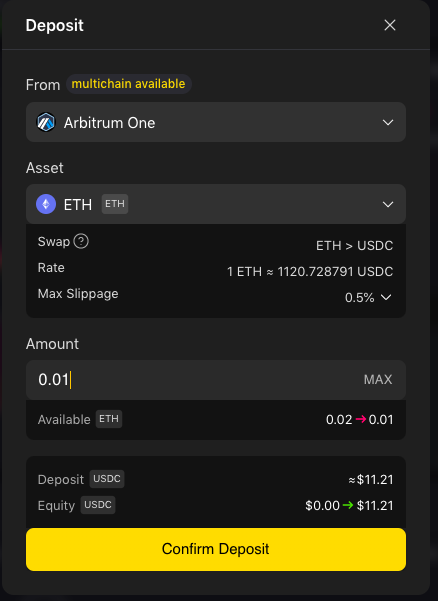

You can then choose the asset you want to use. You’ll have the option to choose assets with less slippage than ETH which we are using for the purposes of this demonstration.

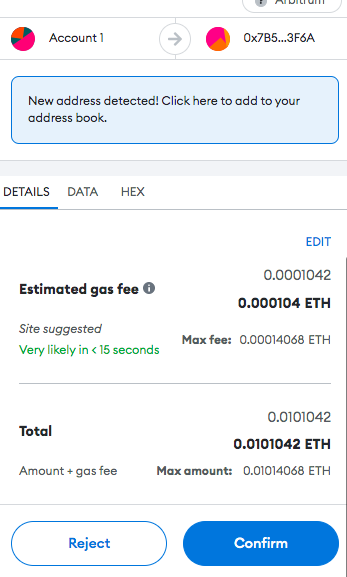

You can then pay the gas fee.

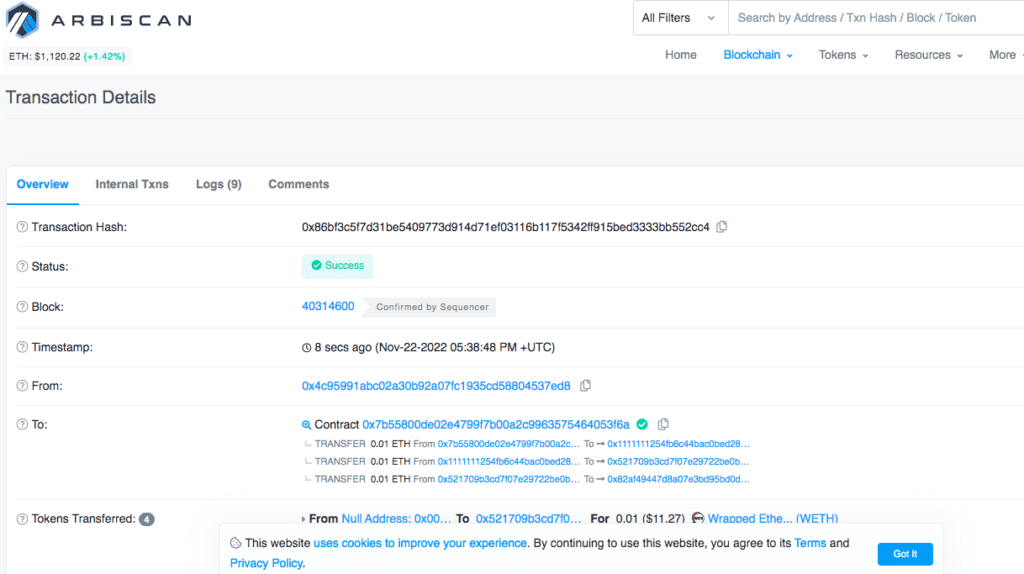

You’ll be able to verify your transaction on Arbiscan – the Arbitrum block explorer.

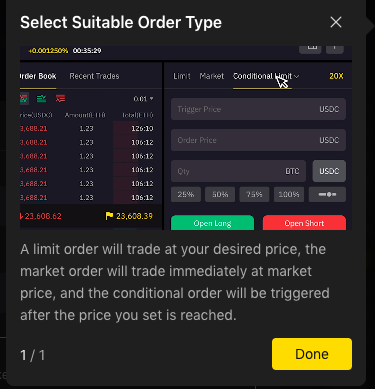

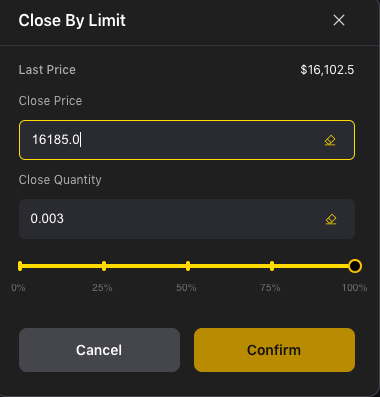

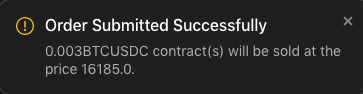

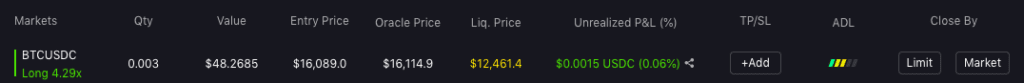

You can then simply proceed to the main trading interface to set up your trades. You choose how much of your total collateral you wish to utilise for your Long or Short positions. Here we took a long position.

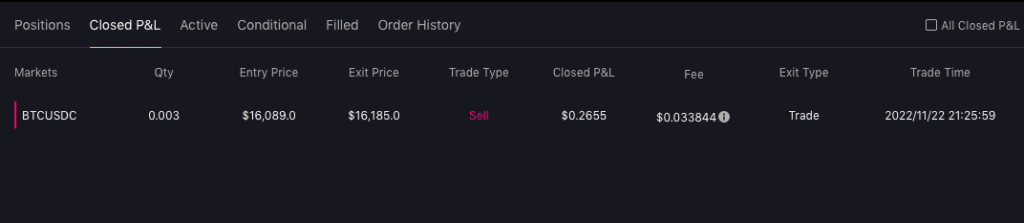

Once your order executes and position is closed you can check your profit and loss.

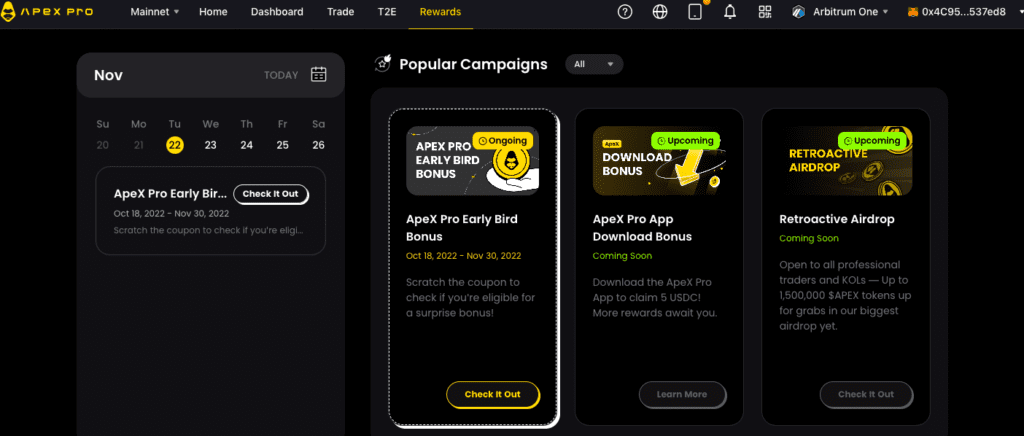

Rewards & Bonuses on Apex Pro DEX

Users can access all of ApeX Pro’s latest promotions and deals.

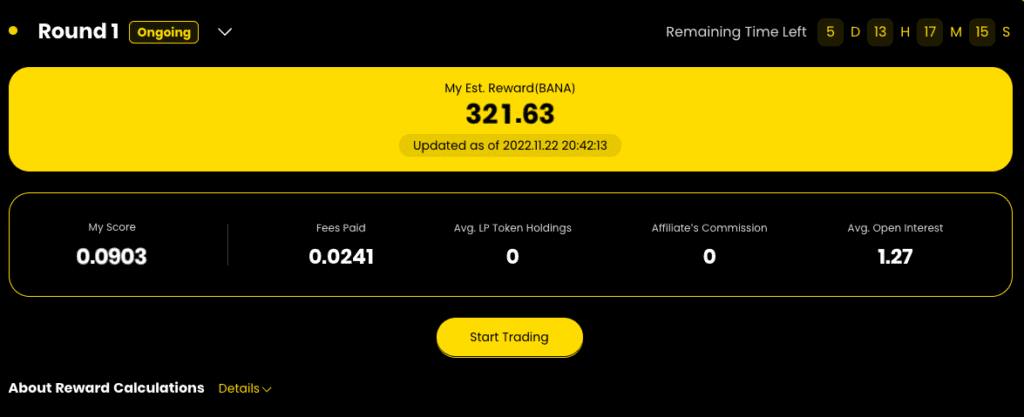

Trade-to-Earn on Apex Pro ($APEX & $BANA Tokens Explained)

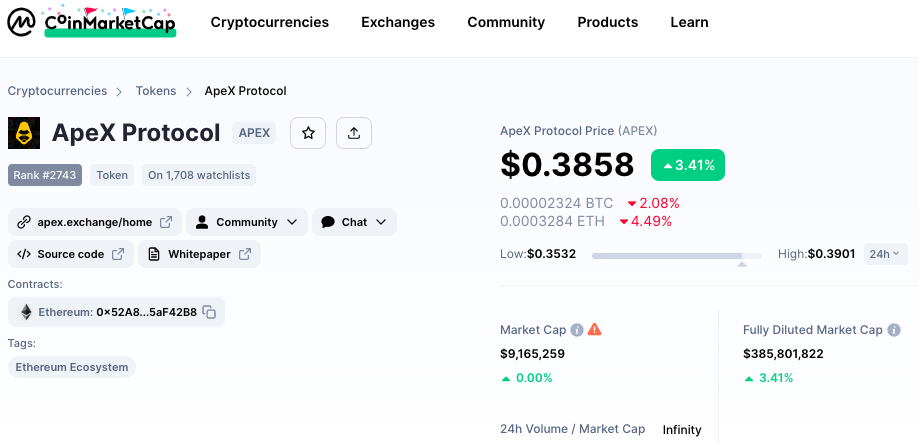

The native token of ApeX Protocol is $APEX. It has different use cases:

- Governance – $APEX token holders can submit and vote on protocol governance proposals.

- Protocol Incentivizes – as a user of ApeX Exchange, you can earn $APEX tokens by participating in liquidity mining or staking to earn rewards.

BANA is an incentive token used to reward platform users via regular trade-to-earn events on ApeX Pro.

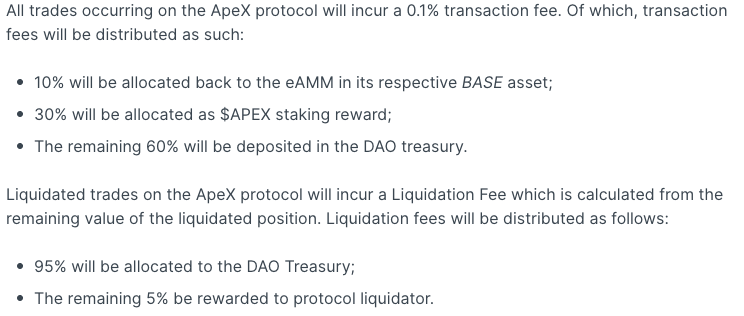

Fees on ApeX Exchange

Why use ApeX Protocol?

If you wish to trade perpetual swap markets for any token pair on a decentralized and non-custodial derivatives protocol, ApeX is a platform that will make it possible for you to do so. If you prefer to trade derivatives on a centralized exchange then you can also choose to trade on a platform such as Bybit. You should always make sure you understand the benefits and risks of using different types of trading platforms so that you’re able to chose what is best suited to your needs.