Over-the-counter (OTC) crypto trading is an essential service for institutions, high-net-worth individuals, and businesses looking to make large trades with minimal slippage and maximum privacy. While crypto exchanges cater to retail traders, OTC desks are built for larger transactions, offering personalized services, deep liquidity, and confidentiality.

Here’s a closer look at the top crypto OTC desks, focusing on their standout features, benefits, and what sets them apart in this evolving sector.

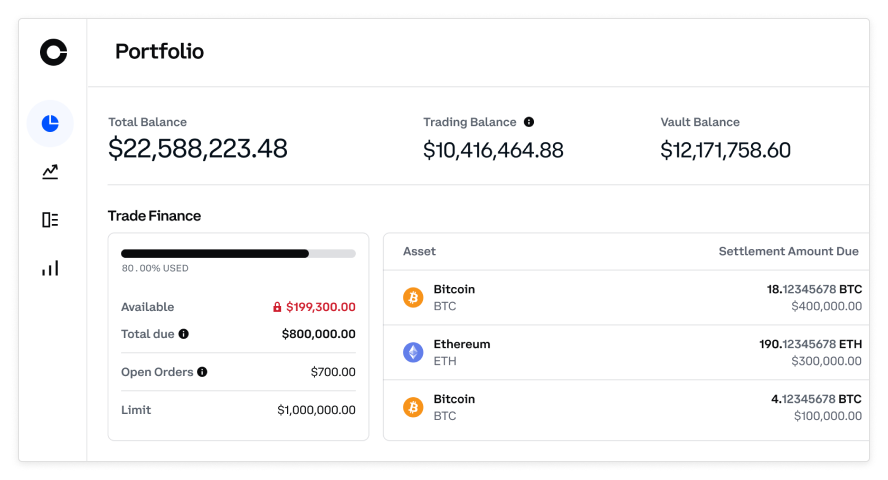

1. Coinbase Prime

- Minimum Trade Size: Unknown

- Available in the US: Yes

- Standout Feature: Institutional-grade NFT custody

Coinbase Prime stands out with its focus on institutional services. As a part of Coinbase, the largest U.S.-based cryptocurrency exchange, this OTC desk offers over 300 supported assets, advanced security measures, and NFT custody, setting it apart from many other OTC services.

Pros:

- NFT Custody: A rare feature among OTC desks.

- Wide Range of Assets: Over 300 supported cryptocurrencies.

- Institutional Support: Provides staking, governance, and deep liquidity through its wide network.

Cons:

- Unclear Minimums: Lacks clarity on minimum trade sizes.

- Heavily Regulated: Operating under strict U.S. regulatory scrutiny.

- Fees: Higher compared to other platforms.

Features:

- Access to external liquidity beyond Coinbase’s internal pool.

- Cold storage for custodial assets with $320 million in insurance coverage.

- An API for automated OTC trades.

Coinbase Prime is ideal for institutions looking for a trusted name in crypto and NFT storage.

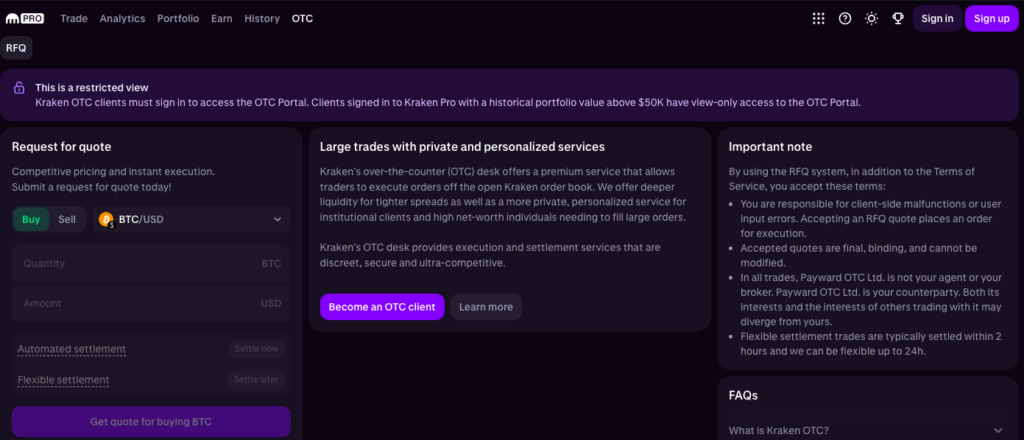

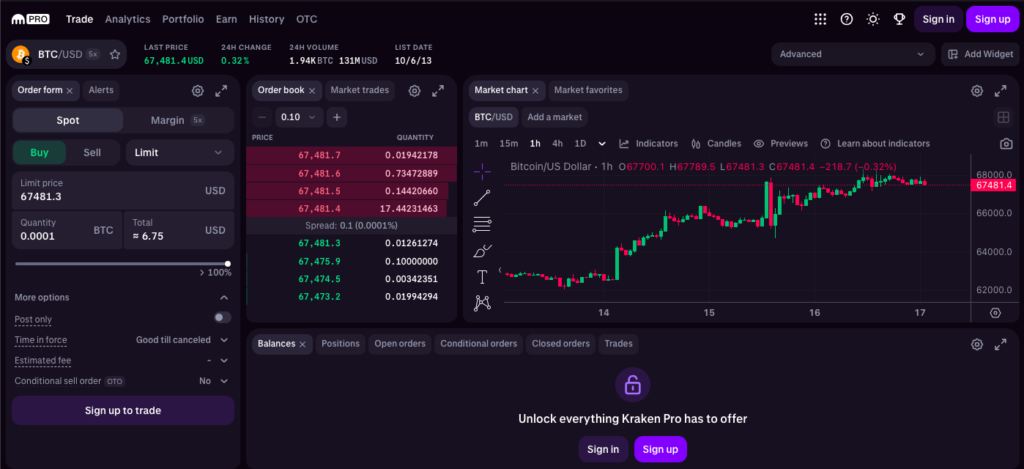

2. Kraken OTC

- Minimum Trade Size: $100,000

- Available in the US: Yes

- Standout Feature: Auto Request-For-Quote (RFQ) system for instant trading

Kraken’s OTC desk is tailored for institutions and large traders, offering 24/7 support, personalized service, and flexible settlement options. Its standout feature, the AutoRFQ system, allows clients to instantly match trades, giving it a significant speed advantage.

Pros:

- Live Quotes: Real-time pricing via AutoRFQ.

- Flexible Settlements: Trade settlements within 24 hours.

- Wide Asset Range: Supports all assets available on Kraken’s exchange.

Cons:

- Limited Global Availability: Not available in Japan.

- Complex Application: Long onboarding process for institutional clients.

Features:

- Personalized service with one-on-one support.

- Self-service trading via the AutoRFQ system.

- Supports trade execution over chat for enhanced flexibility.

Kraken OTC is an excellent choice for those seeking a fast, reliable, and widely recognized trading platform with deep liquidity.

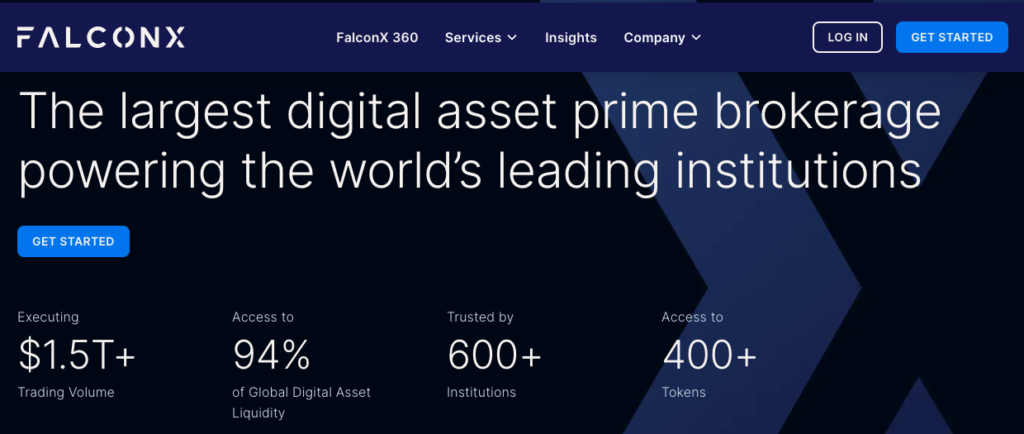

3. FalconX

- Minimum Trade Size: Unknown

- Available in the US: Yes

- Standout Feature: Tailored for traditional institutions entering crypto

FalconX is designed for institutions transitioning from traditional finance into cryptocurrency. It leverages advanced data science and machine learning to offer competitive prices and credit services for large-margin trades. This platform blends institutional professionalism with modern crypto innovation.

Pros:

- Institutional Focus: Tailored for traditional finance institutions.

- Credit and Borrowing: Borrow against staked assets with custom lending rates.

- Market Making: Offers liquidity services for new crypto projects.

Cons:

- Institutional Complexity: Not ideal for retail or smaller traders.

- New to Crypto: Relatively new and focuses primarily on onboarding traditional financial institutions.

Features:

- Custom borrowing rates for margin trading.

- Market-making services for new token launches.

- Institutional-grade credit and clearing facilities.

FalconX is best suited for established institutions looking for a gateway into cryptocurrency, offering white-glove service and advanced trading tools.

4. Crypto.com OTC

- Minimum Trade Size: $50,000

- Available in the US: Yes

- Standout Feature: Comprehensive ecosystem with instant trade execution

Crypto.com is renowned for its wide range of services beyond OTC trading, including an exchange, wallet, NFT marketplace, and even a crypto credit card. The platform’s OTC desk is seamlessly integrated into this ecosystem, making it an attractive option for large traders looking for speed and versatility.

Pros:

- Ecosystem Integration: Offers much more than just OTC trading.

- Fast Trades: Instant trade execution through RFQ.

- Lower Minimums: Relatively low trade minimum of $50,000.

Cons:

- Limited Trade Size: Maximum trade size capped at $5 million.

- Less Personalized Service: Lacks the 1-on-1 support that other OTC desks offer.

Features:

- Support for multiple trading pairs, including BTC/USDT, ETH/USDT, and more.

- Instant quote matching and trade history features.

- Competitive fees with no extra costs on large transactions.

Crypto.com OTC is perfect for high-net-worth individuals who want access to a complete crypto ecosystem, including instant trades and seamless integration across products.

What is OTC Crypto Trading?

OTC trading allows for large transactions to be executed privately and without impacting the broader market. Unlike traditional exchanges, OTC desks provide liquidity by matching buyers and sellers outside public order books. This service is vital for high-volume traders looking to avoid slippage and protect the confidentiality of their trades.

Key Benefits:

- Confidentiality: Large trades are conducted privately, away from public exchanges.

- No Slippage: Ample liquidity ensures prices remain stable for large orders.

- Personalized Service: Most desks offer dedicated account representatives.

- Flexible Pricing: Bulk trades can often be negotiated for better rates.

Risks:

- Counterparty Risk: The risk that the other party in a transaction defaults or fails to deliver.

- Regulatory Uncertainty: Given OTC’s opaque nature, there is the potential for increased scrutiny from regulators.

- Scams and Platform Risks: It is crucial to verify the platform’s reputation and security measures to avoid fraud.

Comparing OTC Trading to Exchange Trading

While OTC desks cater to large, institutional trades, traditional exchanges are designed for everyday retail investors. OTC desks charge lower fees, offer more personalized services, and specialize in high-volume trades, whereas exchanges have higher fees and automated services.

| OTC Trading | Exchange Trading |

|---|---|

| Lower fees included in the transaction | Higher, separate fees |

| 1-on-1 VIP service | Limited support |

| Best for high-net-worth individuals | Best for retail investors |

| Focused on large trades, lending, and borrowing | Broad crypto services including staking, rewards, and more |

Conclusion

For institutions and high-net-worth individuals, OTC desks are a vital tool for making large trades discreetly and with minimal market disruption. Whether you’re looking for white-glove service with Kraken, deep liquidity through Coinbase Prime, or an integrated ecosystem with Crypto.com, there’s an OTC desk that caters to your needs.

OTC desks offer numerous advantages like confidentiality, flexible pricing, and 1-on-1 support, but they come with risks such as counterparty and regulatory uncertainties. By choosing reputable platforms with solid security protocols, traders can execute large trades safely and efficiently.