Top 3 Platforms for Trading Tokenized Stocks

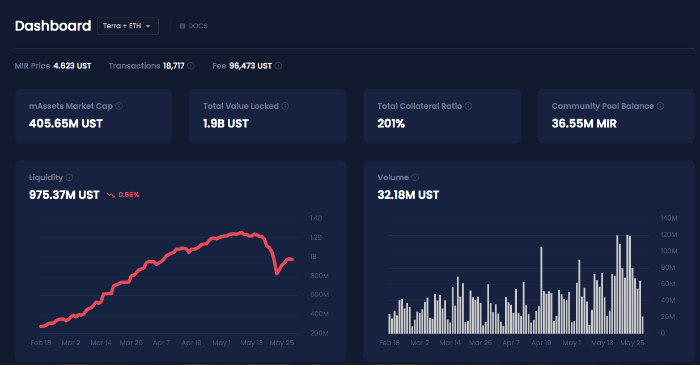

Mirror.Finance Mirror is a smart contract powered DeFi protocol that makes the creation of synthetics/fungible assets using the Terra blockchain

Mirror.Finance

Mirror is a smart contract powered DeFi protocol that makes the creation of synthetics/fungible assets using the Terra blockchain possible. These synthetic assets are called Mirrored Assets (mAssets). Such assets are meant to track the price of real world assets by mimicking price behaviour.

Source: https://mirror.finance/

The purpose of Mirror synthetics is for them to be utilized as key building blocks in smart contracts. This enables traders globally to have access to price exposure without needing to own or transact with real assets. The difference with synthetics compared to conventional tokens is that the latter serve to represent actual or real underlying assets. mAssets on the other hand are ultimately synthetic meaning that they only capture the price movements of corresponding assets.

The Mirror protocol enables anyone to mint an mAsset by locking up collateral. This can either be in the form of a stablecoin or alternatively a different mAsset. How much collateral is required for this? Well, at least a minimum multiple of the asset’s value for instance (150% for stablecoin collateral, 200% for mAsset collateral).

To demonstrate, let’s say stock Y is listed at the trading price of $100. If you wanted to mint 1 mY, you would be required to put up a minimum of $150 in stablecoin, or $200 in a different mAsset. A collateralized debt position (CDP) that mints the mAsset can’t have a collateral ratio below the minimum collateral ratio, lest it be subject to liquidation through auction. In order to burn an mAsset, the issuer is required to burn the amount initially issued in order to receive the locked stablecoin collateral. Synthetic assets such as mAssets are advantageous for the simple reason that they can be traded on automated market makers (AMMs) on public blockchains such as Ethereum or Terra in the case of mAssets. This makes it much easier for those issuing the synthetics and for investors as well to be able to buy and sell them.

An ecosystem such as Mirror’s makes possible two kinds of markets that different participants engage with. On the one hand you have Minters who are those entities minting mAssets and who in essence take the opposite position of the asset’s natural direction. For example, an issuer of mGME (GameStop Corp) is essentially taking a short position on GME. In this case you can see that the system is minter’s counterparty.

The other important group of participants in the Mirror ecosystem are traders. These traders are the entities that buy and sell mAssets on the decentralized exchanges (DEXs) that Mirror supports. Anyone in the world can access mAssets through those DEXs. The Mirror protocol is engineered in a way that incentives entities to mint assets and provide traders with liquidity. The best way to describe the Mirror protocol is that it utilizes automated market makers to facilitate the trading of mAsset against stablecoins.

The Mirror protocol rewards liquidity providers with trading fees in order to incentivize minting and liquidity provision. A tiny commission is paid by all mAsset trades that go through the AMM to the mAsset’s liquidity providers. Mirror also has it’s on native token with a deterministic inflation schedule that rewards mAsset liquidity providers. Governance is also another use case for the Mirror token.

mAssets are minted in a decentralized fashion by users throughout the network who open positions and deposit collateral. The role of Mirror is to ensure that there is always sufficient collateral within the protocol to cover mAssets, and to also manage markets for mAssets through listing them on Terraswap against TerraUSD (UST).

Synthetic assets available on Mirror

- Mirrored Bitcoin (mBTC) – a synthetic asset that tracks the price of Bitcoin.

- Mirrored Ether (mETH) – tracks the price of Ether.

- Mirrored iShares Silver Trust (mSLV) – tracks the price of iShares Silver Trust ETF.

- Mirrored Tesla (mTSLA) – tracks the price of Tesla stock.

- Mirrored Twitter (mTWTR) – tracks the price of Twitter stock.

- Mirrored Apple (mAAPL) – tracks the price of Apple stock.

- Mirrored Netflix (mNFLX) – tracks the price of Netflix stock.

- Mirrored Goldman Sachs Group (mGS) – tracks the price of Goldman Sachs Group stock.

- Mirrored GameStop (mGME) – tracks the price of GameStop stock.

- Mirrored Airbnb (mABNB) – tracks the price of Airbnb stock.

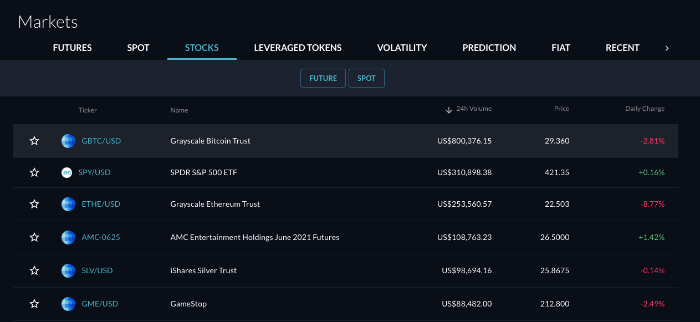

FTX

FTX is a popular derivatives exchange offering more than 100 different crypto futures options compared to competitors like Deribit and Bitmex. FTX lists tokens on the equities for example, you can find a market to trade GameStop tokenized stock https://ftx.com/en/trade/GME/USD. Such spot tokens are backed by shares that CM-Equity AG custodies since FTX partnered with CM Equity to provide brokerage services for tokenized stock trading. The tokenized stocks are redeemable through CM-Equity for the underlying shares if the holder wishes to do so. Currently FTX doesn’t offer any other way to withdraw the tokens from their platform but they do offer support to entities interested in redeeming the tokenized stocks.

Source: https://ftx.com/en/tokenized-stocks

For users to be able to trade tokenized stocks on FTX, they must be subject to KYC verification level 2 minimum on the platform. In addition, users would also be required to pass CM-Equity’s KYC and compliance in order to be able to trade those stocks. The process is fairly simple, a user needs to pass KYC verification level 2 on FTX and then go to their settings page to submit their information to CM-Equity. Currently entities from restricted regions including the USA cannot trade tokenized stocks on FTX. Once you get the greenlight to trade, you can pretty much trade 24/7, however, you should be aware that the liquidity of the underlying assets may vary. Tokenized stocks on FTX are treated like spot tokens e.g. BTC/ETH so they can also be utilized as collateral for futures trading on the platform with a collateral weight of 0.85 (total) and 0.80 (initial). In addition, FTX also lists futures on tokenized stocks, tokenized futures included.

Tokenized stocks available on FTX include:

- GameStop tokenized stock (GME)

- Tesla tokenized stock (TSLA)

- MicroStrategy tokenized stock (MSTR)

- Apple tokenized stock (AAPL)

- NVIDIA tokenized stock (NVDA)

- Uber tokenized stock (UBER)

- Square tokenized stock (SQ)

- PayPal tokenized stock (PYPL)

- Pfizer tokenized stock (PFE)

- Airbnb tokenized stock (ABNB)

Bittrex

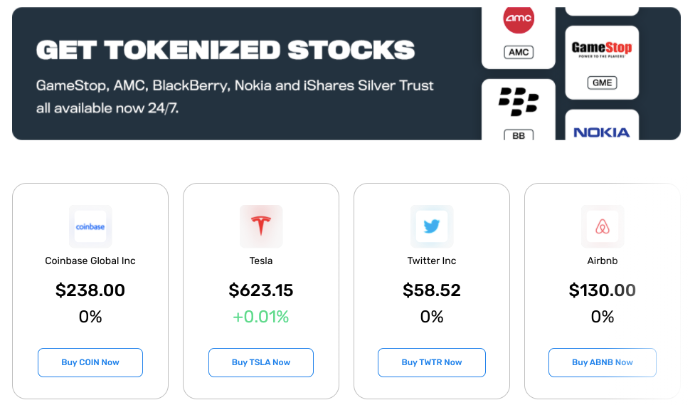

Bittrex, like Binance or OKEx, is another popular cryptocurrency exchange platform that offers tokenized stocks which are simply tokenized derivatives that generally represent conventional securities, especially shares in publicly listed firms which are traded on regulated traditional exchanges.

Source: https://global.bittrex.com/discover/tokenized-stocks

The value proposition for trading tokenized stocks is that you have a market that is open 24/7 and you can also have fractional ownership. Tokenized stocks traded on platforms like Bittrex are typically backed 1:1 to traditional stocks. This means holders are entitled to similar economic benefits that anyone owning the actual underlying stocks have.

According to Bittrex, their tokenized stocks are a tokenization of a digital total return swap contract (“TRS”) which are similar to contracts for differences. The value of the tokenized stocks is based on and collateralized with the underlying asset, a traditional security with the value of the digital asset determined by the value of the traditional security.

Innovative baskets or indexes of traditional securities as well as traditional securities plus cryptocurrencies (for example, BTC and S&P 500) can also be represented by tokenized stocks. Some of the tokenized equities can at times also include leverage, including long or short exposure.

Bittrex lists tokens that represent derivative contracts collateralized by the underlying traditional equities. Currently only spot markets are available on Bittrex. It’s important to remember that just like on FTX, on Bittrex you can only buy and trade tokenized stocks but you cannot withdraw them to exchanges or wallets.

Tokenized stocks you can find on Bittrex include:

- Amazon tokenized stock (AMZN)

- Alibaba tokenized stock (BABA)

- Beyond Meat Inc tokenized stock (BYND)

- Facebook tokenized stock (FB)

- Google tokenized stock (GOOGL)